QI PRO HOLY GRAIL DASHBOARD

LONG MACRO

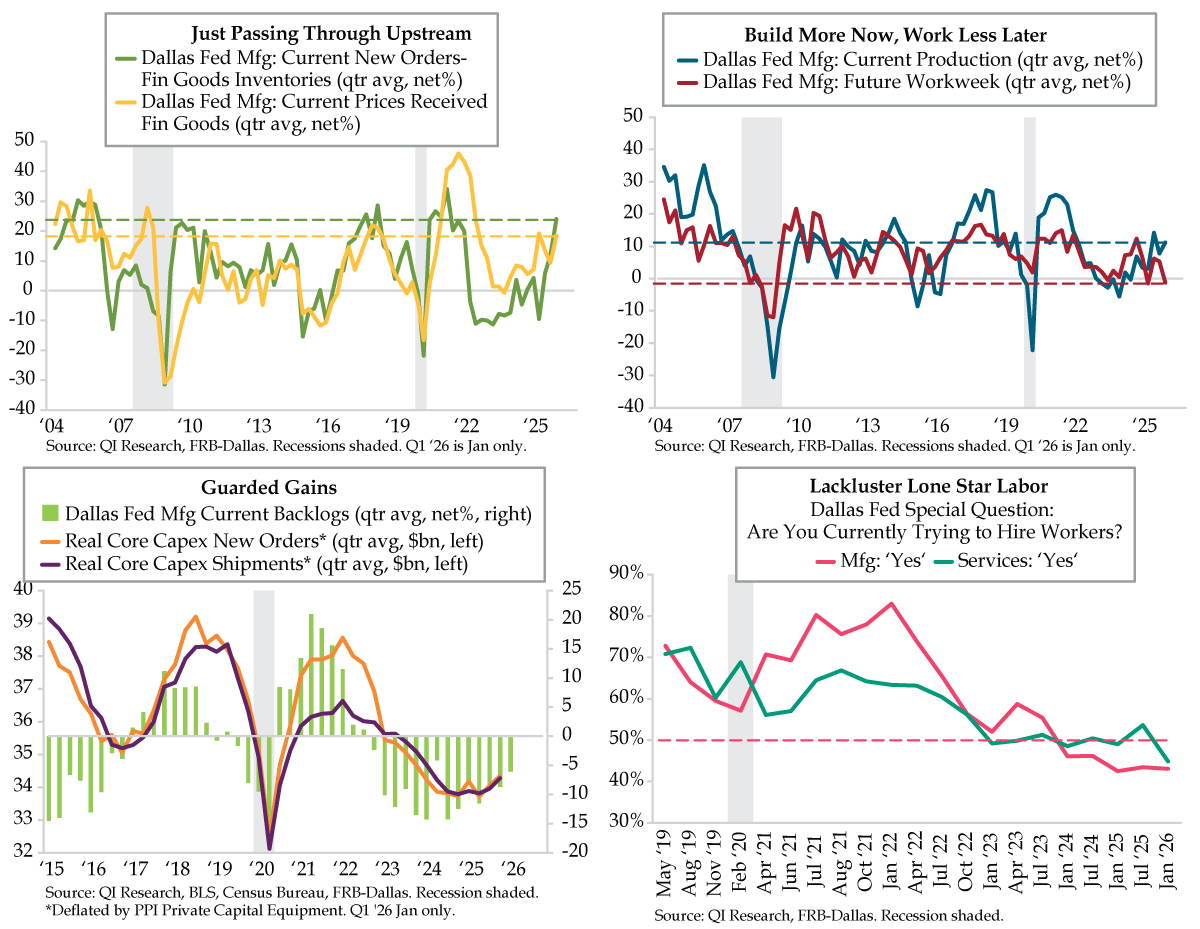

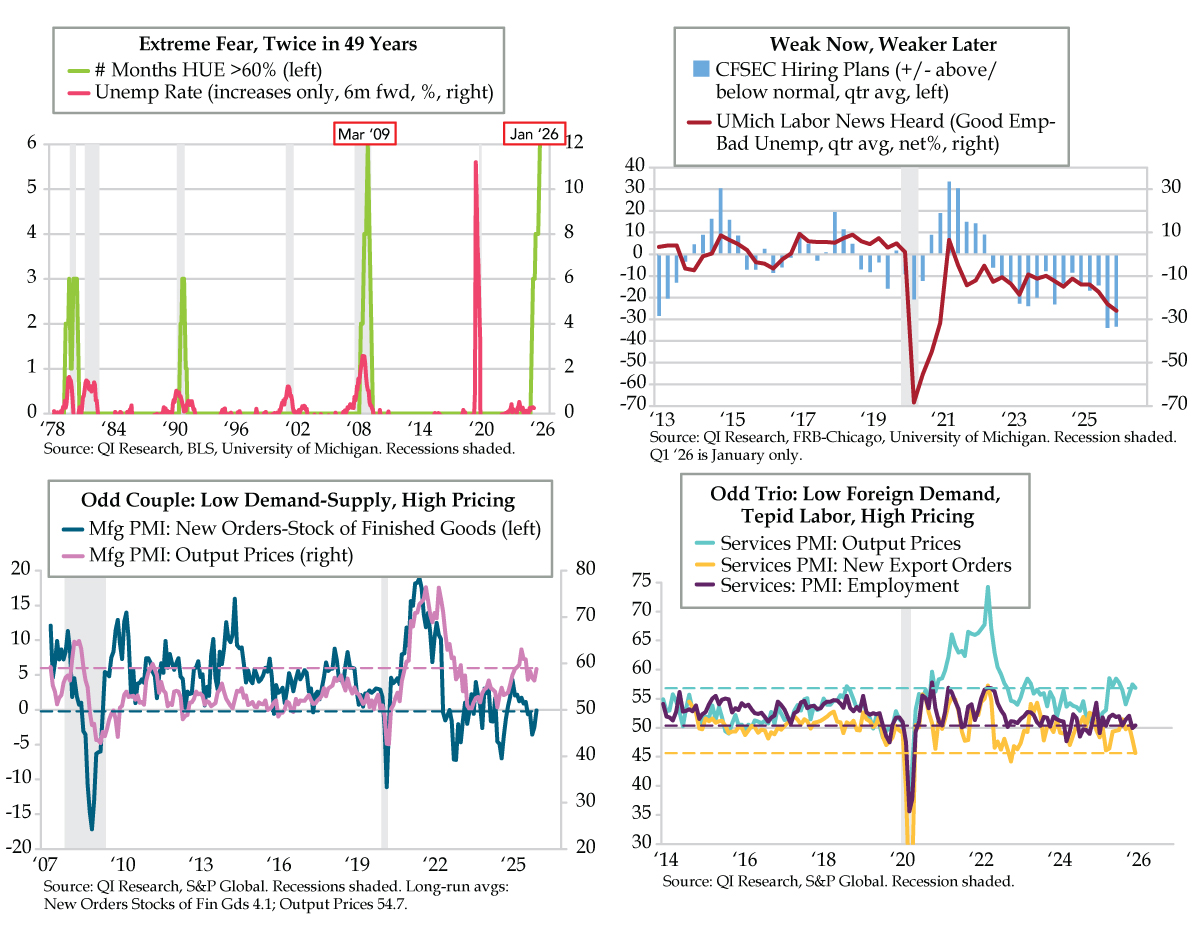

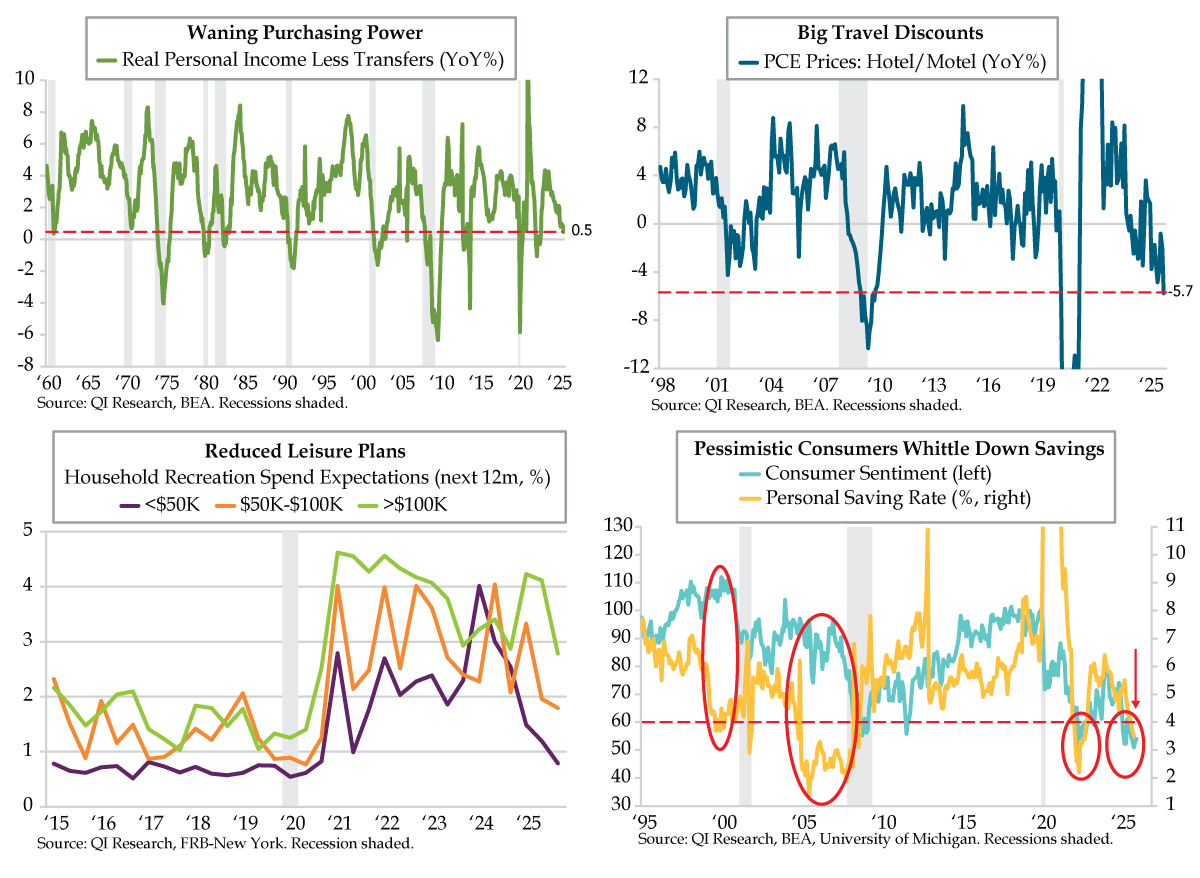

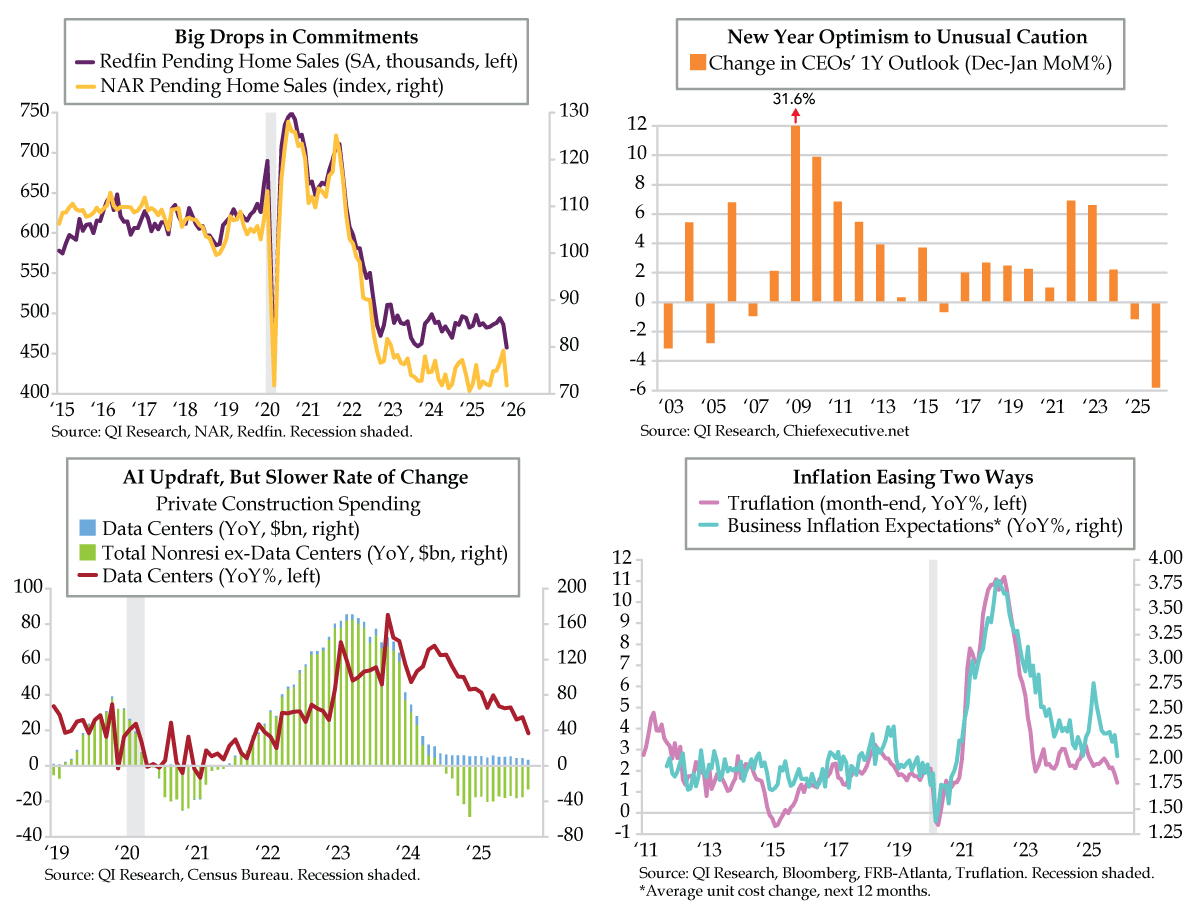

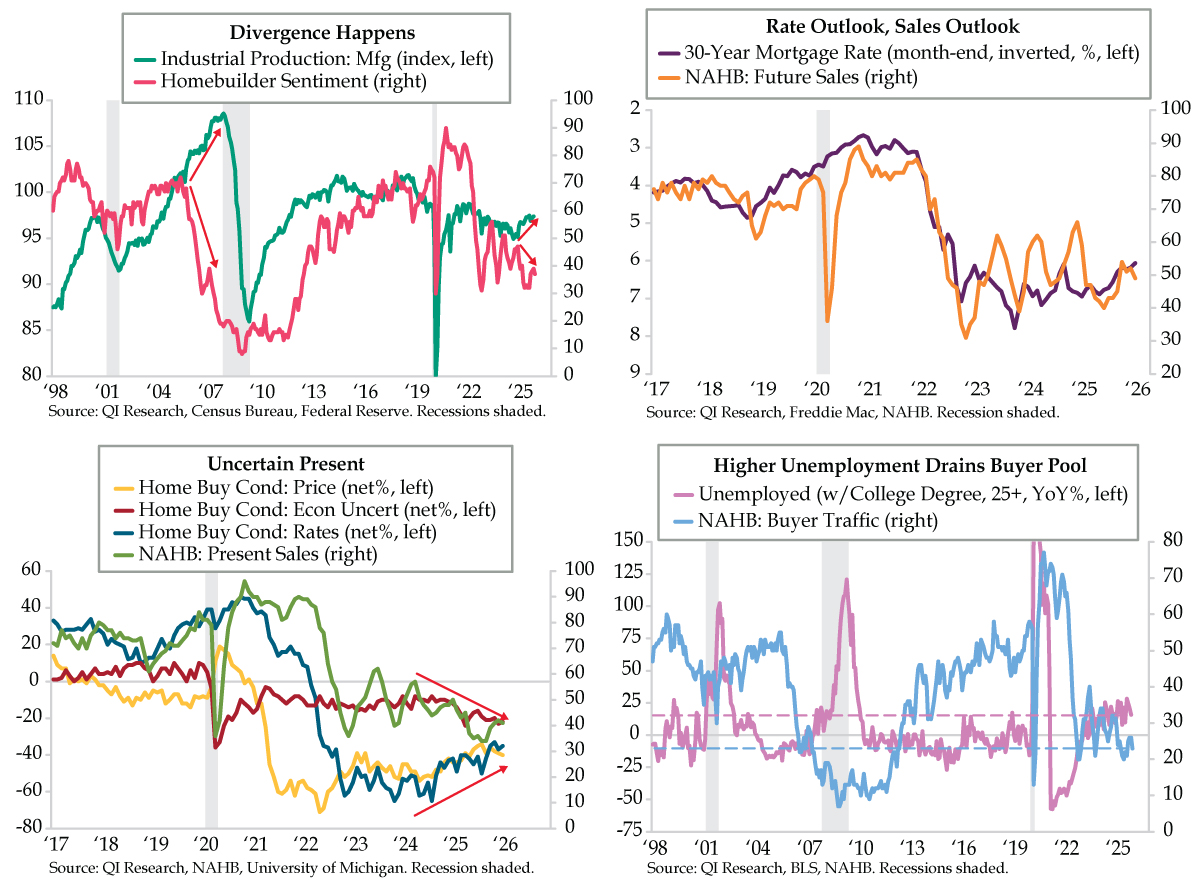

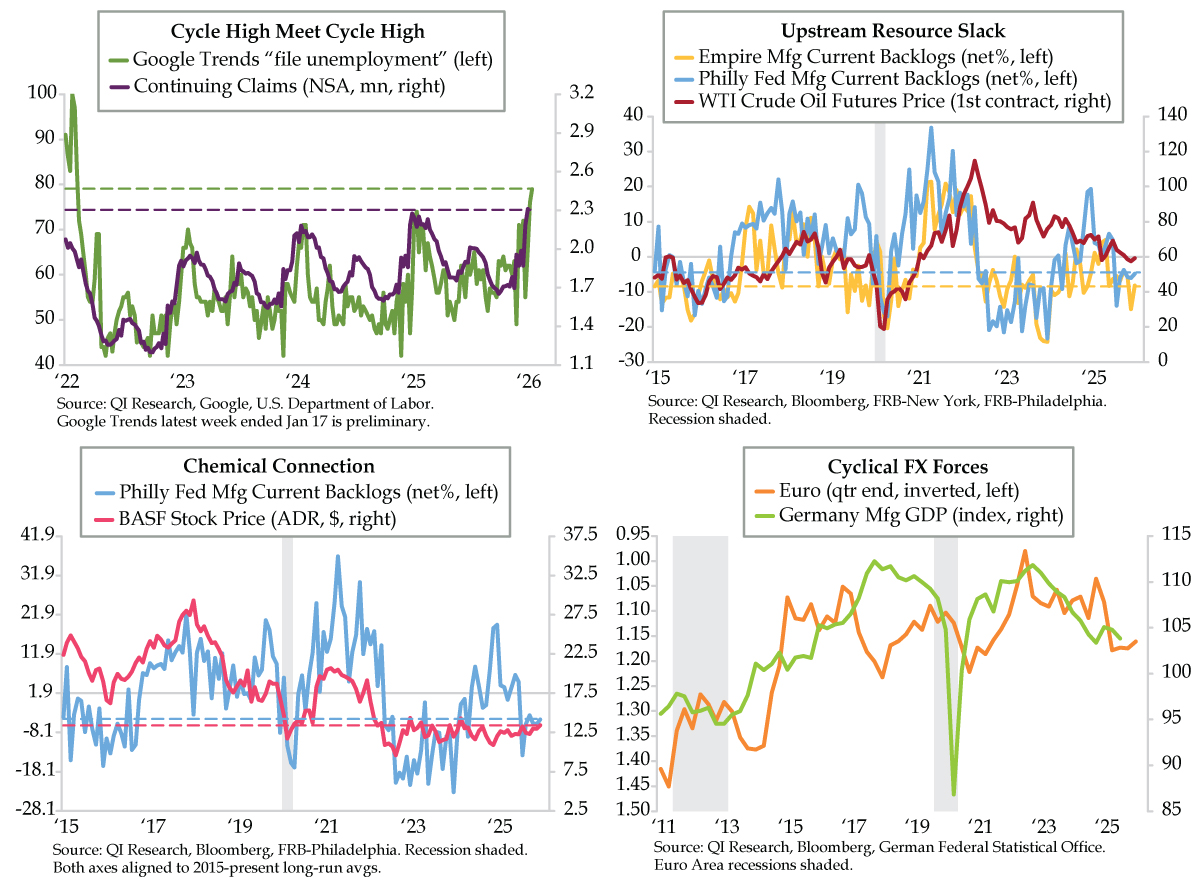

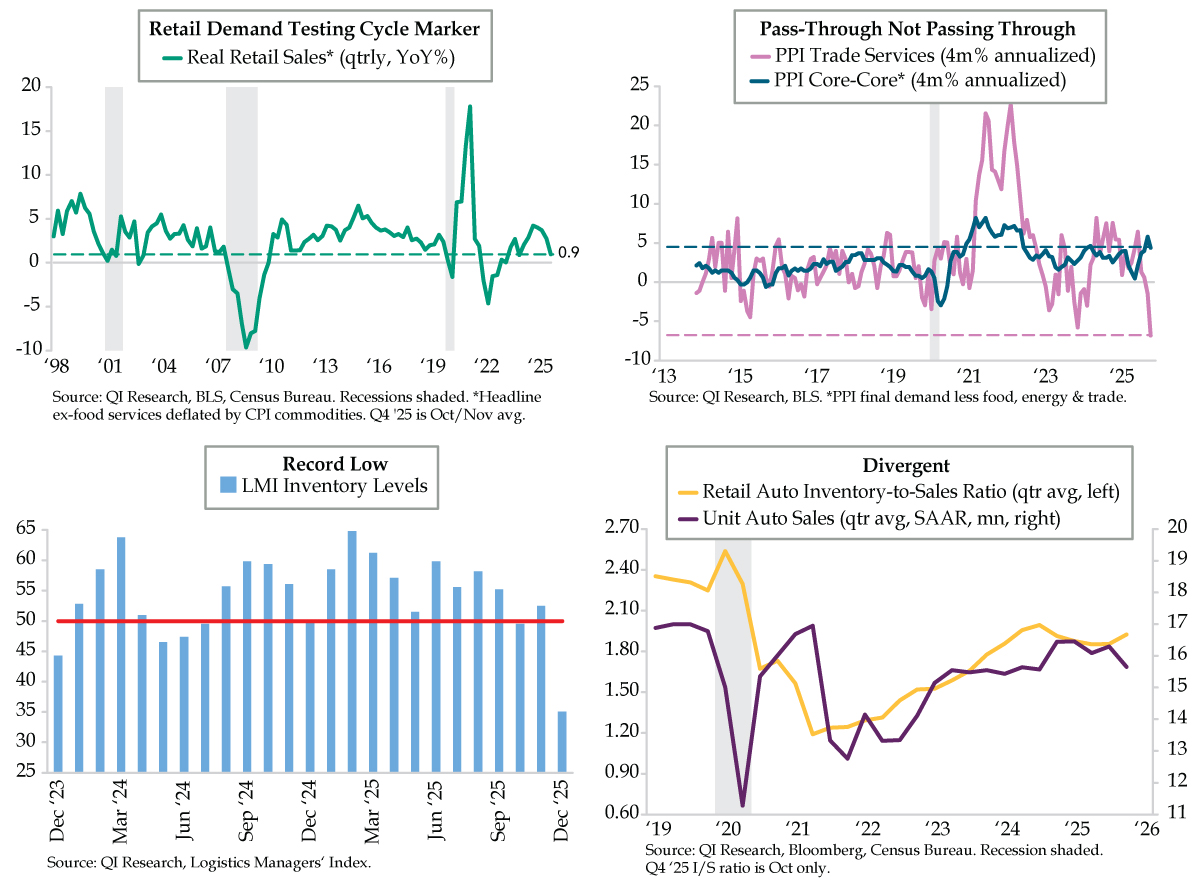

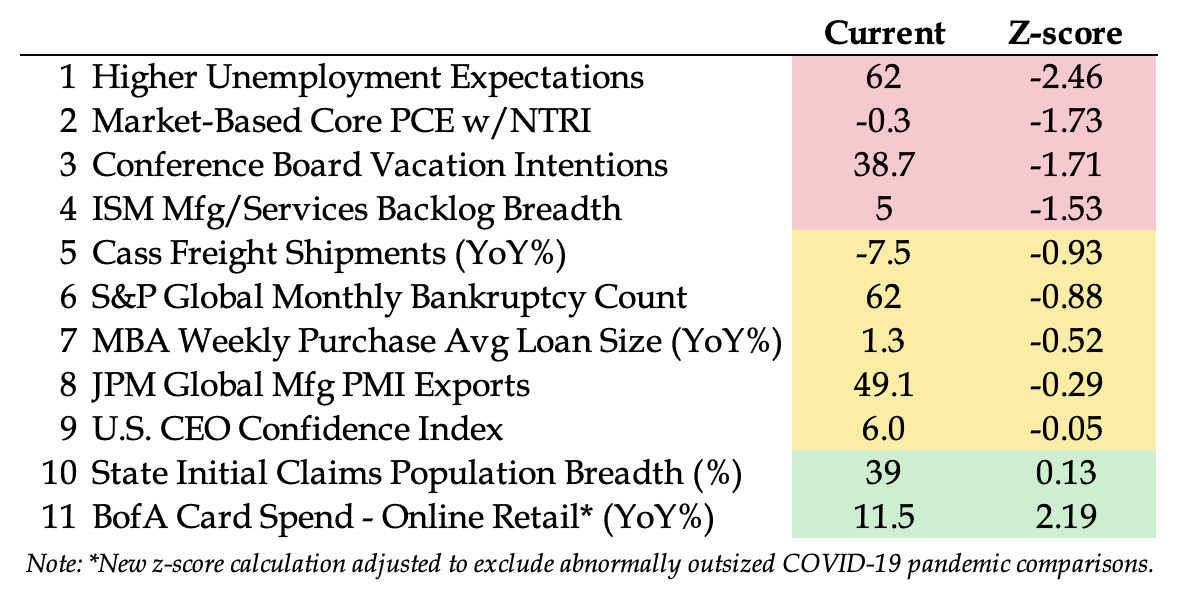

Recession probability to rise into 2025’s second half as private demand underperforms. The tariff shock should generate greater risks for a downshift in business investment and a more challenging environment for consumer cyclicals vis-à-vis consumer non-branded noncyclicals.

Manic shifts in U.S. politics harken first a deflationary gully to cross followed by the threat of impeachment and ultimately, a fourth change in administrations in as many U.S. presidential elections, a first in sequential terms since the precipice of the U.S. Civil War. The subsequent pendulum swing will manifest as Universal Basic Income/Modern Monetary Theory, and with it, the secular rise in inflation being prematurely predicted today by those positioned to profit from being short Treasuries.

Saturday Intelligence Briefing— 1.24.26

“Why live in fear?” That was the question I asked myself Friday morning when I released Open Letter II to the public. The odds of Federal Reserve officials having the temerity to take to heart the guidance of a former Fed advisor are just north of 0%. That they will vanquish their independence appears to be lost on those who will take to countless podiums and lament the choice they fail to make on their own behalf. The odds of Fed Chair Jerome Powell taking the most difficult of paths, retaining his position as governor beyond May, are a scant 35% as of the time of this writing.

This non poetic tragedy adds more flavor yet to the delicious irony of Blomberg’s top headlines:

- “Rieder’s Market Support, Fed Plans Seen as Boon for Chair Job”

- “BlackRock Private Debt Fund Expects 19% Net Asset Value Cut”

As is naturally the case, a Fed official must not have any conflicts of interest in conducting his or her role as a banking regulator. The requirement thus necessitates the divestiture of any and all significant holdings in financial firms.

TACTICAL

RATES:

Short-end and Belly best opportunities for total return. Rally keys off weaker macro. Challenged private demand, higher unemployment and lower core inflation raise Fed rate cut probabilities.

Long-end holds at elevated levels with de facto caps at 4.5% for the 10-year & 5% for the long bond with the term premium supported by fiscal malfeasance exacerbated by falling sovereign revenues and despite diminishing stimulus to the U.S. consumer.

Curve view – Bull steepener in 2025’s second half.

USD:

A sidelined Fed contrasting with most global central banks easing catalyzed a selloff in the greenback. A Fed forced to play catchup could easily thin the massively crowded trade, especially as global trade weakness impairs an open global economy vs. its closed U.S. counterpart.

CREDIT:

• Underweight HY, overweight strong cash-flow IG

• Lower-rated buckets at risk of dispersion with Fed Higher for Longer

• Jobless claims deterioration makes a cautious Street rethink already-wider-spreads 2025 expectations, i.e., up default estimates as bankruptcy cycle speeds up and size

• Fitch’s acknowledgement of cyclical consumer sector “deteriorating” fits this view

EQUITIES:

OW Utilities

OW Fossil Fuel Energy

OW Senior Living

UW Consumer Staples

UW Consumer Discretionary

UW Large & Midsize Banks

OTHER ASSETS:

• USD view supports UW commodities & EM

• Oil is a different story with geopolitical risk ramping (Israel v Iran)

• Long MOVE to capitalize on runaway lending to Nondepository Financial Institutions triggering a credit event

The Feather — Charts of the Week

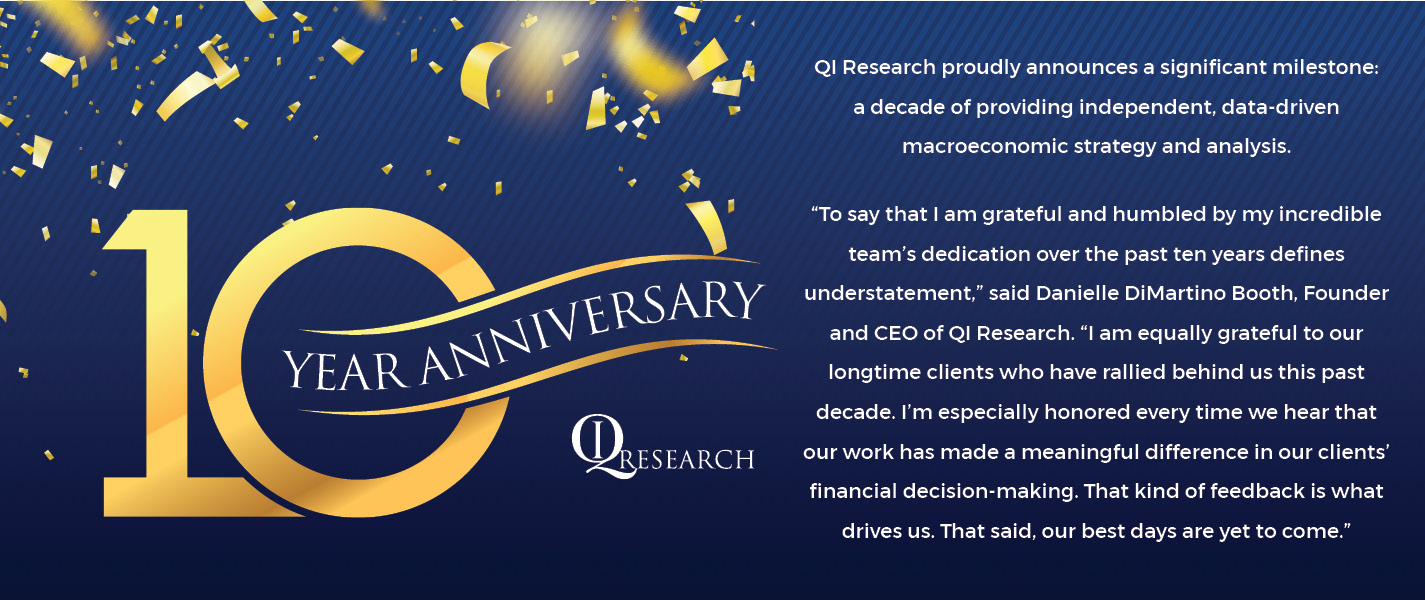

Unemployment Insurance, Then and Now

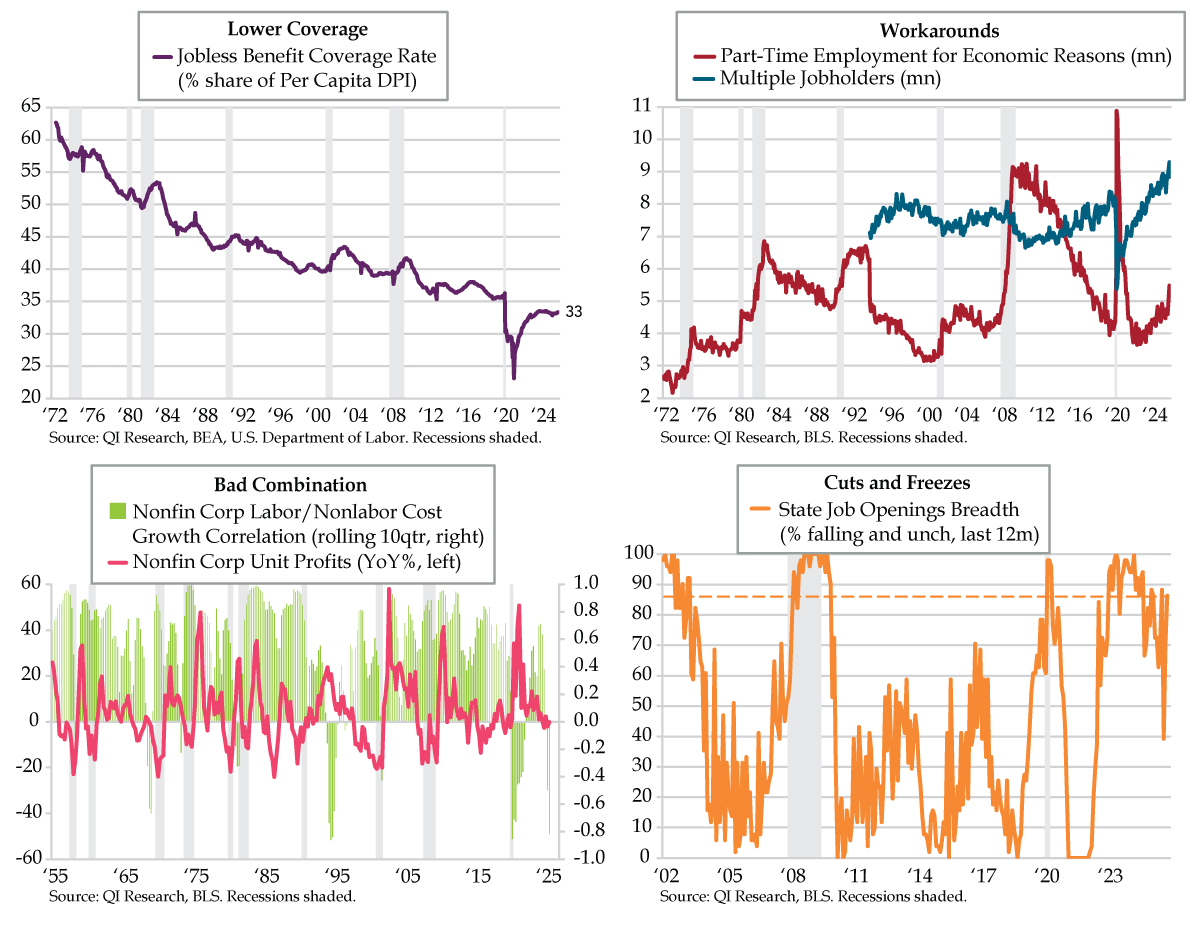

Fed, Are You Listening?

Hurling the Holy Hand Grenade

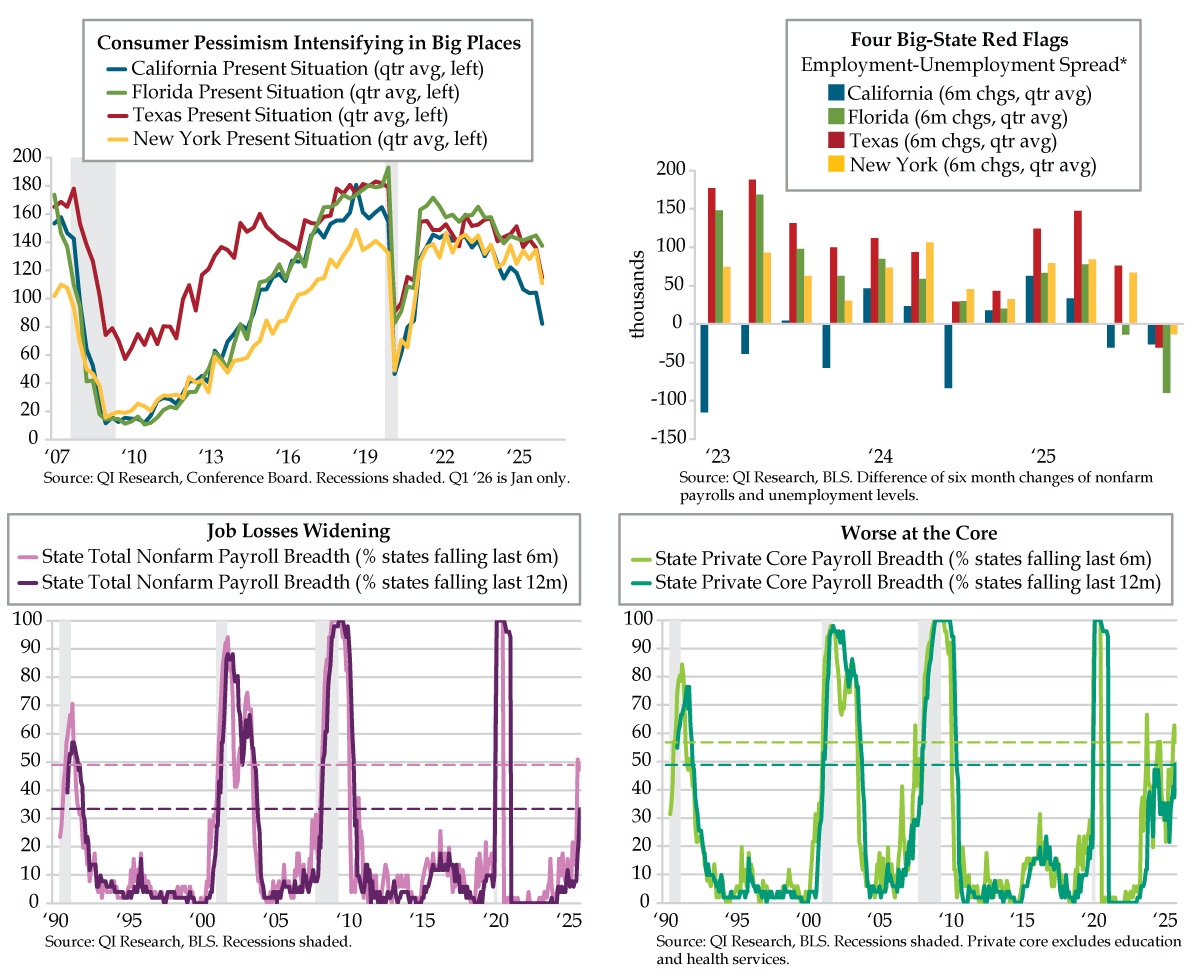

Washington Crossed the Delaware Upstream

Sunset on Sundance

Fuller, Go Easy on the Pepsi!

The Great Piano Drop of 1968

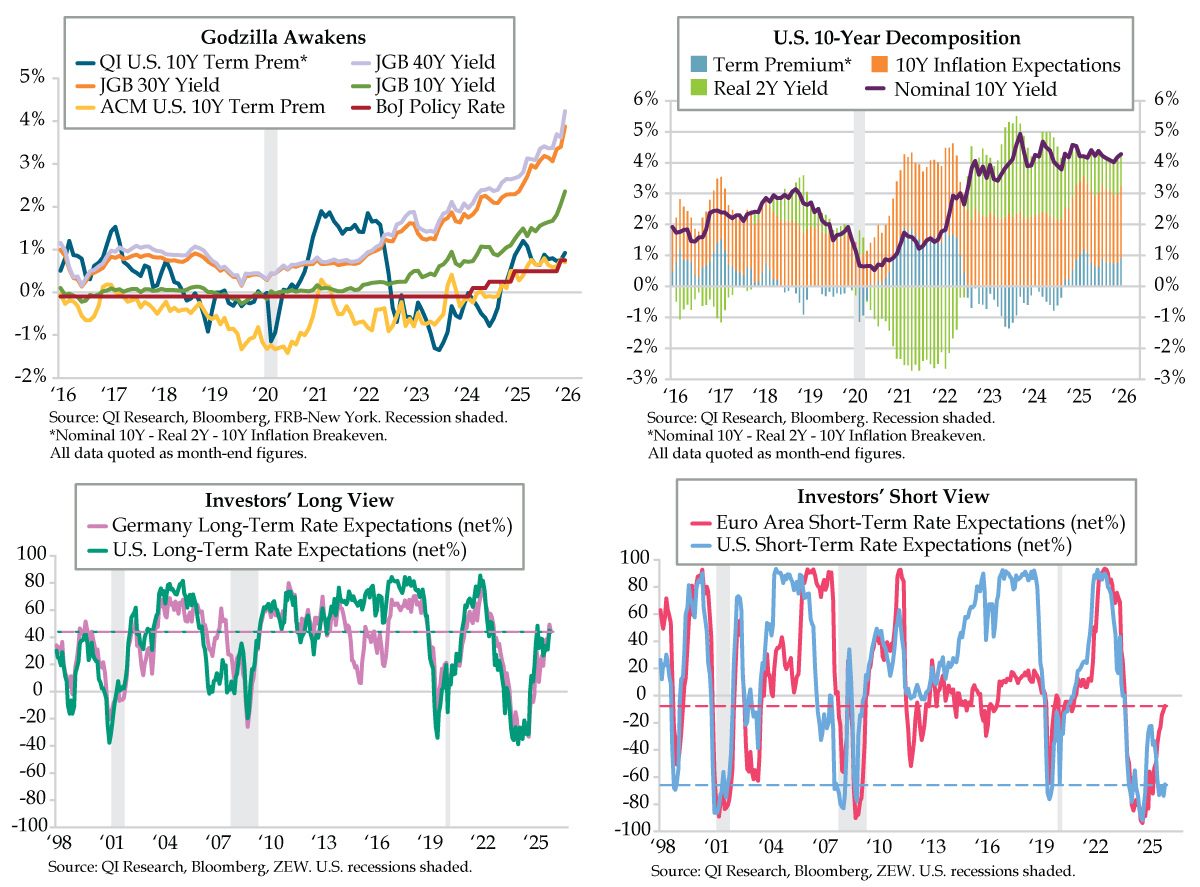

Godzilla vs. Wall Street

Two Trains Leave Chicago…

Hippocrates Meet Gilroy

Judging Tipping Points

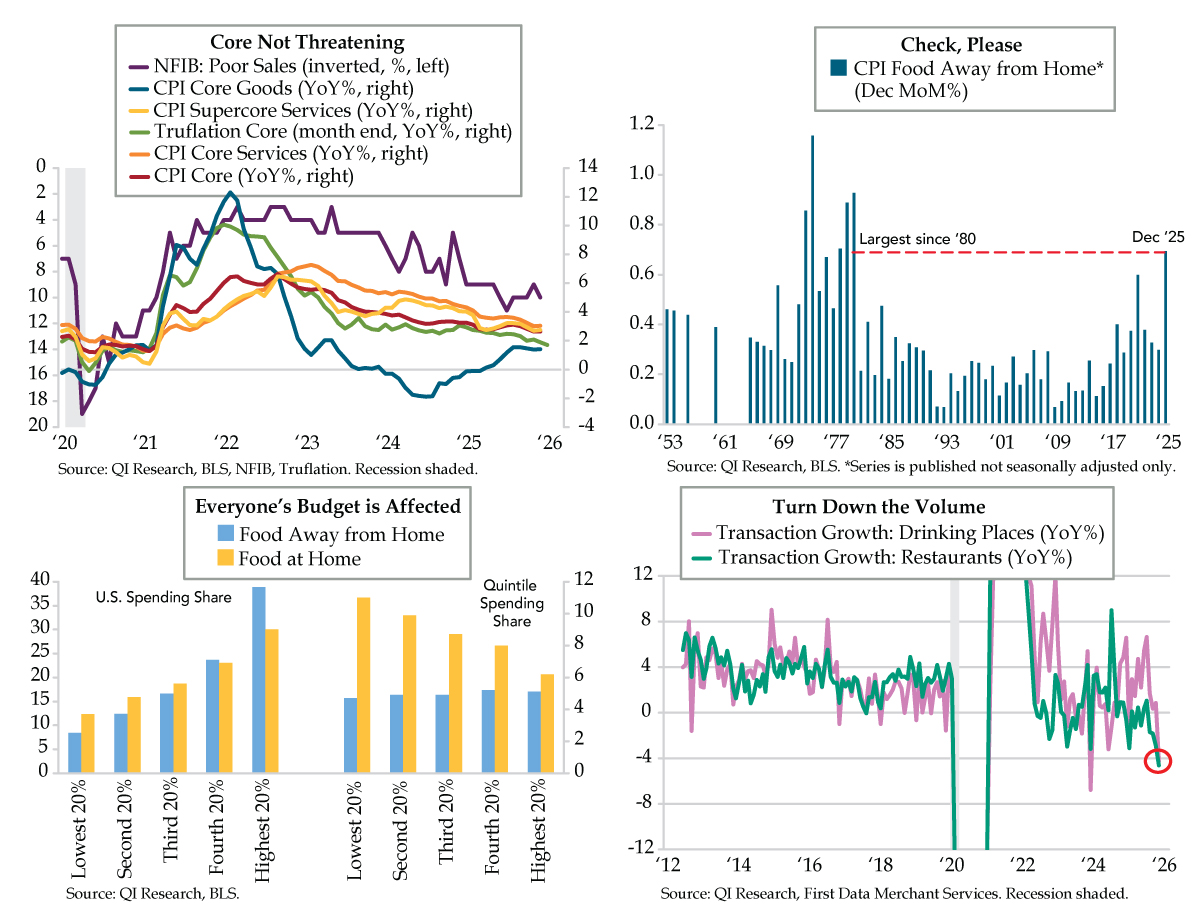

Go Ahead (CPI), Make My Day