VIPs

- Germany is the most underpriced recession risk in 2019 with the probability of contraction over the next 12 months at 15% compared to 20% in the U.S. and 33% in Japan

- The key leading indicator of the Euro Area labor market – unemployment expectations – has registered noticeable deterioration in France, Italy and Spain; the dissipation in the German skill shortage suggests eurozone-wide job market weakness is a palpable 2019 risk

- As the skill shortage is reported to be dissipating, slower job growth and a bottom in German unemployment are palpable 2019 risks

- Look for stronger U.S. dollar to end 2019; rising U.S. recession risks due to ISM cliff risks hitting markets early on thus the dollar is vulnerable to a sell-off before its safe-haven status drives capital inflows escaping a global slowdown

- A 2% 10-year yield? The U.S. growth outlook will be tested early in the year; housing and autos are likely to underperform expectations as upper-income buyers postpone purchases tied to elevated financial market volatility

- The Fed transitioning away from the rigid language of “gradual increases” to a more flexible, financial market and economic data-dependent policy will see traders price both probabilities of hikes and cuts in 2019

Happy Boxing Day! Feel free to let your servants journey home today such that they too can give their “Christmas Boxes” to family members. Wait…those times have luckily come and gone. We don’t have servants who serve us our pudding on Christmas Day, nor are we British for that matter. Instead, we would encourage you to consider the evolution of the meaning of the tradition, which is rooted in the virtues of charitable giving.

In its second life, Boxing Day fell the day after Christmas Day. Monies placed in special boxes during Christmas services were opened the following day and given to the poor. No doubt, many of you will be prompted to do year end giving in the coming days. QI asks that you to join us in keeping the spirit of giving alive to end the year on the happiest note for the less fortunate people in our communities who are most in need.

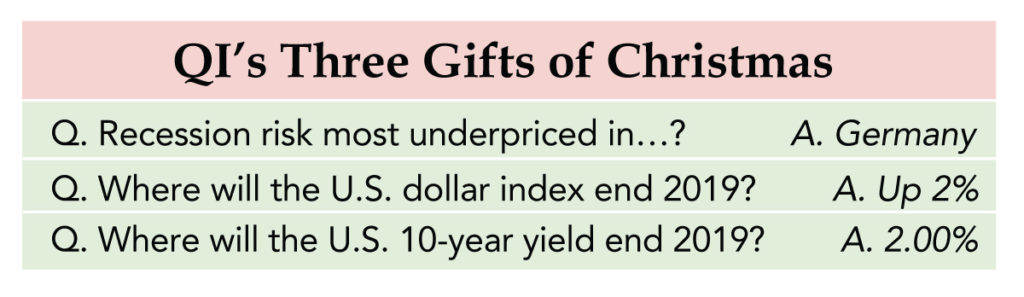

As we look back on the past seven months of writing the Feather since its May 29th launch, our gift to you is a look-ahead to the least expected scenarios to play out in the coming year. To arrive at this juncture, we asked ourselves three questions:

- Where is recession risk the most underpriced?

- Where will the U.S. dollar index end 2019?

- Where, in turn, will the yield on the U.S. 10-year Treasury close on 12/31/19?

Germany: Most underpriced recession risk. The line has been drawn in the sand by the consensus. Germany’s recession probability over the next 12 months stands at 15%, compared to 20% in the U.S. and 33% in Japan. For perspective, relatively lower recession probability breeds business cycle complacency and also can lead to overblown macro outlooks and overvalued financial assets.

Germany’s exposure to the U.S./China trade war makes it decidedly vulnerable to a slowdown. Many blamed the third-quarter decline in German GDP on temporary bottlenecks certifying new vehicles under tougher emissions tests. This interpretation of noise misses the signal from the German export and manufacturing sectors that have faced a persistent loss of traction throughout 2018. As the skill shortage is reported to be dissipating, slower job growth and a bottom in German unemployment are palpable 2019 risks.

Watch contagion risk from Germany’s neighbors. The key leading indicator of the Euro Area labor market – unemployment expectations – has registered noticeable deterioration in three of the Big Four countries — France, Italy and Spain. Germany’s unemployment expectations aren’t raising yellow flags but did trough in July 2018. Further deterioration in Germany’s expectations from here would flag a weakened outlook for growth, inflation, labor and corporate earnings that could lead the DAX to underperform its global peers.

Bullish U.S. dollar. The widely followed U.S. dollar index (ticker DXY) should appreciate by low single-digits (~2%) over the next year versus the 5.5% consensus decline forecasted. Because the euro carries a heavy weight in the DXY, the dollar bull-call is a euro bear-call predicated on surprise economic weakness from Germany.

That said, increased financial volatility from the global central bank shift from QE to QT and rising U.S. recession risks stemming from an ISM cliff threaten to wallop markets early in 2019. The dollar is thus vulnerable to a sell-off first before its safe-haven status drives capital inflows escaping a global slowdown.

Bullish U.S. 10-year yields. The global risk-free rate should fall over the course of the next year (~2.00%) from current levels near 2.75%. This call runs counter to forecasters’ views for rising 10-year yields to 3.30% by the fourth-quarter of 2019.

We disagree with the consensus on the speed of the U.S. slowdown next year.As detailed in our dollar call, the growth outlook will be tested early in the year. The leading housing and auto sectors should continue underperforming expectations as upper-income buyers postpone purchases because of elevated financial market volatility.

We disagree with the consensus outlook for two Fed hikes in 2019.Powell & Co. are likely to be challenged to get off even one more 25 basis-point increase on their desired path to the magic land of neutral.

The return of two-way interest rate risk is another reason investors can price for lower yields.This is a major difference for the rates outlook across the entire term spectrum compared to the QE era when one-way risk prevailed. Investors today are solely pricing rate hike probabilities. The Fed transitioning away from the rigid language of “gradual increases” to a more flexible, financial market and economic data-dependent policy will see traders price both probabilities of hikes and cuts in 2019.

We hope you share QI’s philosophy as you approach investing in 2019. Be contrarian backed not by bravado, but data that lead inflection points. Avoid labels such as “bull” or “bear.” Cycles can turn on a dime.