Abandoned by the Mayan in 1000 AD, British pirates cruising the Caribbean happened upon a haven tucked inside a great barrier reef in the 1600s. There they found a safe place to hideaway their stolen treasures. Ever the seafaring entrepreneurs, pirates were also gifted whalers and recognized the mammoth mammals’ vomit when it washed up on shore. The oil extracted from the ambergris was a prized commodity in Europe as it made the best perfumes at a time bathing was anything but a daily habit. If you’re ever in Ambergris Caye, you’ll know how this largest of 200 islands that comprise Belize got its name. In a sojourn there last week, after enough curry and hogfish to sate our appetites for the local fare, QI was surprised to find one of the best open-air cafes serving up a slice of Americana. The burgers, fries and macaroni & cheese were authentic enough to demand its own episode of Diners, Drive-in’s and Dives. But it was the Philadelphia Cheesesteak served at Toast that really hit home…in Ambergris Caye, Belize.

In the same way Lloyd Bridges’ character in Airplane repeatedly lamented choosing the wrong day to quit smoking or sniffing glue or fill-in-the-blank, QI chose the wrong week to unplug. It started with “Monday the 13th” and the open secret of the Federal Reserve leaking word it would hike by 75 basis points, which set all hell loose. The violent short covering that ensued when Powell delivered landed plenty of whiplash for one trading week. And then came Thursday and something not quite as tasty out of Philadelphia.

In yet another example of what a difference a week can make when a cycle is unwinding at light speed, you may have been unprepared for the Philly Fed’s manufacturing survey if your expectations were formed based on the New York Fed’s Empire counterpart that preceded it Wednesday. Though they tend to be released a day apart, with Philly following Empire, the New York survey is taken about a week prior.

As such, the New York survey’s headline general business conditions remained in contraction, but improved more than 10 points, to -1.2. While unfilled orders fell below zero and delivery times sank for the third straight month, new orders and shipments recaptured positivity. Waving an increasingly familiar red flag, inventories jumped more than nine points. In a stagflationary signpost, prices paid and received stayed elevated even as prices received fell for the second straight month. Employee numbers grew five points while average workweek dropped 5.5 points but remained expansionary. It was bad, but no disaster.

To provide a backdrop, at 2.6, May’s Philly Fed headline fell by 15 points but remained in the green by a hair. There was nothing whiskery about Thursday’s June data. The headline flipped to -3.3, the first negative print since May 2020. New orders contracted for the first time in two years and shipments slumped the lowest since August 2020. Backlogs, delivery times and inventories also sported negative signs. The employment index did hang in there, rising to 28.1 from May’s 25.5, but this could also reflect the ease with which manufacturers can source workers in a fast-slowing economy.

The bloodletting, however, was in what’s anticipated six months out. First, the best news: The six-month forecast for employment only fell to 10.5 from May’s 29.2; the average workweek is seen at 6.4, down from 11.7. Still, both still have plus signs in front of them. Moreover, 72% say their total production in the current will exceed that of 2022’s first three months; only 9% expect a decline in production. These firms put their median capacity utilization rates at 80-90%, up from 70-80% in the year-earlier quarter.

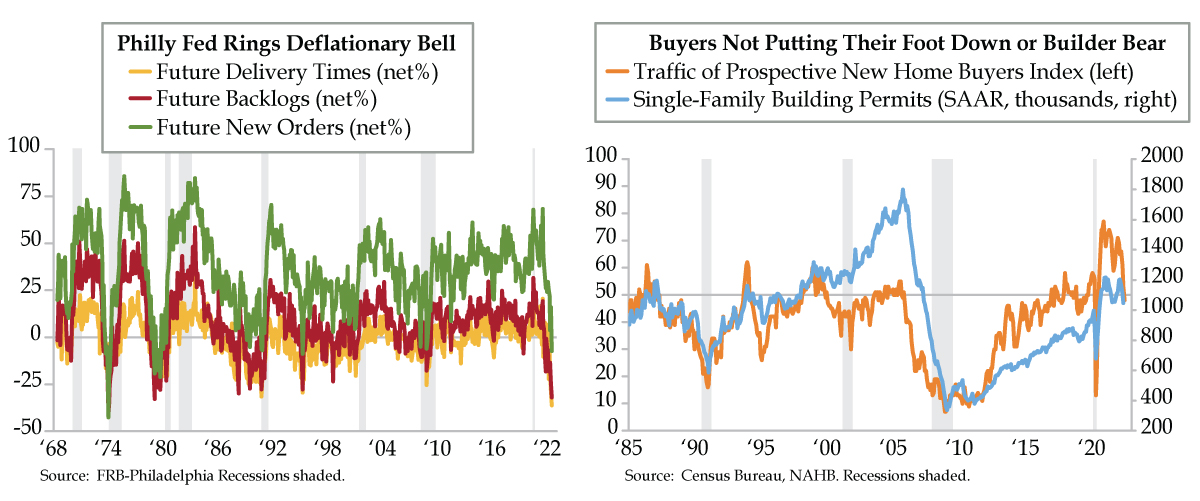

Calling this sanguinity into question, nearly 42% of firms see general business activity declining over the next six months, up from 22% last month. That’s the best of the bad news. Since the early 1980’s, outright contractions in future new orders are exceedingly rare. In June, this gauge abruptly collapsed to -7.4 from last month’s 16.1 (green line). Future backlogs continued their descent to -32.0 from May’s -24.5 (red line). And finally, do you remember that “supply chain constraints” meme (from last week)? Try future delivery times crashing to the lowest on records back to 1968 (yellow line). Expected inventories also slipped into the negative, not a promising signal for the “recession will be short and shallow” crowd. As QI’s Dr. Gates noted, “Forward guidance for growth, inflation and employment are all contracting. This combination preceded four previous recessions in 1973-75, 1980, 1990-91 and 2007-09.”

Broadening out to the national economy, you’re excused for missing the housing data given the melee in the markets. Note that two Rubicons were crossed this week – single family permits hit their lowest since July 2020 (light blue line) while buyer traffic, reported earlier this week by the National Association of Home Builders, slumped to a June 2020 low (orange line). As our friends at Zelman & Associates surmise: “We believe an unwinding of historically-elevated backlogs at a time when economic uncertainty continues to rise, and demand degradation from higher interest rates and other factors becomes more apparent, will result in downward pressure on pricing power across for-sale and rental housing.”

Between evaporating demand in the country’s chemicals hub at the beginning of the manufacturing pipeline and housing in freefall, the only thing out of place is the Fed’s magical modeling that puts 2022 GDP at 1.5-1.9%.