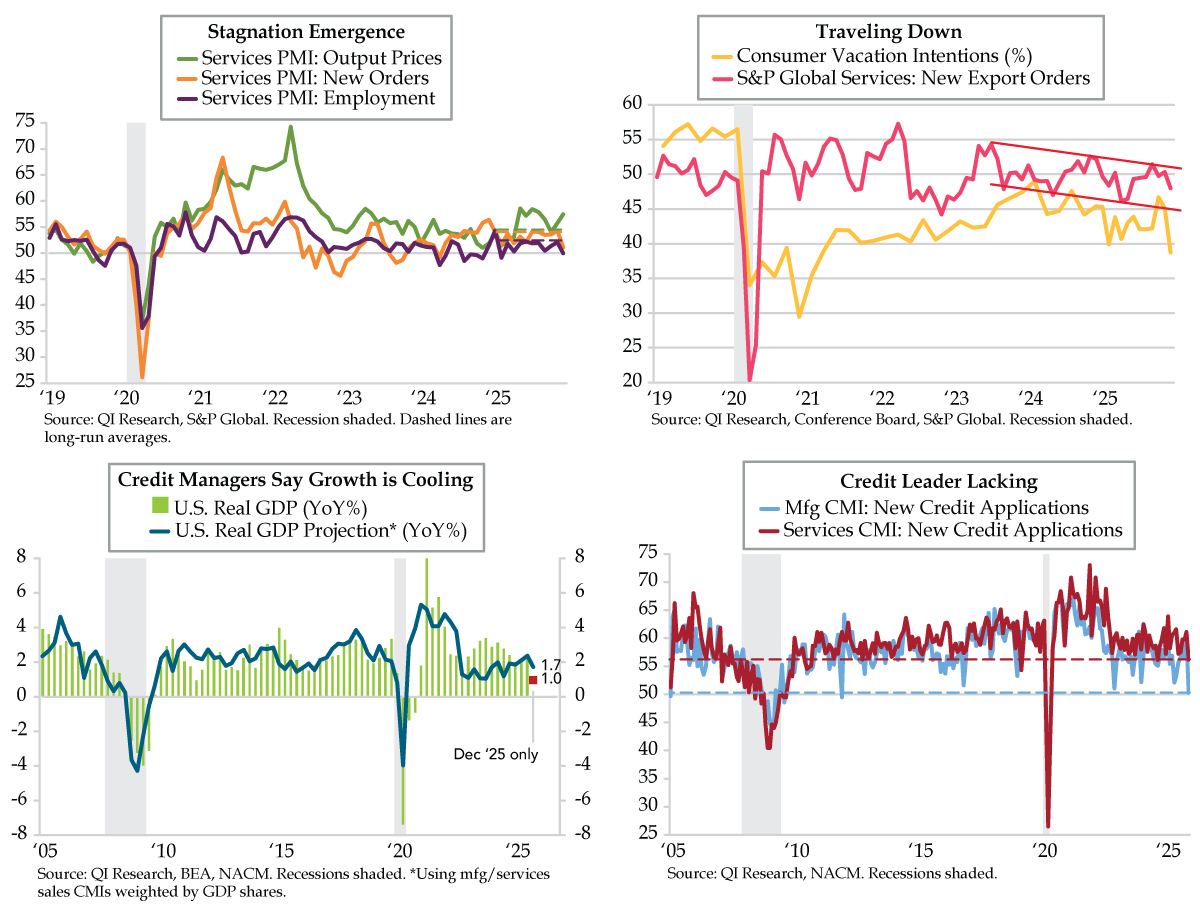

Downside Persists in S&P Global and NACM

January 7, 2026 Quick Quill

QUICK QUILL — S&P Global flagged rising output prices encountering faltering demand and contracting employment in the key services sector. NACM corroborated the signal as sales across the factory and services sectors saw sizeable declines. Credit…

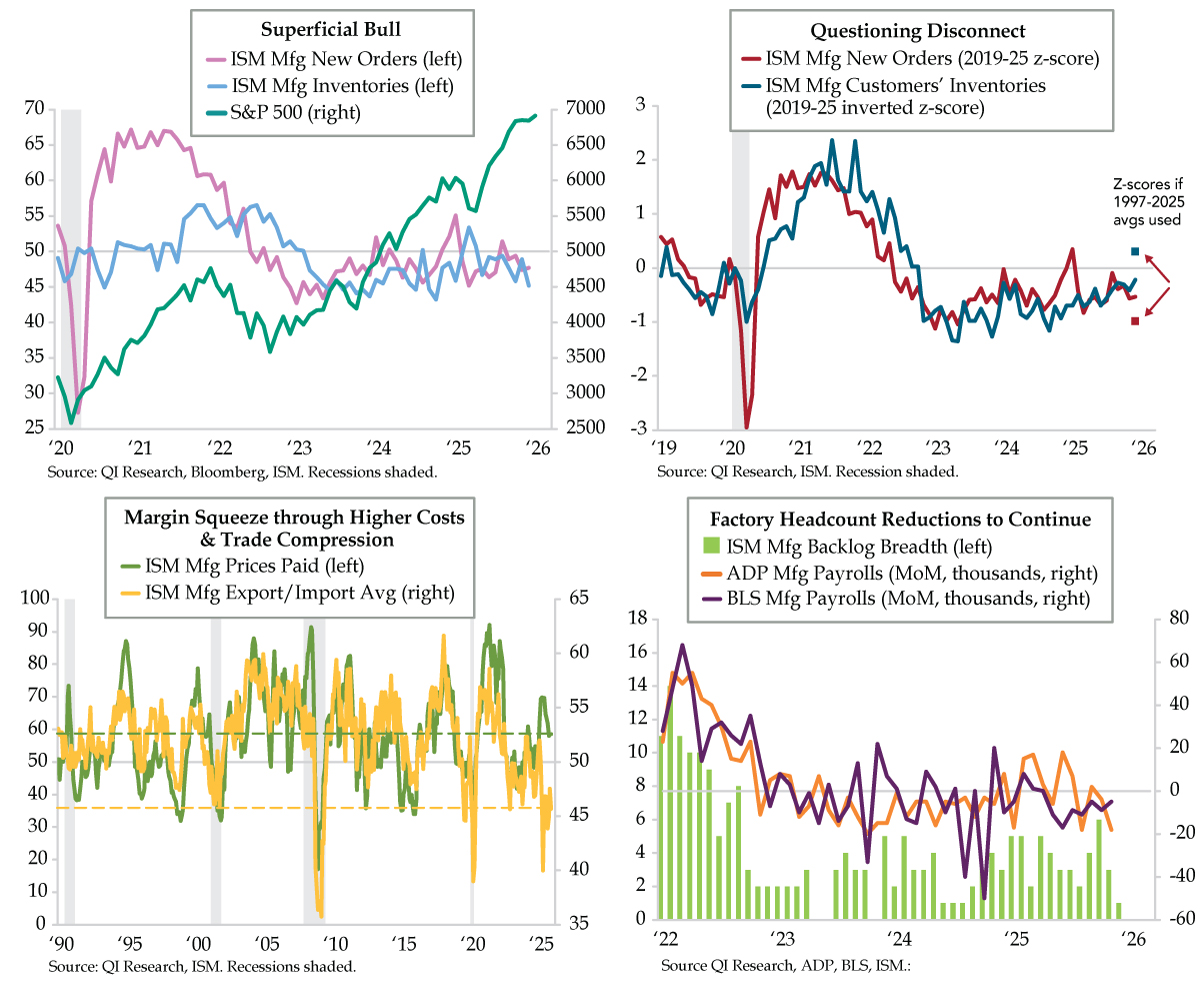

Fade ISM New Orders-to-Inventories Spread as Manufacturing Slump Extends

January 6, 2026 Quick Quill

QUICK QUILL — The ISM report provided superficial support for equity bulls as the New Orders-Inventories spread returned to positive territory in December. Details, however, revealed that the spread was a false positive with Inventories contracting…

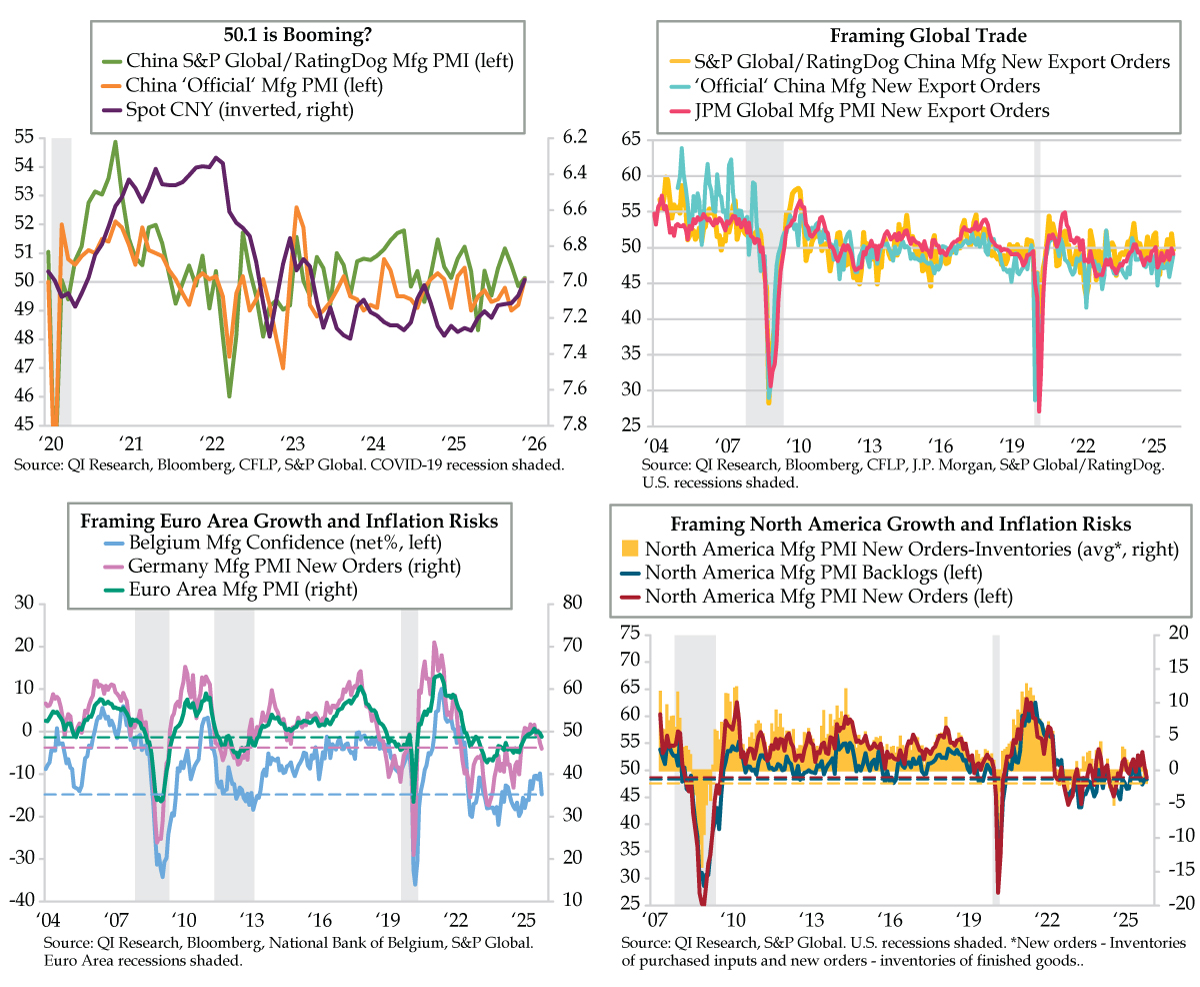

Global Trade Poised to Continue Contracting in 2026

January 5, 2026 Quick Quill

QUICK QUILL — Despite the yuan breaking the ‘7-barrier’ for the first time since 2023, Chinese manufacturers are waxing cautiously and flagging intentions to reduce headcount. Factory counterparts in Europe voice hope for increased investment. A…

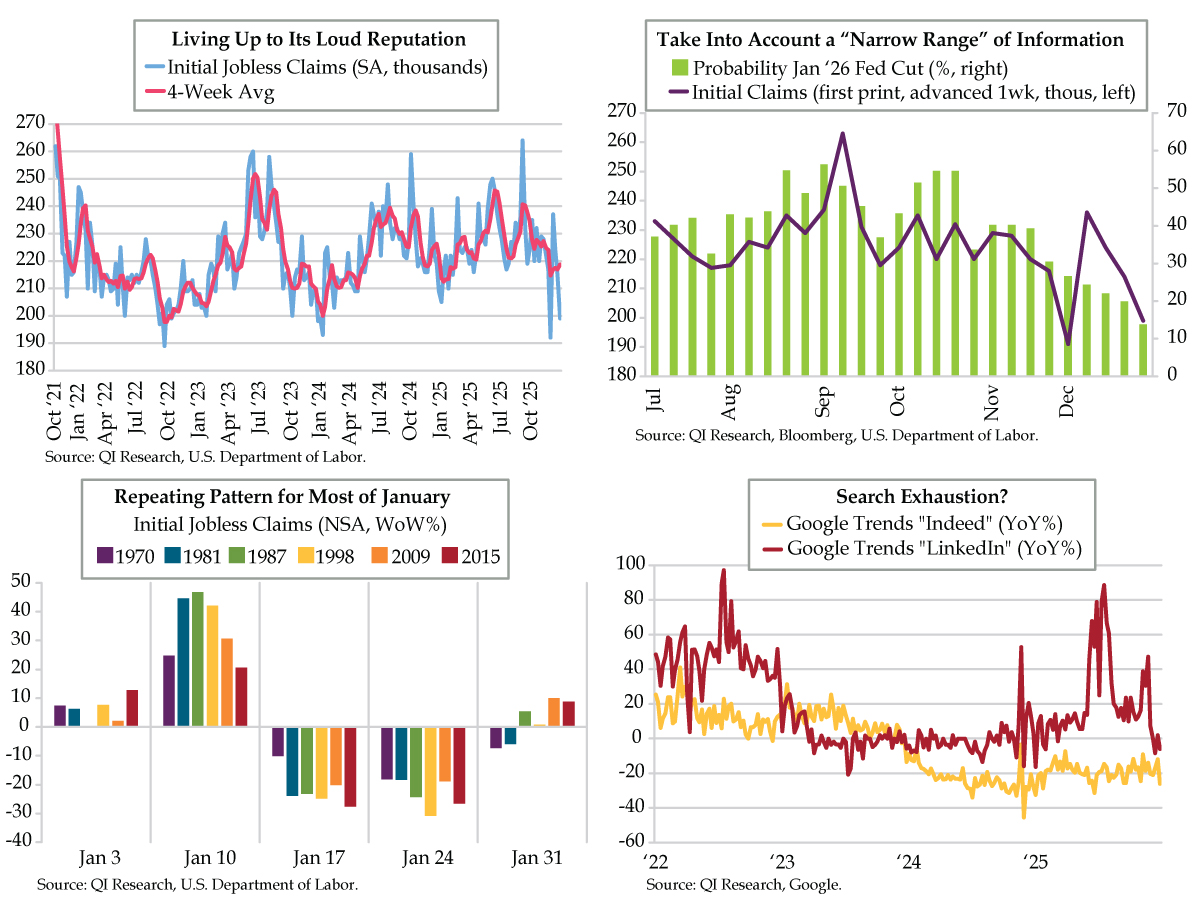

Navigating Claims Preps Payroll Disappointment

January 2, 2026 Quick Quill

QUICK QUILL — “Beats” for initial jobless claims have helped lower January Fed rate cut expectations. However, the noise from Thanksgiving and Christmas weeks shows the smoother four-week trend is rising, not falling. As we look…

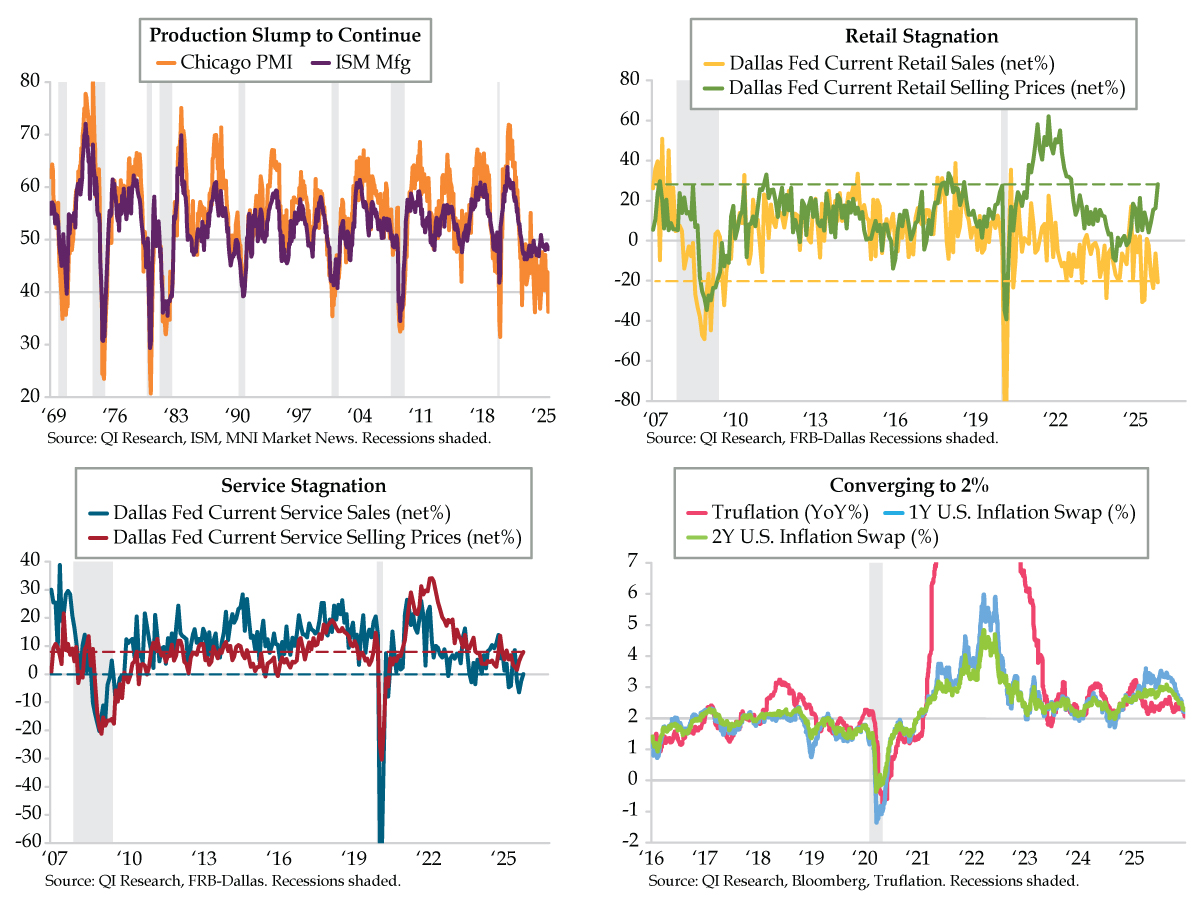

Chicago and Dallas Regions Amplify Disinflationary Risks

December 31, 2025 Quick Quill

QUICK QUILL — Chicago and Dallas regions revealed upstream and downstream disinflationary evidence, indicating the production slump should continue and stagnation is present in retail and service sectors. Truflation’s march toward a 2%-handle is bringing one-…

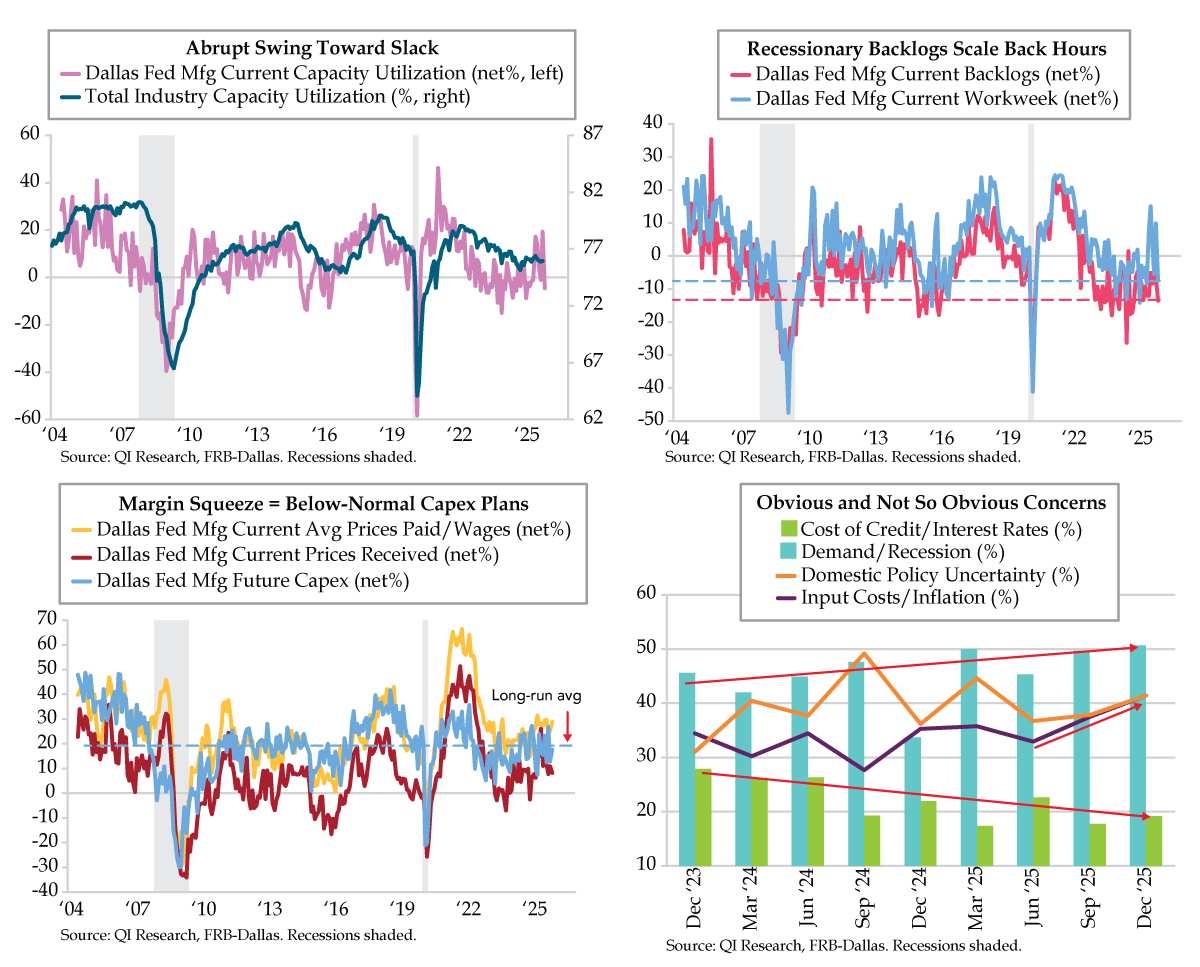

Texas Factory Recession Blueprints Additional Fed Cuts

December 30, 2025 Quick Quill

QUICK QUILL — The disappointing Dallas Fed manufacturing survey added to the upstream slack theme manifest in disappointments via other December Fed regional industrial surveys. A record negative swing in capacity utilization and compression in backlogs…

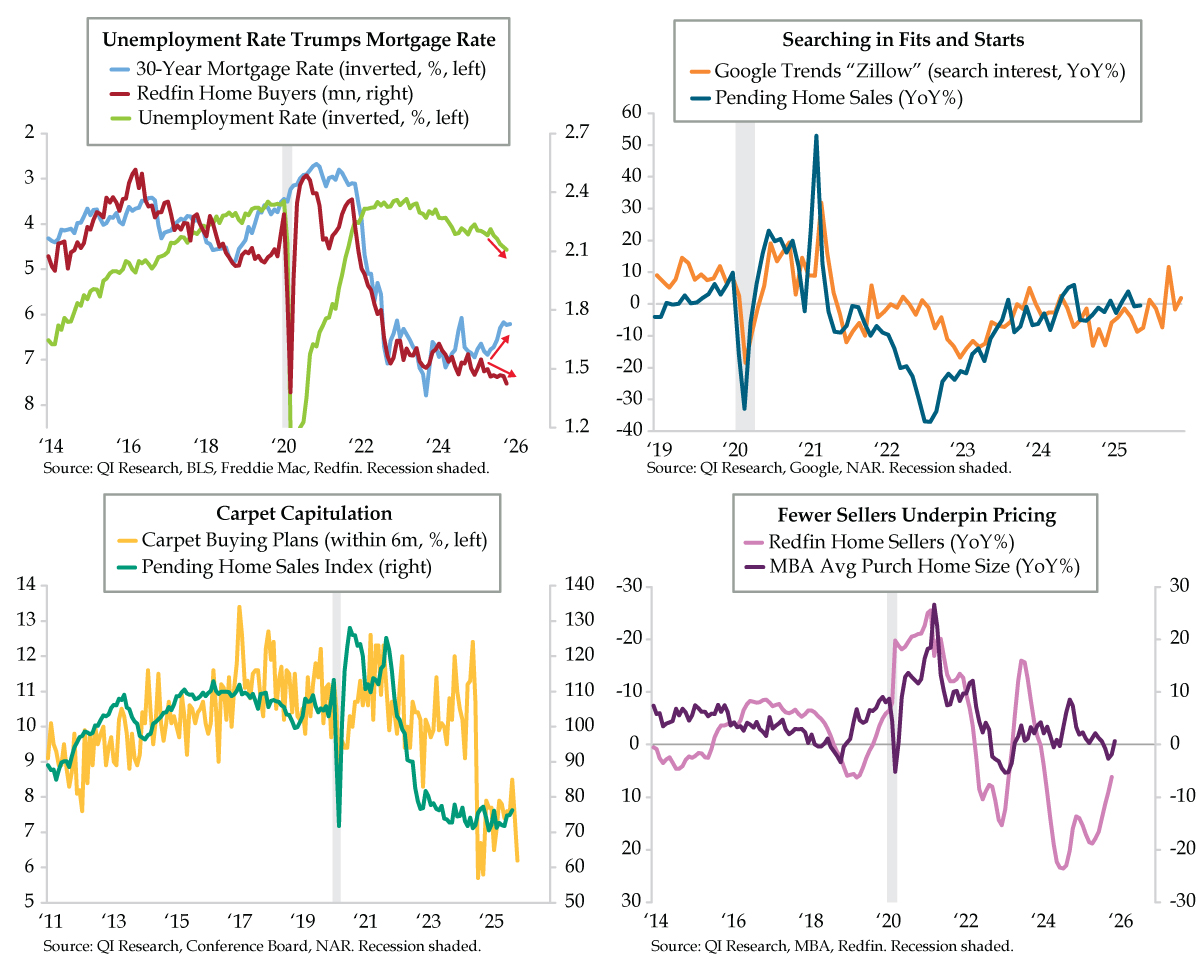

2026: The Year U.S. Housing Capitulates

December 29, 2025 Quick Quill

QUICK QUILL — If 2024 was the year the U.S. housing market was frozen, 2025 was the year of the initial thaw. A quicker pace of increase in the unemployment rate should make 2026 the year…

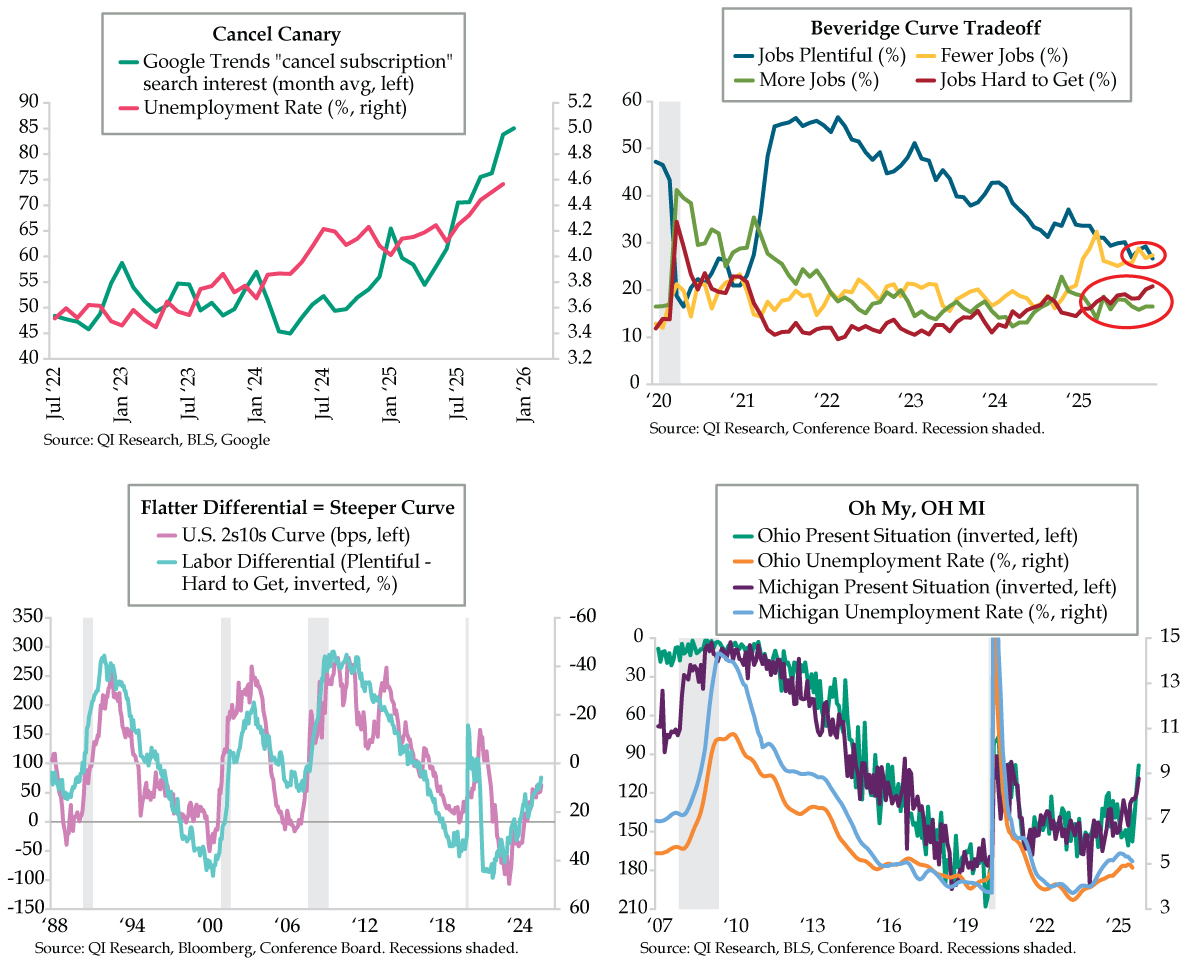

Consumer Confidence Supports a Bull Steepener

December 26, 2025 Quick Quill

QUICK QUILL — Subscription cancellations are trending and reinforce a higher jobless trend. Conference Board’s December Consumer Confidence survey added to this theme as unemployment leader, Jobs Hard to Get, reached a cycle high, and Fewer…

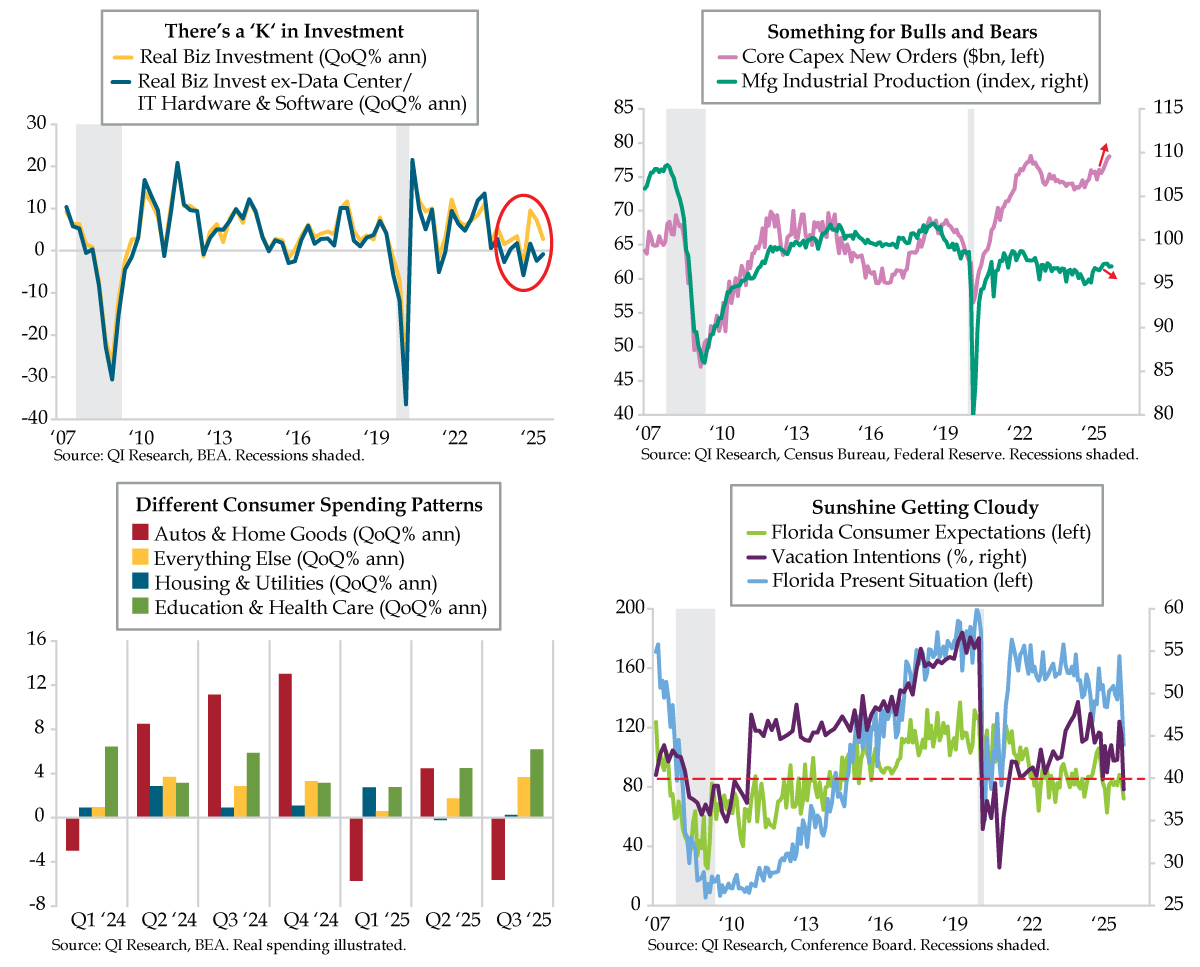

Ks in Investment and Consumer Spending Cloud the Outlook

December 24, 2025 Quick Quill

QUICK QUILL — The ‘K’-shaped AI vs. non-AI investment profile was perpetuated in the “old” third-quarter GDP release. Even reports on durable goods and industrial production showed nominal core capex orders on the top of the…

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115