At 9:00 AM, two trains leave Chicago’s Union Station, embarking on cross-country journeys in opposite directions. Heading east toward New York City is the Lake Shore Limited, maintaining a steady cruising speed of 60 mph as it cuts through the industrial corridors of Indiana. Simultaneously, the California Zephyr departs toward San Francisco, traversing the tracks across the vast Illinois prairies. The westbound train is traveling at a slightly faster average speed of 65 mph. If both trains do not make any stops, at what exact time will both trains be precisely 500 miles apart?

If you have youngins under your roof who avoid word problems like the plague, don’t worry. This is a simple Distance = Rate x Time exercise. First, find the combined rate of separation by summing individual speeds together (60mph + 65 mph = 125mph). Second, solve for time (500miles = 125mph x t; t = 4 hours). Third, determine the clock time by adding 4 hours to the departure time. The answer is 1:00 PM.

Coming into this holiday-shortened week, last Friday’s U.S. economic calendar was reminiscent of the “two trains leave Chicago” equation. Industrial Production and Homebuilder Sentiment were the locomotives moving in different directions. The driver of December’s upside and November’s upward revision in total Industrial Production (IP) was manufacturing output. Last month’s manufacturing IP advanced 0.2% month-over-month (versus the -0.1% consensus estimate), and November was revised up three-tenths to 0.3% MoM (from 0.0% prior). On the flip side, the National Association of Homebuilders (NAHB) Housing Market Index took two steps back in January, to 37 from December’s 39; the MoM drop countered to the 40-consensus estimate going in.

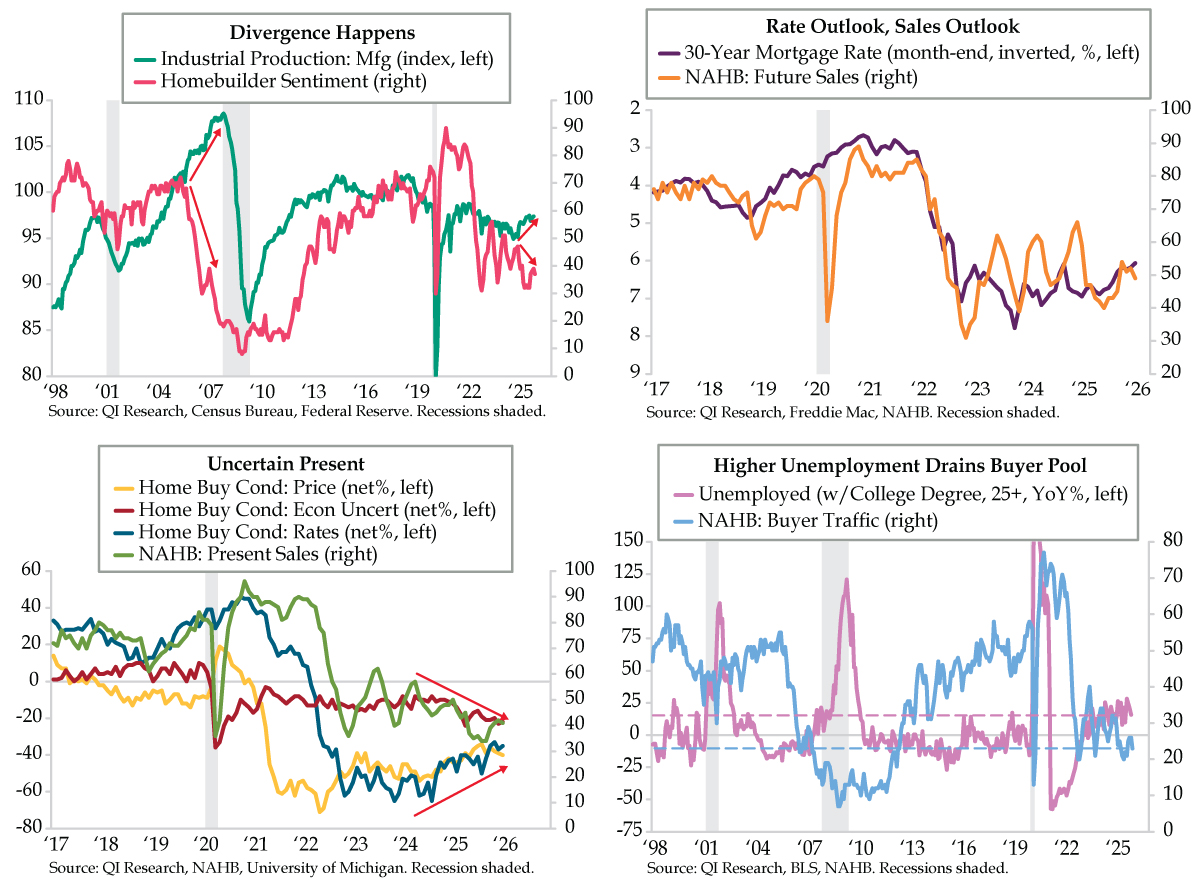

Pitting manufacturing IP (teal line) against NAHB sentiment (fuchsia line) in the first quad chart illustrates cyclical sensitivity. But there are times when the two move opposite one another, with the last year being one of them. Applying a rolling 12-month correlation over the period revealed interesting results. During 2025’s second half, the correlation crossed under the -.80 mark. Since 1998, initial breaches of this threshold occurred in March 2000, January 2006, December 2007, October 2018, October 2019 and July 2025. In order, these dates align with: the Internet bubble; Housing bubble; Subprime mortgage crisis; First ever QT (quantitative tightening); Recession that wasn’t; Second ever QT. Anyone else think there’s another three-word-or-less phrase missing at the end?

While you’re holding that thought, a peek under the NAHB hood is in order. Starting with NAHB Future Sales, the gauge has made four stabs at a sustainable recovery since reaching a cycle low in 2022. In all four cases, it failed. In this most recent attempt, there’s been no net improvement; since October 2025’s recent high of 54, it’s backslid to 49 (orange line). Over time, mortgage rates – and by extension, the rates outlook – tend to dictate sales’ prospects. This stands to reason as rates adjust more frequently vis-à-vis home prices or the labor picture; the latter two are much more fundamental pillars underpinning housing demand. It remains to be seen whether the 6.06% new low in 30-year mortgage rates (inverted purple line) jolts pessimism back into optimism.

The second NAHB component measuring Present Sales (green line) took its first step backward in five months (to January’s 41 from December’s 42) and has been mired in a down channel since 2024. As for the ‘why,’ the University of Michigan (UMich) has something to say about that. Conveniently, Home Buying conditions assess the influence of prices, rates and economic uncertainty, all of which translate to the state of the labor market.

The first two, prices (yellow line) and rates (dark blue line), have been on an upward track for two years, suggesting less concern about “high home prices and mortgage rates” the NAHB report cited as impediments. Moreover, UMich survey results conflict with homebuilders’ perceptions of the current sales environment. Economic uncertainty, on the other hand, is consistent with NAHB’s expression – it tumbled near a cycle low in December and January (red line), flagging fundamentals at play.

QI’s ‘holy grail,’ UMich’s Higher Unemployment Expectations (not depicted), has been north of 50%, in unequivocal recession territory for the last year. That it’s above 60% into 2026 backs builders’ worries. NAHB commentary suggests second-round effect labor weakening: “40% of builders reported cutting prices in January, unchanged from December but the third consecutive month the share has been at 40% or higher since May 2020…the average price reduction was 6% in January, up from the 5% rate in December. The use of sales incentives was 65% in January, marking the 10th consecutive month this share has exceeded 60%.”

The third NAHB subindex, Buyer Traffic, has fared the worst; it lost three points in January (light blue line), a level on par with the 1990-91 recession (not illustrated) and right there with 2007 readings during the subprime mortgage crisis. As the most educated (who also earn more than those with less education) have faced acute job losses in the current cycle, this pool of potential homebuyers has been drained. The year-over-year rate at which the unemployment rate for those aged 25 and over with a college degree has advanced at a double-digit rate nearly every month over the last year and a half (lilac line). This unprecedented stretch suggests that homebuilders’ top lines and bottom lines will continue to be pressured as 2026 unfolds, a lot tougher math problem than “Two trains leave Chicago…”