For Gen-Xers, John Cusack was a sensitive heartthrob in 1980s films like Better Off Dead, Say Anything… and One Crazy Summer. In 1997, Cusack reemerged from obscurity to portray depressed hitman Martin Q. Blank in the black comedy Grosse Pointe Blank. His therapy was a return to his Michigan hometown for his 10-year high school reunion. There he bumps into Debi Newberry (Minnie Driver), an old flame Blank stood up for the prom. It’s not all pleasure as Martin’s secretary (Joan Cusack) efficiently sets up a hit for him on his visit. When Martin discovers the target is Debi’s father, he assassinates his assignment as Debi gets caught in the crossfire between rival assassin Grocer (Dan Aykroyd) who was also trying to take out Debi’s dad. During the siege, Martin confesses he’d ditched her on prom night to protect her from his homicidal urges. His reawakened heart stereotypically gives him newfound respect for life. After a perfectly filmed shootout, he proposes to a stunned Debi. His life saved, her father quips, “You have my blessing.”

Of the 17 locations for filming, IMDB lists a couple in Michigan but most in California. Both states rose to the fore in July’s Conference Board consumer confidence data. Of the eight large states surveyed monthly — California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, and Michigan — only The Wolverine State’s headline index took out the COVID-19 flash recession low. It plunged 21.6 points this month, the largest one-month post-pandemic decline to a seven-year low of 77.2.

The losing streak for California consumer confidence also piqued our attention. Confidence in The Golden State registered a decline for a fourth consecutive month. While the eight separate state series don’t share the aggregate index’s historical footprint back to 1967 as does the aggregate U.S., the shared 2007 starting point does allow for at least one other cycle comparison. In what’s becoming a recurring echo across data sets, the only four-month precedent for California was a four-month stretch was in 2008, in the heat of the Great Recession.

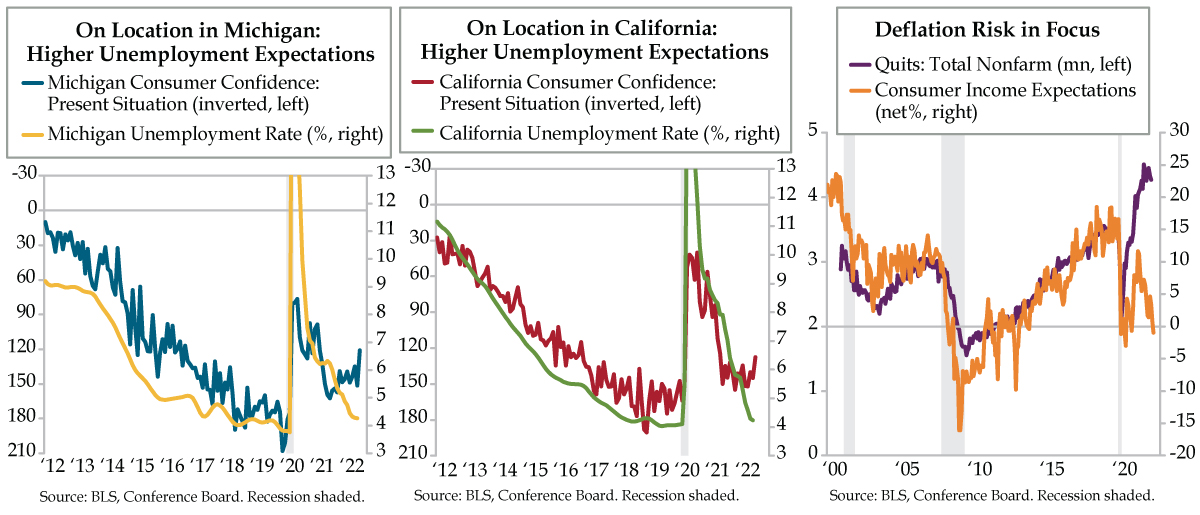

Regular followers of the confidence data are naturally drawn to the forward-looking expectations gauge. That said, the present situation read offers great value if you know what you’re looking for and how to view it. With that as inspiration, we flipped Michigan’s and California’s present situation indices on their collective heads, illustrating them in an inverted fashion. Although the Conference Board doesn’t publish state-level series on its key take on the labor market — Jobs Hard to Get — we can still tap as proxies state unemployment rates for Michigan (yellow line) and California (green line). The breaks in both Michigan (blue line) and California (red line) suggest that higher unemployment expectations in these two key states could be signaling a turn higher for their respective unemployment rates, yet another recession marker.

To be sure, inflated job openings are masking the true state of the job market. The invisible oversupply of labor has been effectively hidden by the post-COVID labor grab of startups and e-commerce outfits. Think Amazon plus Silicon Valley over-funded, overvalued via VCs-with-too-much-committed-capital startups (Thank you, Chair Powell!). That technical oversupply is being released just as traditional layoffs are commencing catalyzed by the demand destruction that accompanies plain-vanilla recessions. Because we’re faced with two distinct sources of labor supply, the economy is experiencing a labor shock obfuscated by the lagged deterioration in labor market metrics delivered via confidence and sentiment surveys.

Combined with inflation high enough to add a “stag-” to the “-flation,” expect a prolonged recession and downturn in risky assets. Indeed, credit stress has also lagged in manifesting because of the time bought and paid for by overly loose monetary policy. An oversupply of liquidity kept hidden credit stress under wraps. In Michigan, the onset of the household credit default cycle will be felt in the auto sector. We’ve also heard anecdotally that California is a hotbed of auto repossessions. As reported Monday in the Los Angeles Times, concentrations invite vulnerabilities: “In Orange County at Westminster-based LBS Financial Credit Union, autos make up 70% of its total loans.”

We’d add that the labor shock also will be exacerbated by depleting cash flow, as evidenced by AT&T’s and GE’s warnings. On Tuesday, GMAC also raised its loan loss provisions tenfold in the year to June 2022 – to $320 million from $33 million. GM CEO Mary Barra warned of belt-tightening in the works due to “concerns about economic conditions.” Headcount reductions will be driven increasingly by cost cuts as employers move to safeguard precious cash cushions.

On cue, consumer income expectations dipped below zero for the first time in 18 months. U.S. households also expect reduced future cash flow. Negative readings for income expectations are rare historically, occurring just 8% of the time since the survey’s 1967 inception. These deflationary tendencies have become more prevalent in the post-quantitative easing era.

Powell has publicly taken constant comfort in an abundance of job openings. This indicator, released with a two-month lag, is on borrowed time given the rapid tightening of monetary policy. Diminished job opportunities nix the swagger that’s been on bold display among job hoppers. The nonfarm Quits Rate has a.91 correlation with job openings over time; it’s already flagging a top. You don’t have to be a depressed hitman to know that it won’t be long before the Great Resignation supercharged wage growth succumbs to deflationary forces.