Category Archives: Uncategorized

Living to Tell

VIPs

- Germany as the most underpriced recession risk was an accurate call; QI’s new call: Europe will test lows of the Negative Interest Rate Policy era at 0.48% leading to more frequent market chatter for the ECB to resurrect quantitative easing

- QI’s bullish U.S. dollar call for 2019 has almost reached our target with five months on the books; looking ahead, we’re bearish commodities, specifically copper and copper producers, with an eye to downside risk to Chile and Peru, given the U.S.’s long-standing inverse relationship with commodity producers

- As for our third call, a follow-on to our year-end 10-yr yield call, our most recent Quill illustrated clear downside risks to core PCE inflation from deflating Cass freight volumes, slumping auto manufacturing and slipping home pricing

There’s no such thing as a one-month anniversary. To purport as much suggests a serious etymological error. The word “anniversary” first appeared in 13th century England and derives from the Latin “anniversaries,” as in “annus” for yearly and “versus” for turning. Note the underlying annual root of the word and you begin to appreciate how sweet, but erroneous, adolescence can be. After all, nothing says first love like celebrating your first, second and third monthly anniversaries. Maybe we need to come up with a new word to mark these grand occasions of greater frequency given first loves rarely live to tell tales of true anniversaries.

We at Quill Intelligence could not be any prouder to report that we have indeed lived to tell. Today marks the one-year anniversary of the first Daily Feather. From our first reader to you, if you’re the latest addition to the QI family, we can’t thank you enough for the feedback and encouragement to do what we do best – chase cycles. With that, we thought it best to circle back to the start of 2019 with the quickest of reviews of our three big calls for the year and then look ahead to the next three developments we foresee as we forge into the second half of the year at the end of this week.

LINK HERE to view these predictions we made in December

1. Germany as the most underpriced recession risk was an accurate call. Germany’s twelve-month forward recession probability rose the most over the last six months, to 25% from 10%, compared to other major developed market and emerging market countries. Additionally, the German Manufacturing PMI ran at the back of the pack versus 40 other nations in April. And German recession risk has manifest into German industrial recession risk.

Contagion from manufacturing to the broader service sector is a known risk, as widely reported by IHS Markit, and is a pivot from growth risks to labor risks inside Germany. An underappreciated risk in our view is Euro Area deflation risk from emerging imbalances in the supply chain, at the core in Germany and upstream in the periphery, notably Belgium, a crucial cog for intermediate production.

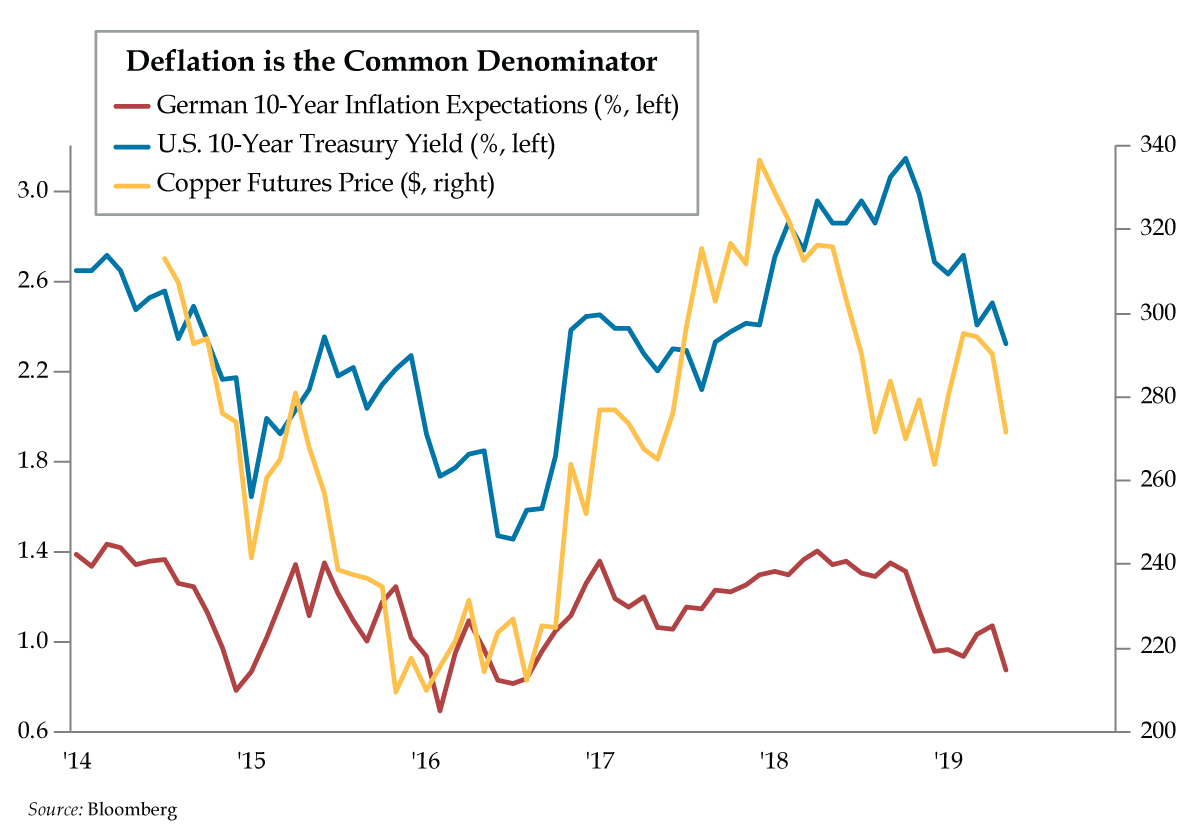

The new call: German 10-year inflation expectations, currently 0.88%, to test lows of the Negative Interest Rate Policy (NIRP) era at 0.48%. This would lead to more frequent market chatter for ECB to bring back QE to fight deflation risk. Both Germany’s ifo and Belgium’s BNB surveys revealed sustained oversupply signals for manufacturing inventories. The deflationary impulse from these developments also is visible with Belgium’s current prices in the red and Germany’s downshifting quickly.

2. Bullish U.S. dollar call for 2019 has almost reached our target expectation with only five months on the books. Through May, the widely followed U.S. dollar index (ticker DXY) is up 1.6% versus our call for an appreciation in the low single-digits (~2%) for the entire year. Because the euro carries a heavy weight in DXY, dollar bull-call was a euro bear-call predicated on surprise economic weakness from Germany; euro has depreciated 2.4% year to date. Escalation of U.S./China trade tensions risks even more dollar appreciation. Greenback’s safe-haven status should continue to drive capital inflows escaping a global slowdown.

The new call: Bearish commodities, especially copper and copper producers, like Chile and Peru. Historically, the U.S. dollar has a long-standing inverse relationship with commodity prices. Because commodities are priced in dollars, a stronger dollar reduces global purchasing power of primary inputs into the production process, like copper. China is the largest marginal buyer in the world of many commodities and faces yuan depreciation risks from the trade war. But pure fundamental economic signals aren’t likely to emanate from the yuan. Guo Shuqing, PBoC’s Party Secretary publicly warned speculators that shorting the yuan would cause them to suffer great losses. Where to look for cleaner signals? Copper and top global copper producers, Chile and Peru.

3. Bullish U.S. 10-year yields have been an accurate forecast. The new call: Same as the old call. As of Friday, 10s were yielding 2.32%. Lower inflation expectations should drive the push to 2% for two reasons. First, the Fed will be sidelined for some time so don’t expect rate cuts to boost inflation expectations anytime soon. Second, core inflation is set to underperform, pushing into the 1%-1.5% range in the second half. Evidence is building. Our most recent Quill illustrated clear downside risks to core PCE inflation from deflating Cass freight volumes, below-trend Chicago Fed National Activity index, auto manufacturing risking house price disinflation, and stronger dollar. Technicals also are favorable; the next support level for 10-year yields: 2.04%.

Deflation is the common denominator for the three new calls, whether you choose to express your investment decisions as we suggest – short German breakevens, bearish copper, or bullish U.S. 10-year Treasuries – or not.

Shadow Boxing the Consensus

VIPs

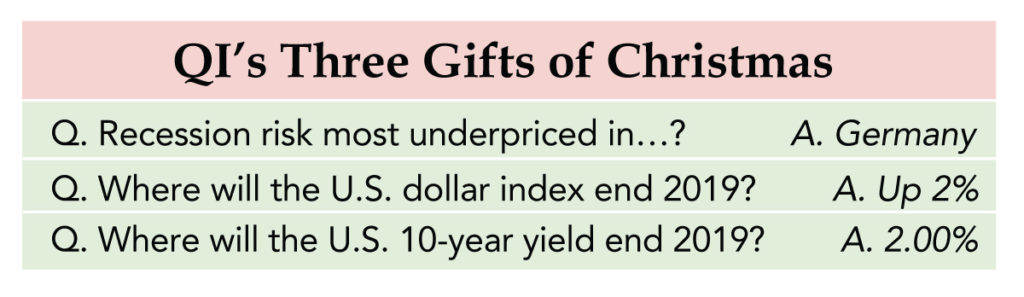

- Germany is the most underpriced recession risk in 2019 with the probability of contraction over the next 12 months at 15% compared to 20% in the U.S. and 33% in Japan

- The key leading indicator of the Euro Area labor market – unemployment expectations – has registered noticeable deterioration in France, Italy and Spain; the dissipation in the German skill shortage suggests eurozone-wide job market weakness is a palpable 2019 risk

- As the skill shortage is reported to be dissipating, slower job growth and a bottom in German unemployment are palpable 2019 risks

- Look for stronger U.S. dollar to end 2019; rising U.S. recession risks due to ISM cliff risks hitting markets early on thus the dollar is vulnerable to a sell-off before its safe-haven status drives capital inflows escaping a global slowdown

- A 2% 10-year yield? The U.S. growth outlook will be tested early in the year; housing and autos are likely to underperform expectations as upper-income buyers postpone purchases tied to elevated financial market volatility

- The Fed transitioning away from the rigid language of “gradual increases” to a more flexible, financial market and economic data-dependent policy will see traders price both probabilities of hikes and cuts in 2019

Happy Boxing Day! Feel free to let your servants journey home today such that they too can give their “Christmas Boxes” to family members. Wait…those times have luckily come and gone. We don’t have servants who serve us our pudding on Christmas Day, nor are we British for that matter. Instead, we would encourage you to consider the evolution of the meaning of the tradition, which is rooted in the virtues of charitable giving.

In its second life, Boxing Day fell the day after Christmas Day. Monies placed in special boxes during Christmas services were opened the following day and given to the poor. No doubt, many of you will be prompted to do year end giving in the coming days. QI asks that you to join us in keeping the spirit of giving alive to end the year on the happiest note for the less fortunate people in our communities who are most in need.

As we look back on the past seven months of writing the Feather since its May 29th launch, our gift to you is a look-ahead to the least expected scenarios to play out in the coming year. To arrive at this juncture, we asked ourselves three questions:

- Where is recession risk the most underpriced?

- Where will the U.S. dollar index end 2019?

- Where, in turn, will the yield on the U.S. 10-year Treasury close on 12/31/19?

Germany: Most underpriced recession risk. The line has been drawn in the sand by the consensus. Germany’s recession probability over the next 12 months stands at 15%, compared to 20% in the U.S. and 33% in Japan. For perspective, relatively lower recession probability breeds business cycle complacency and also can lead to overblown macro outlooks and overvalued financial assets.

Germany’s exposure to the U.S./China trade war makes it decidedly vulnerable to a slowdown. Many blamed the third-quarter decline in German GDP on temporary bottlenecks certifying new vehicles under tougher emissions tests. This interpretation of noise misses the signal from the German export and manufacturing sectors that have faced a persistent loss of traction throughout 2018. As the skill shortage is reported to be dissipating, slower job growth and a bottom in German unemployment are palpable 2019 risks.

Watch contagion risk from Germany’s neighbors. The key leading indicator of the Euro Area labor market – unemployment expectations – has registered noticeable deterioration in three of the Big Four countries — France, Italy and Spain. Germany’s unemployment expectations aren’t raising yellow flags but did trough in July 2018. Further deterioration in Germany’s expectations from here would flag a weakened outlook for growth, inflation, labor and corporate earnings that could lead the DAX to underperform its global peers.

Bullish U.S. dollar. The widely followed U.S. dollar index (ticker DXY) should appreciate by low single-digits (~2%) over the next year versus the 5.5% consensus decline forecasted. Because the euro carries a heavy weight in the DXY, the dollar bull-call is a euro bear-call predicated on surprise economic weakness from Germany.

That said, increased financial volatility from the global central bank shift from QE to QT and rising U.S. recession risks stemming from an ISM cliff threaten to wallop markets early in 2019. The dollar is thus vulnerable to a sell-off first before its safe-haven status drives capital inflows escaping a global slowdown.

Bullish U.S. 10-year yields. The global risk-free rate should fall over the course of the next year (~2.00%) from current levels near 2.75%. This call runs counter to forecasters’ views for rising 10-year yields to 3.30% by the fourth-quarter of 2019.

We disagree with the consensus on the speed of the U.S. slowdown next year.As detailed in our dollar call, the growth outlook will be tested early in the year. The leading housing and auto sectors should continue underperforming expectations as upper-income buyers postpone purchases because of elevated financial market volatility.

We disagree with the consensus outlook for two Fed hikes in 2019.Powell & Co. are likely to be challenged to get off even one more 25 basis-point increase on their desired path to the magic land of neutral.

The return of two-way interest rate risk is another reason investors can price for lower yields.This is a major difference for the rates outlook across the entire term spectrum compared to the QE era when one-way risk prevailed. Investors today are solely pricing rate hike probabilities. The Fed transitioning away from the rigid language of “gradual increases” to a more flexible, financial market and economic data-dependent policy will see traders price both probabilities of hikes and cuts in 2019.

We hope you share QI’s philosophy as you approach investing in 2019. Be contrarian backed not by bravado, but data that lead inflection points. Avoid labels such as “bull” or “bear.” Cycles can turn on a dime.