QI TAKEAWAY — The Fed’s campaign of terror has taken down home prices which points to a weakening in realtor incomes and direct and indirect businesses linked to home sales. As housing is local, a Main Street income shock is setting up for 2023.

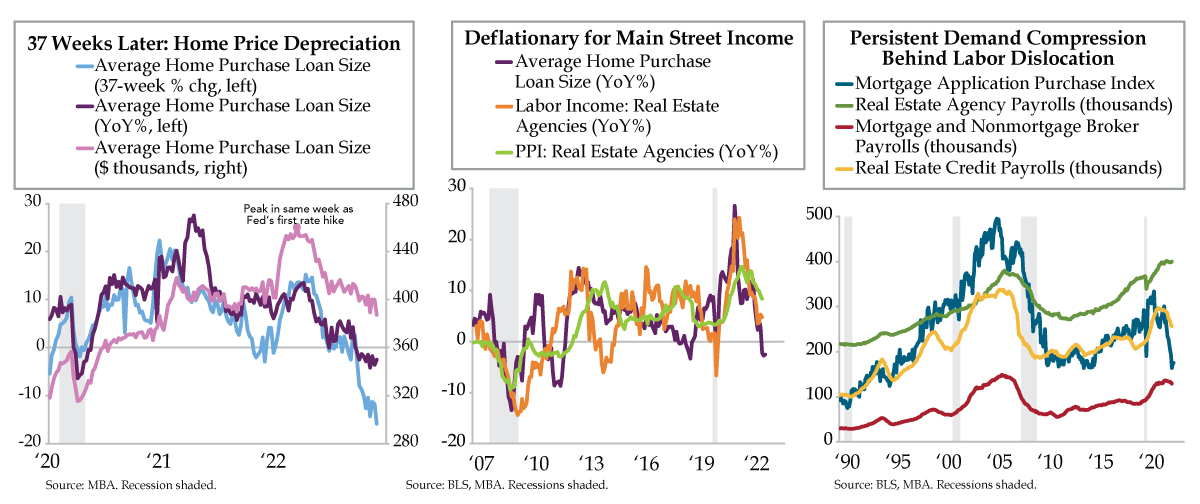

- Since peaking at 7.16% the week of October 21, the MBA’s 30-year fixed mortgage rate has fallen 75 bps to 6.41%; at the same time, average home loan purchase size has fallen 15.8% from its mid-March peak, steeper than the worst 37-week drop of -14.8% seen pre-GFC

- At 4.8% YoY through October, Labor Income: Real Estate Agencies is at its lowest levels since September 2020; with shrinking loan sizes portending further deflation, PPI: Real Estate Agencies has a long way to fall into 2023, given it was still up 8.4% YoY in October

- MBA’s purchase index and real estate credit payrolls move together, and the former’s decline suggests real estate agency payrolls are at risk; Zelman & Associates data, along with recent layoff announcements, highlight that falling rates aren’t saving the housing sector