From the Dead Ball Era to Mickey Mantle’s booming home runs, Casey Stengel’s colorful personality made him one of baseball’s most beloved characters. Known more for his managing prowess than his playing career, Stengel guided the New York Yankees from 1949 to 1960. “There is less wrong with this team than any team I have ever managed,” Stengel said after taking the helm. His plaque at the Baseball Hall of Fame describes his success: “Won 10 pennants and 7 World Series with New York Yankees. The only manager to win 5 consecutive World Series 1949-1953.” Dubbed “The Old Professor” by sportswriters for his sharp wit and ability to speak at length on anything baseball related, the Yankees dismissed him following a loss in the 1960 World Series, citing Stengel’s advancing age. In 1962, he returned to the Big Apple to manage the expansion Mets – and captured the hearts of New Yorkers all over again. Celebrated as baseball’s lovable losers, the Mets lost 120 of 160 games that first season. In 2024, the Chicago White Sox are on pace to match the Mets’ .750 losing percentage by posting Ls in 45 of their first 60 games.

Losing streaks in the dismal science typically draw out for longer than it takes the ‘Boys of Summer’ to complete a full season. It’s taken two years for U.S. job openings to slough off a cumulative 4.123 million positions since peaking in March 2022. And then came April in the long-lagged series. The plunge to 8.059 million openings not only surprised all 32 economists queried by Bloomberg, the vanishing of an incremental 296,000 openings took the two-month total of decimated job demand to -754,000. Moreover, 96% of the drop was centered in the private sector with the biggest losses in health care (down 270,000), finance and insurance (down 179,000) and construction (down 118,000). Medium-sized firms (down 611,000) accounted for most of the weakness, while large companies (down 148,000) more than offset mild gains for the smallest operators (up 36,000).

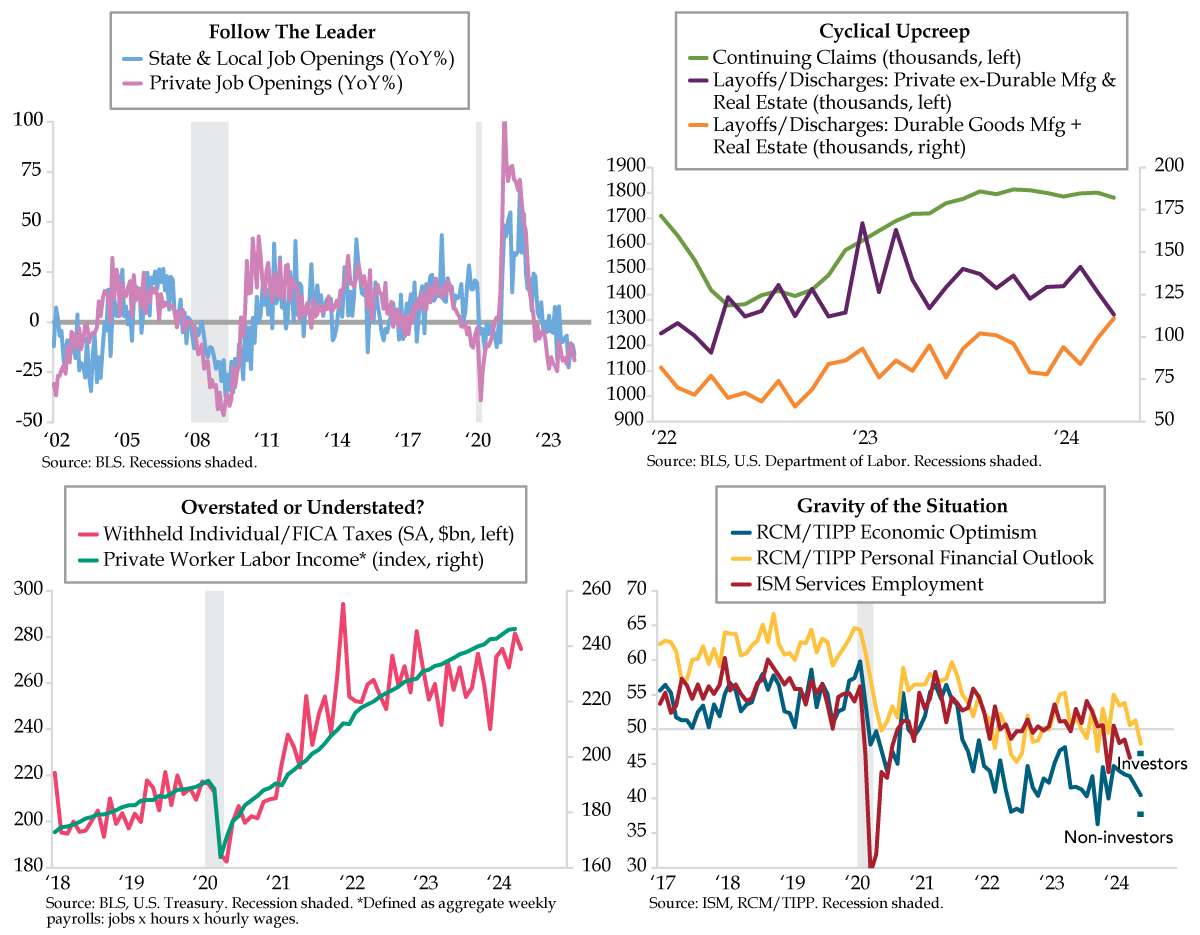

Notably, the persistence of private labor demand destruction – openings here have suffered double-digit year-over-year (YoY) declines in every month save one since February 2023 (lilac line) — has bled into the public sector as evident in the weakness in State and Local job postings. Pinched private sector revenues naturally trigger a more cautious stance on state and local government budgets. Double-digit YoY compression in job postings did not begin until January 2024 (light blue line).

The economywide rollover in job demand can only compound disinflationary pressures. Plagued by the lowest post-pandemic survey response rates of all Bureau of Labor Statistics surveys, Layoffs and Discharges across most private industries appear to have been largely rangebound since 2022 (purple line). Distress in Durable Goods Manufacturing and Real Estate, which have always fulfilled the role of recession canaries – hit fresh highs in April (orange line). While continuing claims have temporarily stabilized, we’d not be resting easily on their recent stasis (lime line). As destabilization ratchets up in the banking sector anew, one must be cognizant that real estate’s exposure to Higher for Longer Federal Reserve, increasingly manifests as a deepening slump in housing, raises the vulnerability quotient in commercial real estate.

Weakening labor ups ante for an income shock, which is easily tracked in real-time via the Daily Treasury Statement. As the name states, every day, the U.S. Treasury reports Federal deposits of withheld individual/FICA taxes. With a full compilation for May in hand, we can best describe the month as mixed. The uneven improvement – and we use that word loosely – in 2024 has not pushed the level north of the December 2021 post-pandemic peak (fuchsia line). Overlaying private labor income, defined as payroll jobs times weekly hours times hourly earnings, leads us to question the strength of the aggregate (teal line), especially with withheld taxes trending below labor income in 2023 and thus far in 2024.

Too bad we can’t ask consumers to chime in? We couldn’t have better scripted the first two words of the headline for the RealClearMarkets (RCM)/TIPP economic optimism index any better: “June Swoon.” The RCM/TIPP headline leads all other gauges of household sentiment. In June, it fell 3.1% to 40.5 (blue line). Optimism among investors edged up a mere 0.4% to 46.3, while it slumped a sharp -6.0% among non-investors to 37.7, which marked the third time in the last four months this cohort has driven the decline (blue markers). Because this group is less influenced by asset prices and more by the real economy, it suggests something more fundamental is amidst. To that end, one component of the headline’s composition – the Personal Financial Outlook Index — declined -6.6% to 47.9 in June, the year’s first contraction and the weakest print in eight months.

The Old Professor would agree that the rumblings from RCM/TIPP increase the odds that weakness will spread across the macro spectrum. The labor-intensive nature of the U.S. service sector makes it a prime candidate. Based on this statement, today’s Institute for Supply Management (ISM) Services Report on Business should be highly informative as the multitude of negative signposts raises the risk for downside in the survey’s May employment index (red line). This warning applies equally to an extension in the string of negative revisions come Friday morning’s big jobs data drop.