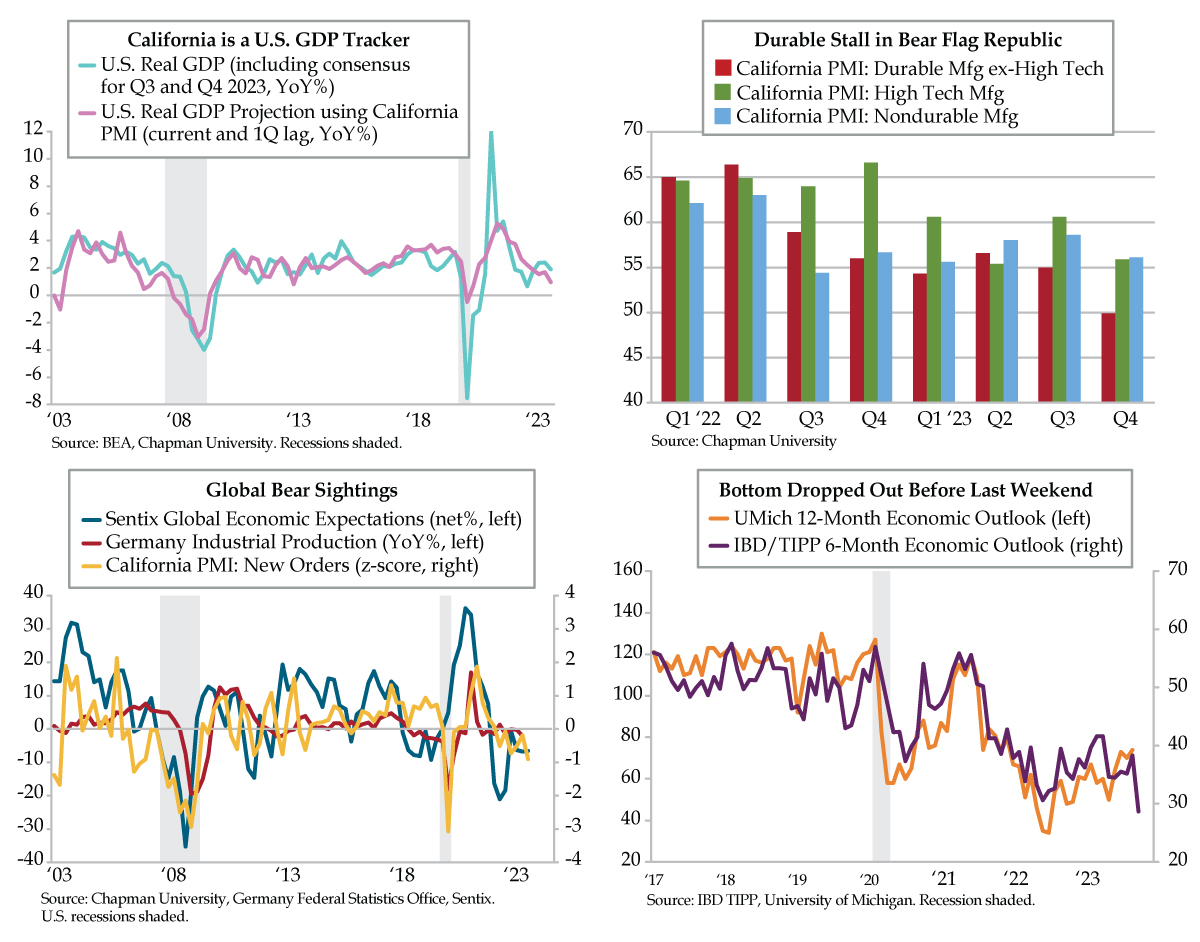

QUICK QUILL — The bellwether California PMI flags inflated expectations for near-term U.S. economic expectations. Persistent contraction in Golden State New Orders is colliding with persistent investor pessimism for global economic prospects and the gravity of Germany’s industrial recession. Moreover, the suddenness and abruptness in the IBD/TIPP economic outlook prompted its arbiters to warn that the magnitude of decline “appears worse than it was at the depths of the dot-com crash, the Great Financial Crisis and the coronavirus pandemic.” All of these data points preceded war in the Middle East and validate crumbling expectations for a Fed rate hike come November 1st.

TAKEAWAYS

- Chapman University’s California PMI has fallen to 53.7 in Q4, the weakest expansion, COVID notwithstanding, in 10 years; given the series has historically guided U.S. GDP, the headline predicts a softening of U.S. output to 1% YoY in Q4, half the sell-side consensus

- As z-scores, California PMI New Orders have been negative for six consecutive quarters, last seen in the lead-up to the GFC; the weak signal from California, the world’s fifth largest economy, aligns with Sentix’s Global Expectations Index being in contraction since Q2 2022

- IBD/TIPP’s Economic Optimism Index fell to 36.3 in October, its lowest since August 2011, with the 6-month Economic Outlook falling to a record low 28.7; should similar weakness appear in UMich’s preliminary October data, it will raise the volume on calls for a Fed pause