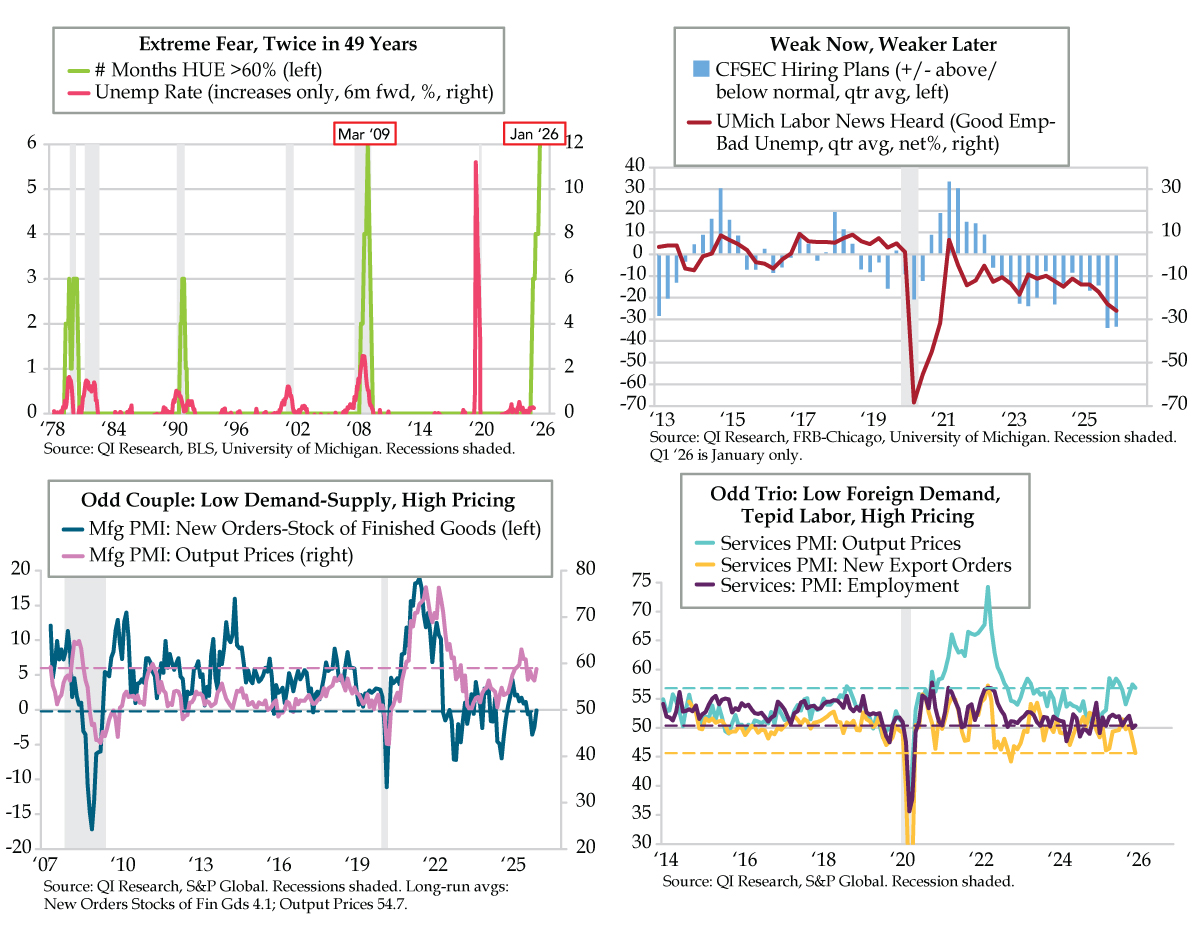

QUICK QUILL — UMich Higher Unemployment Expectations have been north of the 60%-line for six months running, matching the sole precedent of March 2009. In that episode, the unemployment rate had risen by more than one percentage point six months later, which would land today’s rate at 5.5%, defying the Fed’s year-end projections. The news households are hearing on the labor market is at a cycle low, indicating a more moribund level than the 2010s expansion. At -33.0, Chicago Fed Hiring Plans are far below the -3.2 long-run average flagging further labor market distress. S&P Global Services New Export Orders, reflective of inbound international travelers to the U.S., are at their lowest level since November 2022, warning of a deepening compression in hospitality employment. Given the hostile political backdrop, Fed officials are almost certain to ignore all of these signs come Wednesday, upping the need to ease more aggressively in 2026 than they would have to otherwise.

TAKEAWAYS

- UMich Higher Unemployment Expectations have been north of 60% for six months, a streak only otherwise seen in March 2009; six months out, the unemployment rate had risen more than 1 point, conflicting with the Fed’s current median year-end 2026 projection of 4.4%

- The UMich Good-Bad News Heard on Employment spread fell 3 points to a net -26.0 in January, a cycle low worse than any time during the 2010s expansion; CFSEC Hiring Plans, at a net -33.0, are far below the -3.2 long-run average and flag further troubles ahead

- While S&P Mfg Output Prices sit at 58.8 vs. their 54.7 long-run average, the New Orders-Stock of Finished Goods spread has been negative for five months; meanwhile, Services New Export Orders, affected by weak foreign travel, are at their lowest since November 2022