QI TAKEAWAY — Labor and consumer survey data flag a steepening yield curve. There’s relative value dipping into long positions in short duration bonds. More visible evidence of an unemployment shock will signal the time to add to this tactical trade.

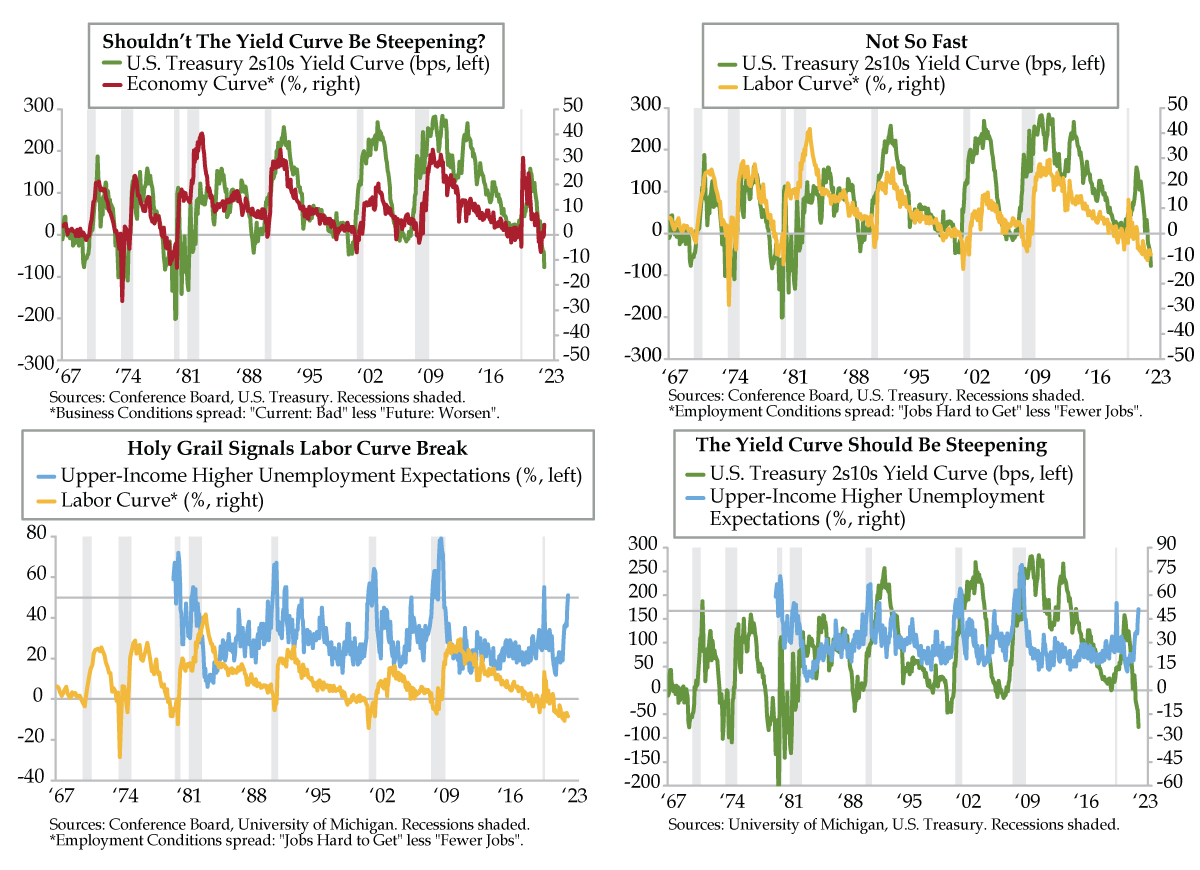

- QI’s “economy curve”, the spread between negative current and future business conditions from Conference Board, has inverted from June’s low of -6.9 and now sits at 4.0; while this curve flags recession, the 2s10s continues to reflect expectations of additional tightening

- QI’s “labor curve”, the spread between “Jobs Hard to Get” and “Future Jobs”, was inverted for 19 months but has begun to shift as layoff anecdata proliferate; given Jobs Hard to Get has a 0.88 correlation with unemployment, the labor curve predicts steepening is in train

- UMich Upper-Income Higher Unemployment Expectations rose to 51% in November, the first peek above 50% since early 2020 and a level reached prior to past recessions; in every recession since 1980, deterioration in these expectations has foreshadowed a steeper 2s10s