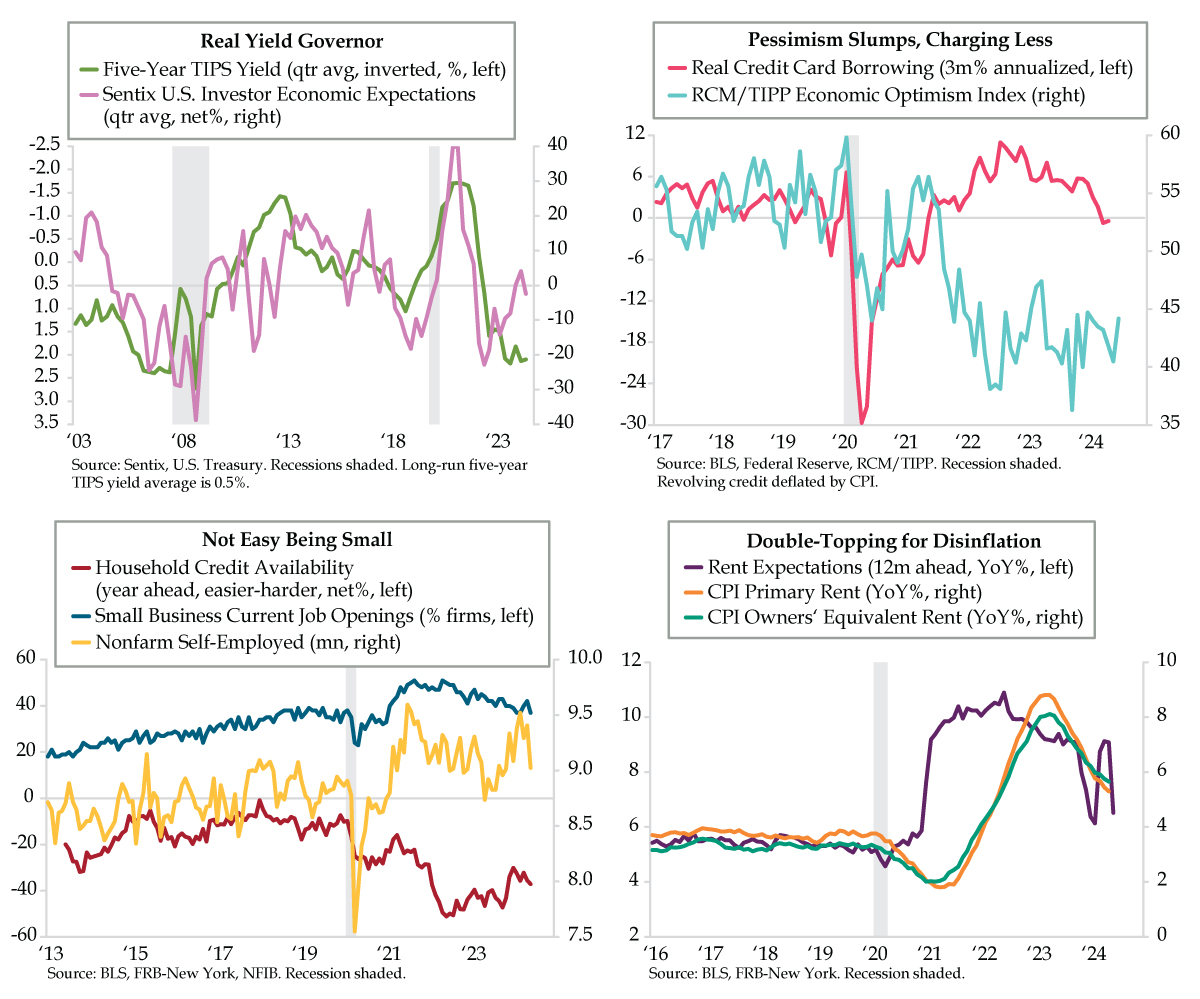

QUICK QUILL — Above-trend real yields take a bite out of investors’ growth optimism. Consumer pessimism has manifested as a short-run contraction in credit card borrowing volume, adding to downside risks. Impaired household credit availability will act as a governor on small business job creation; nonfarm self-employed have already lost a half million in the second quarter. High conviction for rent disinflation is growing as households become aware of concessions required to move new product amidst an onslaught of fresh supply. All told, these growth, labor and inflation risks fundamentally suggest cheap vol presents a tactical opportunity.

TAKEAWAYS

- The Sentix U.S. Investor Economic Expectations Index fell to -2.5 in June, with institutional investor sentiment plummeting to -7.0 vs. retail’s still-positive 2.0; Higher for Longer has left 5-year TIPS yields north of 2% since Q3 2023, well above of their long-run 0.5% average

- Real revolving credit fell -0.4% on a 3MA basis in May, the first negative print, excluding COVID, since Q4 2019, when the economy was sliding into recession; continued weakness in the RCM/TIPP Optimism Index also flags further downside risk for consumer spending

- In the NY Fed’s Survey of Consumer Expectations, Household Credit Availability fell to a net -37.2 in June, down from January’s local high of -30.2; this aligns with NFIB current job openings falling to 37 alongside a loss of half a million nonfarm self-employed workers in Q2