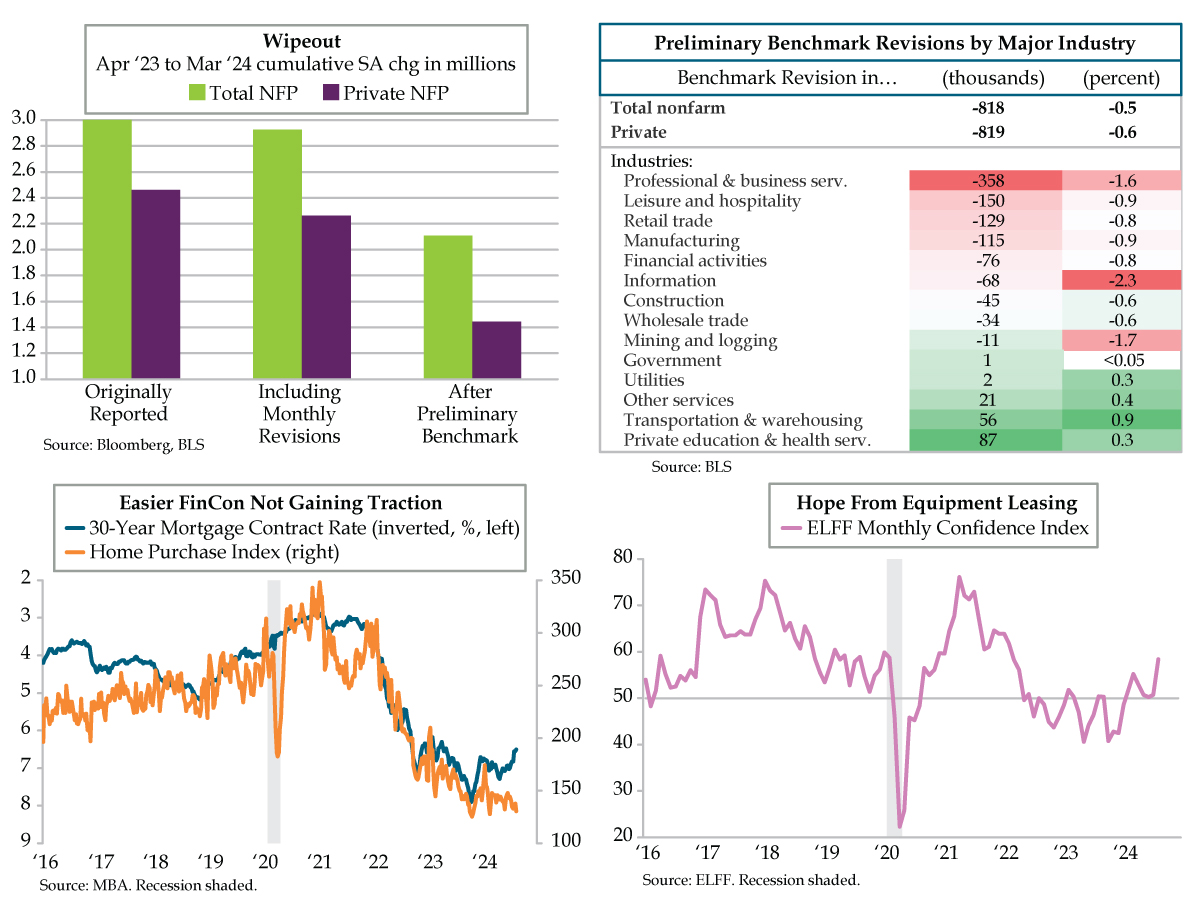

QUICK QUILL — The preliminary benchmark payroll revision was five times larger than normal and six times that for the private sector. More than a million private sector jobs have been wiped off that which was originally reported. Rates markets bull steepened and added additional probability that the Fed could undertake 100 basis points of rates reductions by year-end. Recent declines in mortgage rates, however, haven’t spurred home-buying activity reflecting the anemia in the job market.

TAKEAWAYS

- The preliminary benchmark revision of -818,000 was -0.5% of total nonfarm employment, five times worse than normal; on the private side the decline was six times worse, taking the original 2.461 million jobs added in the 12 months ended March down to just 1.444 million

- Professional and Business Services accounted for 358,000 or 44% of private sector losses, followed by Leisure/Hospitality’s 18%, Retail Trade’s 16%, and Manufacturing’s 14%; Information, a key GDP proxy, had the largest percentage rewrite of any sector at -2.3%

- Though 30-year mortgage rates have fallen in 12 of the last 16 weeks, per the MBA, the Purchase Index has fallen by -7.8% from its late-April high; the continued weakness in housing is indicative of the labor market picture laid bare by yesterday’s payroll revisions