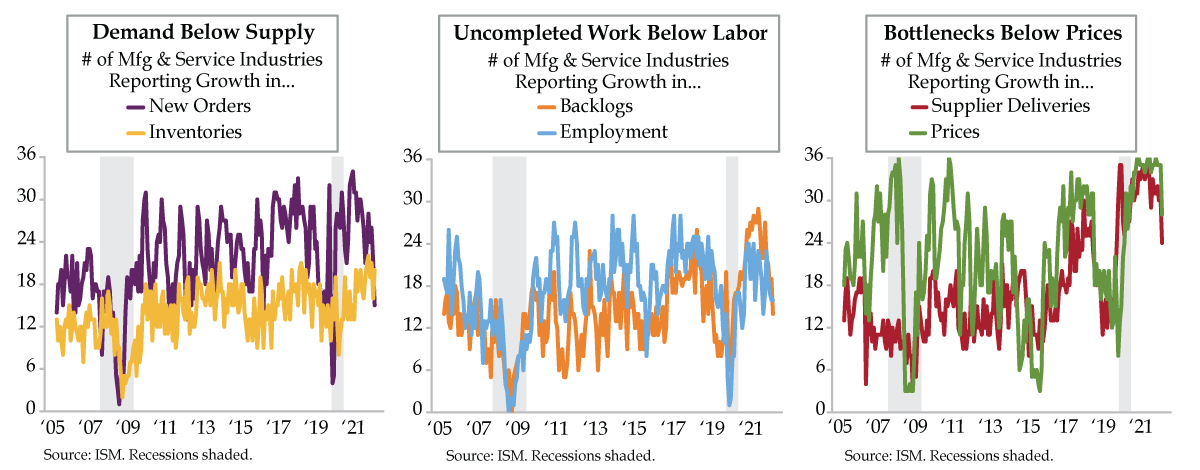

QI TAKEAWAY — While the risk asset rally could continue, we’d look to a disappointingly hawkish Powell at Jackson Hole later this week. Financial conditions have loosened to too great an extent and he is focused on headline CPI, which remains unacceptably high. We expect the layoff parade to continue and volatility to resurge while the flattening of the yield curve also resumes.

- The net of Good-Bad News Heard from UMich was 17 in August’s preliminary data, off the average of 9 from the last 3 months but well below April 2021’s 100; meanwhile, the recent gas price declines and equities rally have helped pull down consumer inflation expectations

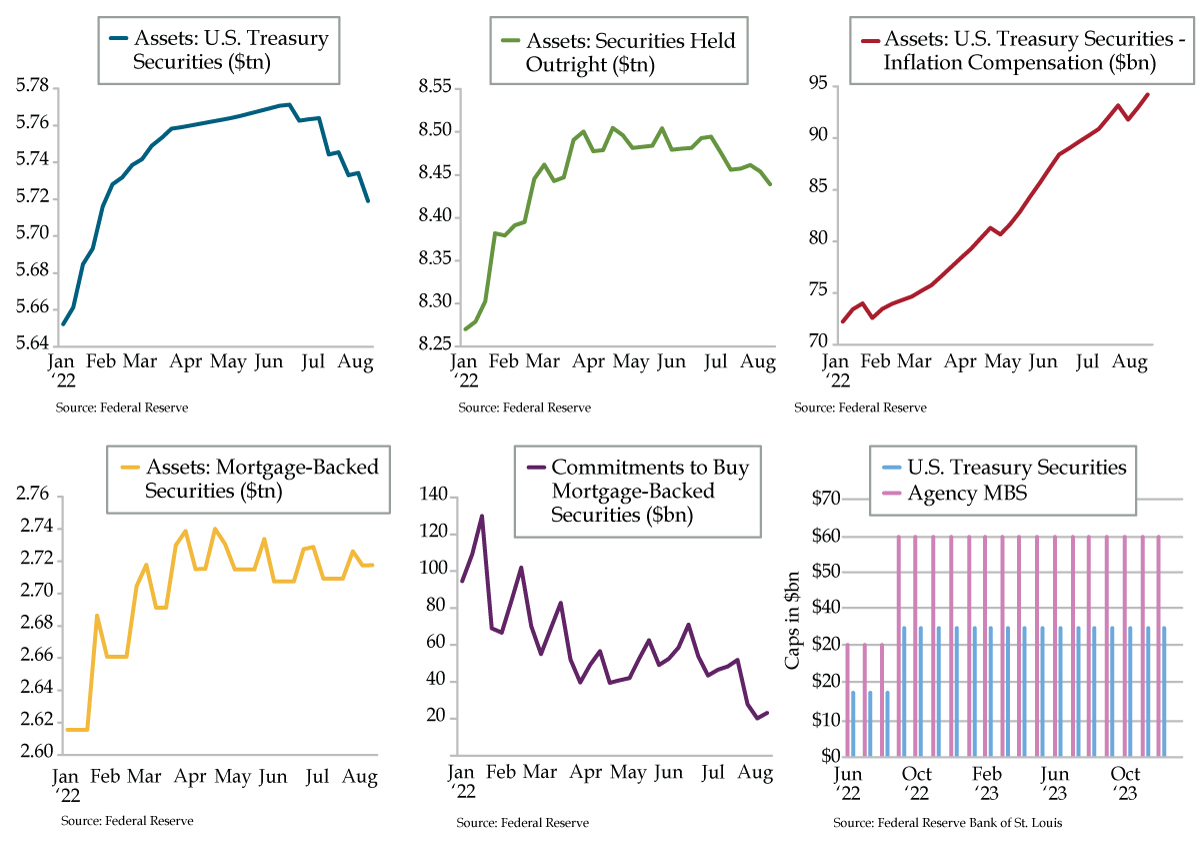

- At 288 bps, the shadow fed funds rate is 58 bps north of actual, and $53 billion in QT to-date suggests roughly 1 bp in added tightening per $1 billion; against the backdrop of Other Deposits falling since March, markets seem blind to the risks as QT ramps up next month

- Stale listings, on the market for 30+ days, hit 61.2% of homes for sale in July, per Redfin, up from 54.4% last year; this is the first YoY increase in supply post-pandemic, and is evidence of liquidity depletion manifesting in housing as selling conditions rapidly fall off their highs