Category Archives: Uncategorized

Living to Tell

VIPs

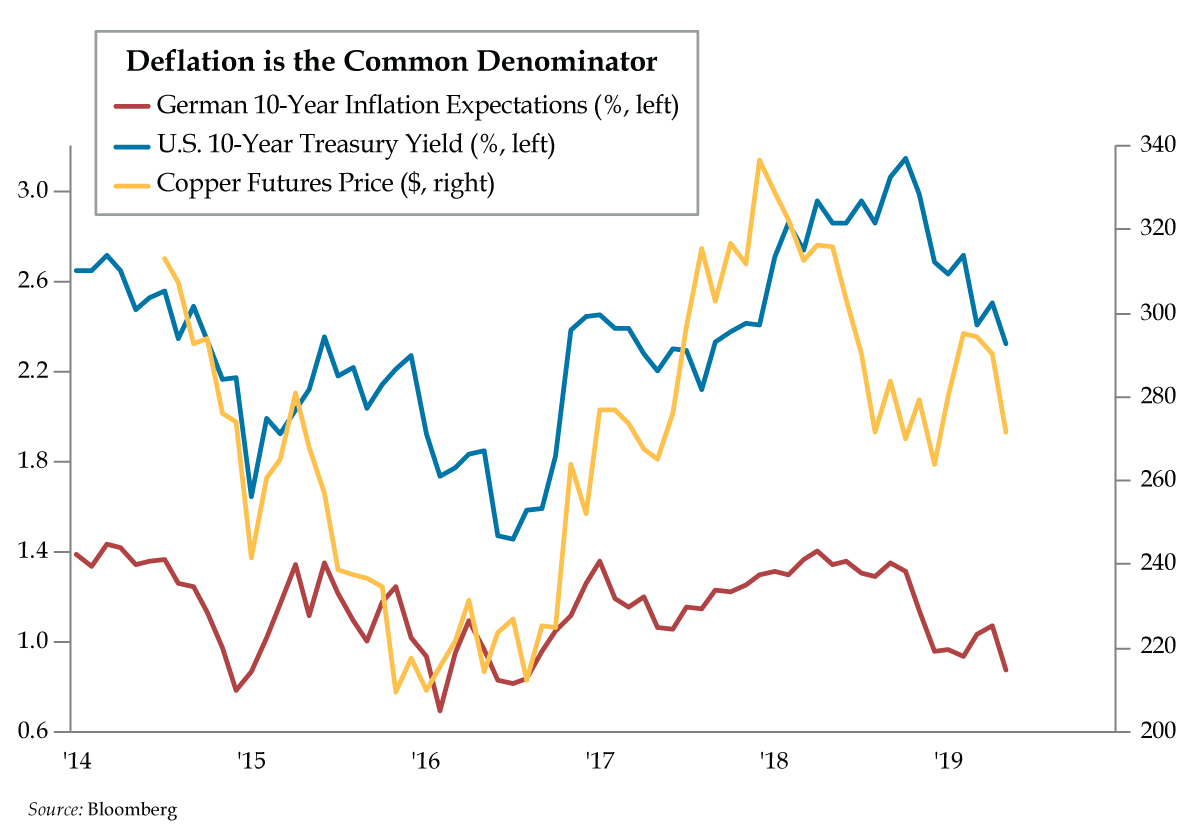

- Germany as the most underpriced recession risk was an accurate call; QI’s new call: Europe will test lows of the Negative Interest Rate Policy era at 0.48% leading to more frequent market chatter for the ECB to resurrect quantitative easing

- QI’s bullish U.S. dollar call for 2019 has almost reached our target with five months on the books; looking ahead, we’re bearish commodities, specifically copper and copper producers, with an eye to downside risk to Chile and Peru, given the U.S.’s long-standing inverse relationship with commodity producers

- As for our third call, a follow-on to our year-end 10-yr yield call, our most recent Quill illustrated clear downside risks to core PCE inflation from deflating Cass freight volumes, slumping auto manufacturing and slipping home pricing

There’s no such thing as a one-month anniversary. To purport as much suggests a serious etymological error. The word “anniversary” first appeared in 13th century England and derives from the Latin “anniversaries,” as in “annus” for yearly and “versus” for turning. Note the underlying annual root of the word and you begin to appreciate how sweet, but erroneous, adolescence can be. After all, nothing says first love like celebrating your first, second and third monthly anniversaries. Maybe we need to come up with a new word to mark these grand occasions of greater frequency given first loves rarely live to tell tales of true anniversaries.

We at Quill Intelligence could not be any prouder to report that we have indeed lived to tell. Today marks the one-year anniversary of the first Daily Feather. From our first reader to you, if you’re the latest addition to the QI family, we can’t thank you enough for the feedback and encouragement to do what we do best – chase cycles. With that, we thought it best to circle back to the start of 2019 with the quickest of reviews of our three big calls for the year and then look ahead to the next three developments we foresee as we forge into the second half of the year at the end of this week.

LINK HERE to view these predictions we made in December

1. Germany as the most underpriced recession risk was an accurate call. Germany’s twelve-month forward recession probability rose the most over the last six months, to 25% from 10%, compared to other major developed market and emerging market countries. Additionally, the German Manufacturing PMI ran at the back of the pack versus 40 other nations in April. And German recession risk has manifest into German industrial recession risk.

Contagion from manufacturing to the broader service sector is a known risk, as widely reported by IHS Markit, and is a pivot from growth risks to labor risks inside Germany. An underappreciated risk in our view is Euro Area deflation risk from emerging imbalances in the supply chain, at the core in Germany and upstream in the periphery, notably Belgium, a crucial cog for intermediate production.

The new call: German 10-year inflation expectations, currently 0.88%, to test lows of the Negative Interest Rate Policy (NIRP) era at 0.48%. This would lead to more frequent market chatter for ECB to bring back QE to fight deflation risk. Both Germany’s ifo and Belgium’s BNB surveys revealed sustained oversupply signals for manufacturing inventories. The deflationary impulse from these developments also is visible with Belgium’s current prices in the red and Germany’s downshifting quickly.

2. Bullish U.S. dollar call for 2019 has almost reached our target expectation with only five months on the books. Through May, the widely followed U.S. dollar index (ticker DXY) is up 1.6% versus our call for an appreciation in the low single-digits (~2%) for the entire year. Because the euro carries a heavy weight in DXY, dollar bull-call was a euro bear-call predicated on surprise economic weakness from Germany; euro has depreciated 2.4% year to date. Escalation of U.S./China trade tensions risks even more dollar appreciation. Greenback’s safe-haven status should continue to drive capital inflows escaping a global slowdown.

The new call: Bearish commodities, especially copper and copper producers, like Chile and Peru. Historically, the U.S. dollar has a long-standing inverse relationship with commodity prices. Because commodities are priced in dollars, a stronger dollar reduces global purchasing power of primary inputs into the production process, like copper. China is the largest marginal buyer in the world of many commodities and faces yuan depreciation risks from the trade war. But pure fundamental economic signals aren’t likely to emanate from the yuan. Guo Shuqing, PBoC’s Party Secretary publicly warned speculators that shorting the yuan would cause them to suffer great losses. Where to look for cleaner signals? Copper and top global copper producers, Chile and Peru.

3. Bullish U.S. 10-year yields have been an accurate forecast. The new call: Same as the old call. As of Friday, 10s were yielding 2.32%. Lower inflation expectations should drive the push to 2% for two reasons. First, the Fed will be sidelined for some time so don’t expect rate cuts to boost inflation expectations anytime soon. Second, core inflation is set to underperform, pushing into the 1%-1.5% range in the second half. Evidence is building. Our most recent Quill illustrated clear downside risks to core PCE inflation from deflating Cass freight volumes, below-trend Chicago Fed National Activity index, auto manufacturing risking house price disinflation, and stronger dollar. Technicals also are favorable; the next support level for 10-year yields: 2.04%.

Deflation is the common denominator for the three new calls, whether you choose to express your investment decisions as we suggest – short German breakevens, bearish copper, or bullish U.S. 10-year Treasuries – or not.