QI TAKEAWAY — Hard data illustrates dated recent U.S. export strength. Soft data are pointing in the opposite direction. Watch for this GDP support to buckle as the economy exits the summer quarter. Signs of broad export weakness across industries and countries is bearish for transports.

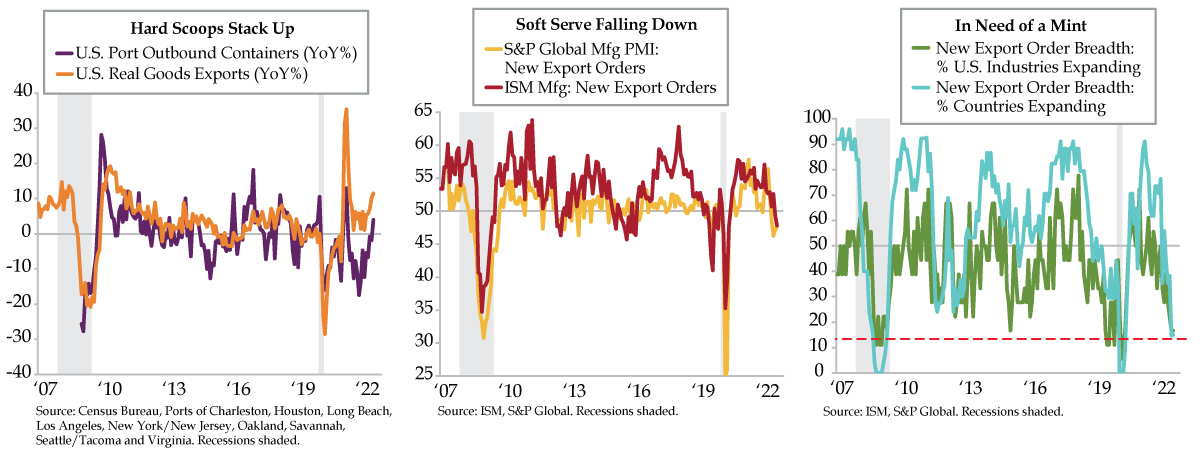

- The U.S. trade deficit narrowed for a fifth straight month to -$67.4 billion, driven by relative strength in exports; real goods exports rose at 11.5% YoY, while outbound container volumes from major U.S. ports rose 4.0% YoY, the first positive print in 15 months

- More recent data flags weakness in exports, with ISM and S&P Global PMIs posting sub-50 readings for New Export Orders in September; since 2007, there have been four other instances where both series were negative, and all occurred during contractionary periods

- In ISM’s latest Manufacturing report, just 3 of 18 industries reported expanding export orders, a 17% breadth; meanwhile, outside of the U.S., just 15% of the 34 nations that report export orders saw growth in September, flagging the unsustainability of U.S. export strength