In physics, a liquid is one of three principal states of matter, intermediate between gas and crystalline solid. You’ll not get wet with liquids in quantum physics. Quantum spin liquid is all about magnets that never freeze and the way electrons spin in them. Per the Harvard Gazette, reporting on its team that finally cracked the code, experimentally documenting this elusive state of matter: “In regular magnets, when the temperature drops below a certain temperature, the electrons stabilize and form a solid piece of matter with magnetic properties. In quantum spin liquid, the electrons don’t stabilize when cooled, don’t form into a solid, and are constantly changing and fluctuating (like a liquid) in one of the most entangled quantum states ever conceived.” If only physicist Philip W. Anderson had lived to see his 98th birthday, which would have been this past Monday, he could have seen for himself his 1973 theory manifest, which will keep the United States in the quantum computing race.

Doing his part is the now co-director of the Harvard Quantum Institute, Russian-born Mikhail Lukin, who was 21 in 1990 and not yet a PhD student at Texas A&M when the “Physics First” movement was launched. Teachers and scientists were determined to teach physics to American 9th graders to allow for more advanced studies in biology and chemistry in subsequent school years. One must wonder if there was pushback in the states of Philadelphia and New Jersey, the nation’s chemistry hub. At QI, our focus is the intersection of chemistry and economics given chemicals command first place in the manufacturing pipeline.

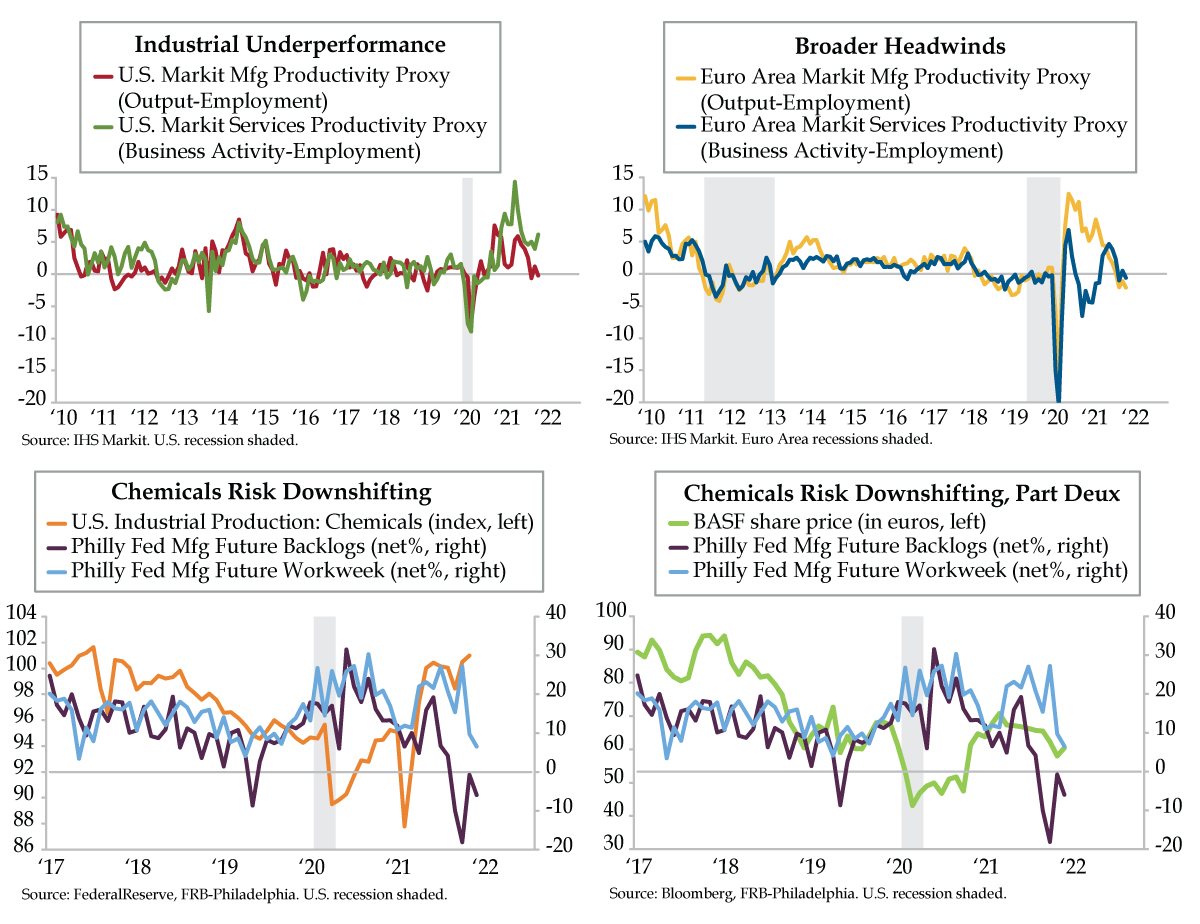

Thursday’s release of December’s Philadelphia Federal Reserve Manufacturing Survey thus gave us pause. It wasn’t the notoriously noisy headline diffusion index falling 24 points to 15.4 over the month. It’s rather the trends in two of the most forward-looking indicators – Future Backlogs (purple line) and Future Employment (light blue line). The former, which assesses perceived demand over the horizon, put in a post-pandemic peak of 31.5 in June 2020 and has been in the red for the past four months. At 6.5, expected employment has fallen for five straight months and is at the lowest since April 2019, when world trade was contracting, and an industrial recession threatened.

Two corollaries to these trends emerge. Because of what the bottom right chart says about the bottom left, we sense U.S. Chemicals Industrial Production (orange line) is peaking. It comes down to stock prices, by definition, pricing in all future known knowns. At $72.3 billion in 2020 revenues, German chemical mammoth BASF is not only the world’s largest operator; it widened its sales lead over the No. 2, Sinopec, from about $5 billion in 2019 to nearly $21 billion in 2020. As well as the giant weathered the pandemic, its stock price’s 15% slump since April (light green line) speaks volumes as to what’s to come.

We’re sticklers for corroboration here at QI. Econ 101 dictates that productivity is a proxy of corporate earnings – the more you get out of each employee, the higher your profits. As we were just in Germany, we’ll stay in the Euro Area. In the industrial sector, the difference between Output and Employment (yellow line) serves as a productivity stand-in. On the services side, the parallel spread pits Business Activity against Employment (blue line). As you see on the upper righthand chart, the manufacturing surrogate has been in the red for the last three months while its services counterpart has contracted in two of the last three months.

The sheer magnitude of U.S. fiscal stimulus couches the country’s relative outperformance given the delta of the assistance that preceded the pandemic and what’s on offer today. In this week’s Quill, we detailed how the average household with two children that qualifies to be caught up in the social safety net is getting:

- At least $550 a month in cash child tax credit

- Just north of $550 a month in monthly Supplemental Nutrition Assistance Program

- A minimum of a $600 offset in what’s being saved by not shelling it out in family care center if one spouse stays on the labor force sidelines.

The math is simple and simpler yet for a family of 5 or more. At a starting point of $1,700 after taxes, the math will never justify the prior minimum-wage-earning spouse, who is out of the workforce, coming off the sidelines. Overwhelming fiscal spending also explains inflation in food and the relative strength in services spending. Even so, the manufacturing proxy (red line) has contracted in two of the last three months. Even in the U.S. cyclicals lead the cycle. As for services, the U.S.’s productivity proxy (dark green line) is running at less than half the pace it was when spending peaked in May, one month after Stimulus Check 3.0 was directly deposited into households’ checking accounts.

If there’s one thing the cyclically sensitive economy worldwide will not appreciate in the short term, it’s a Fed that’s tightening at a more aggressive pace than what had been hoped for. Especially as the Bank of England lobbed the first truly hawkish volley across the bow, we can be assured that any further dollar strengthening will be greeted by investors with disdain, to use a polite term. While we can applaud the observance of spin liquidity in the quantum space, investors care only about the old-fashioned form of the salve that keeps markets humming.