Pippi: Per your predicament, I printed a pertinent page from Wikipedia [Reads]

Pippi: “Gentoo penguins may periodically imprint on a particular person as if they were a penguin. Once imprinted, they remain permanently proximate to their parental proxy.”

Mr. Popper: Is it actually written that way?

Pippi: I’m paraphrasing.

Pippi Pepennopolis is Mr. Popper’s personal assistant who processes his paper and procures his periodicals. Played by Ophelia Lovibond, Pippi skillfully steals scenes with her expert alliterative proficiency from star Jim Carrey in the 2011 comedy film Mr. Popper’s Penguins. Unfamiliar with alliteration, as in consonant sounds in two or more neighboring words or syllables being repeated? Welcome to the Quill Intelligence family as we’re prodigious users of the fine art common to poetry, songs, raps, speeches and…Feather tops.

Chart titles also employ alliteration to hook the eye, while eliciting a slight delight at the quick wit. Our marketing department relishes the rapid-fire examples that rivet our readers’ collective psyche. (OK, maybe not “rivet.”)

Though not related to Peter Piper, Pippi would proudly stake claim to the example of today’s left chart, which was extracted from yesterday’s third-quarter U.S. Productivity and Costs report. The nonfinancial sector proxies the broader economy as it accounts for roughly half of U.S. GDP. If you’re curious as to the balance, nonfinacials exclude excludes general government, nonprofit institutions, private households, unincorporated businesses, bank holding companies and the finance and insurance sector.

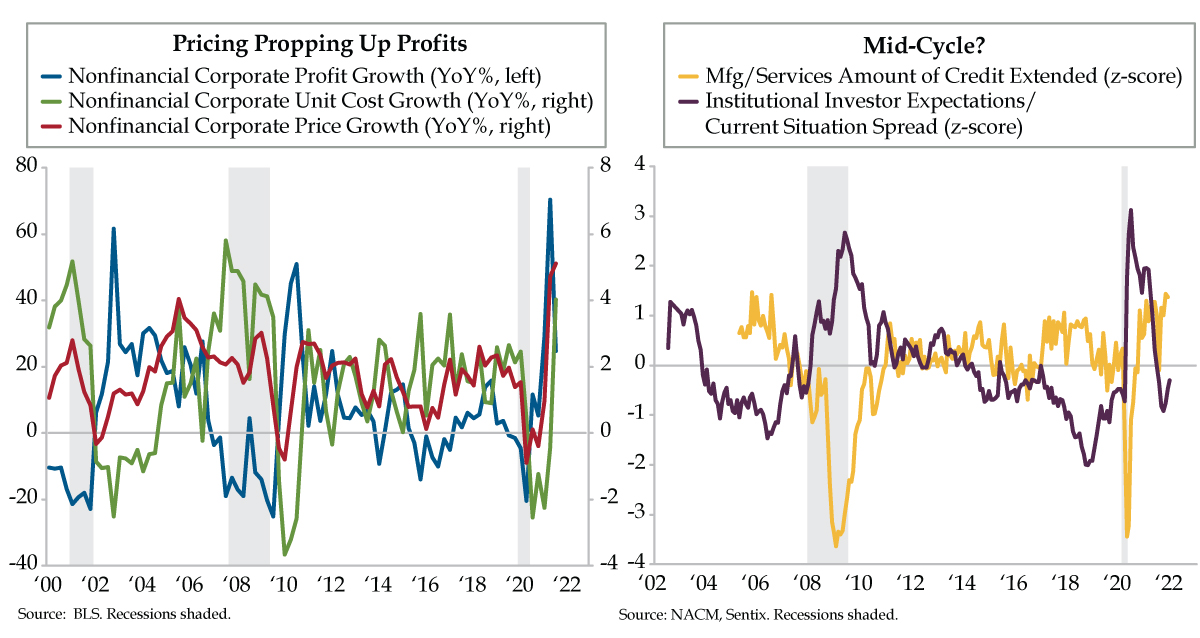

Pricing Propping Up Profits. We draw this conclusion from the post-pandemic spike in earnings that radically departs with the patterns of past cycles — pricing power (red line) took longer to get off the ground, so the primary propping of profits (blue line) would come from continual cuts to costs (green line). Note that after the 2001 and 2007-09 recessions, the green line collapsed helping to send the blue line soaring in the early phase of recovery. In the current recovery, thanks to ill-conceived and overly aggressive fiscal stimulus, prices surged at the same time costs crumbled and profits rebounded in lightning-fast fashion. Little surprise, the second quarter’s 70.4% year-over-year (YoY) gain in nonfinancial corporate earnings was a postwar record. This moonshot is as right tail as they come, and also designates that a peak signal for the profit cycle has been reached.

As the prep goes into tomorrow’s Weekly Quill deep dive into commercial real estate, which is also peaking and behaving very late cycle, we find ourselves having lost count of the ‘peaks,’ whether referencing the job market, trade, goods sales, housing…at some point, the length of the list of peaks will matter.

The third quarter’s easing to a 24.7% YoY rate was still respectable by any measure. But it coincided with a significant ramp up in costs. Nonfinancial unit cost growth advanced at a 4.0% YoY rate, the largest since 2009’s second quarter, after declining 0.4% over the prior four quarters. The 12-month comparison was backloaded to boot. The 7.7% quarter-over-quarter annualized increase in the summer quarter showed that the cost acceleration is more acute in the here and now.

A tight supply chain and a tight labor market are likely to keep squeezing margins. Given the inflationary backdrop that’s unfolded in 2021, these factors also point to the 5.1% YoY rise in nonfinancial pricing power having legs in coming quarters. By the way, it was the first 5-handle for this metric since 1982. While we’ve begun to see signs that disinflation will be the bigger risk a year from now, that should in no way take away from the damage being inflicted today.

We have to ask why, given the increasing ubiquity of late cycle evidence, the German think-tank Sentix was so sanguine on the outlook for America’s economic prospects. Its December report, “Lockdown Blues” categorized the Euro Area, Germany, Switzerland and Austria, as economies undergoing a “slowdown,” while Eastern Europe fell under the “stagnation” umbrella.

Sentix noted that “The U.S. economy remains comparatively robust. Although consumer sentiment has deteriorated considerably in recent months, this has so far had little impact on investors’ assessment of the economy. The situation index fell again, for the fifth time in a row, by about 3 points, but remains at a high level of 34.3 points. Expectations even improved slightly to 14.5 points. For the USA, therefore, we are clearly sticking to our expectation that it is currently only a typical ‘dip’ in the middle of an economic cycle.”

Focusing solely on institutional investors, the relative difference between this cohort’s view on the economic outlook and the current situation is below normal. Using our favorite normalizer, the z-score (deviation from the mean adjusted for volatility), the expectations/current situation spread has been negative for the seven months ended December; at -0.91, September marked the low point.

History is lacking in these Sentix series, but there’s enough to judge that the level of the September z-score – 17 months after recession – happened much sooner in this cycle than the in the last two (32 months 2001’s recession and 102 months following that of 2007-09). Yes, Virginia – the cycle is compressed.

Perfect predictions are perpetually problematic. Be that as it may, November’s National Association of Credit Management (NACM) Credit Managers’ Index provides corroborating evidence via the late cycle build in credit growth to offset slowing earnings. Credit extended (purple line) has surged to record levels in record time. Consider yourself properly, prudently prepared.