Category Archives: Uncategorized

Weekly Quill — The Economic Betrayal of the American Public

QI Research proudly announces a significant milestone: a decade of providing independent, data-driven macroeconomic strategy and analysis. The firm was founded in 2015 by Danielle DiMartino Booth following her departure from the Federal Reserve Bank of Dallas, where she served under President Richard W. Fisher. Upon leaving, she launched the firm—originally branded as MoneyStrong—with a vision to offer deep, unfiltered economic insights.

We humbly credit our success to you—our loyal clients and the growing community of those who’ve joined the #ResearchRevolution. In celebration of this milestone, we’re pleased to extend, for the first time, a limited-time discount to The Daily Feather and our premium institutional newsletter, The Weekly Quill.

To receive 20% off your first annual subscription to QI Pro, sign up HERE:

https://quillintelligence.com/register/weekly-quill-annual/

When checking out, use this coupon code: QITenYears

To receive 20% off your annual subscription to The Daily Feather via Substack, visit:

https://dimartinobooth.substack.com/QITenYears

As a preview of what QI Research offers: a seminal missive on the betrayal visited upon America: Weekly Quill — The Economic Betrayal of the American Public

Housing Lacking Positraction

Thanks to advanced engineering and analysis of crash data, newer vehicles are built better and safer than ever. From seat belts, airbags, and backup cameras, to blind spot warnings, driver assistance and electronic stability control (ESC), each advanced technology sequentially emerged to give vehicle occupants ever-increasing protection. Traction control systems fall under ESC. Their purpose is straightforward: When the rubber doesn’t grip the road, steering control and driving stability are compromised. Since 2012, it’s been a requirement for many new cars to have the feature. But predecessors date back decades. High-torque, high-power rear-wheel-drive cars included a ‘limited slip differential,’ a system that transferred power to the wheels that weren’t slipping. General Motors’ trademark, Positraction, is more recognized for its silver screen reference than discussions around the dinner table. But it wasn’t until 1971, nearly a decade after the production of the 1963 Pontiac Tempest Marisa Tomei testified about in My Cousin Vinny that Buick introduced MaxTrac, which used an early computer system to detect rear wheel spin and modulate engine power to those wheels to provide the most traction.

Traction for monetary policy operates differently. When the Federal Reserve is in tightening mode, the aim is to cool economic activity and reduce inflation. When Powell et al are easing, the intent is to underpin interest-rate-sensitive sectors. Last week’s run of U.S. housing data updated the efficacy of the Fed’s rate cut traction.

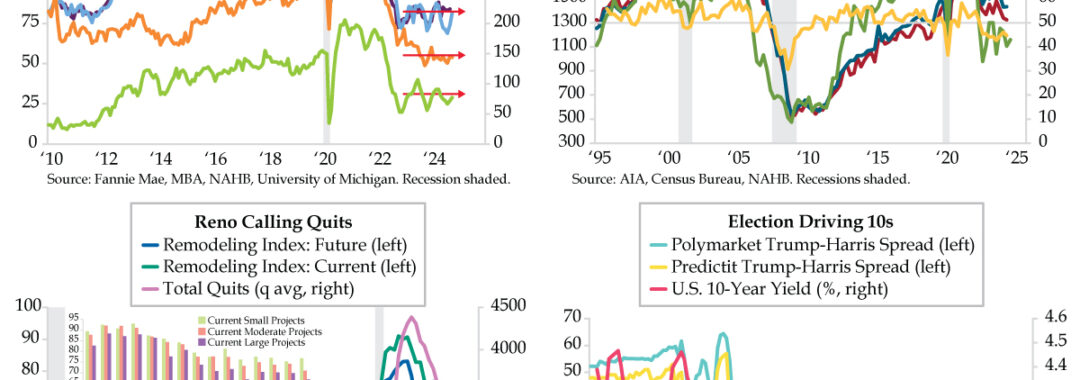

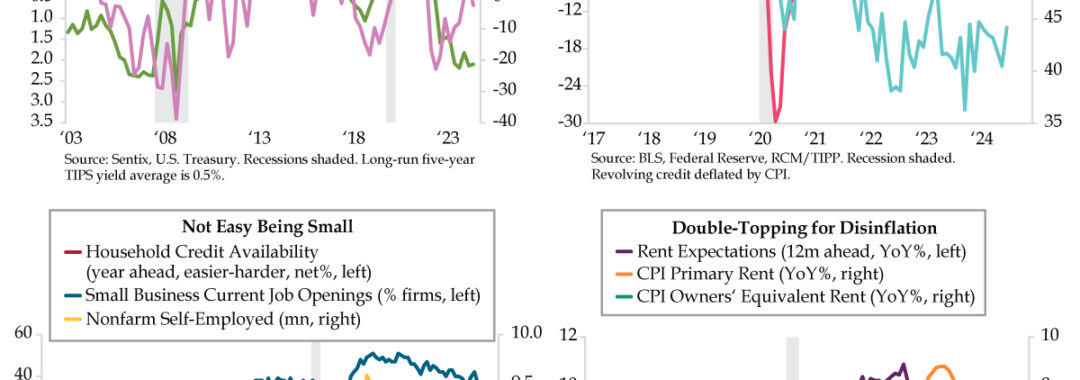

Wednesday’s latest weekly take from the Mortgage Bankers Association (MBA) report highlighted the effect of the backup in the 30-year mortgage rate to the 6.5% zone in the week ended October 11. The upshot was home purchase application volume contemporaneously falling 7.2% week-over-week, the steepest decline since February. On a smoother monthly average basis, the purchase index has been treading water all year (orange line).

The National Association of Home Builders (NAHB) Buyer Traffic index continues to show that housing affordability lacks traction. At 29 in October, the level is in line with the year-to-date average, going nowhere fast and well south of the long-run trend of 40 (lime line). NAHB proposed that “despite the beginning of the Fed’s easing cycle, many prospective buyers remain on the sideline waiting for lower interest rates,” a not-so-veiled suggestion that Powell & Co. have more wood to chop. Two survey measures from Fannie Mae and the University of Michigan concur. Averaging buying and selling conditions (because most sellers buy after they sell) generates yet another depiction resembling spinning wheels (purple and light blue lines).

How do builders see the market? Friday’s Housing Starts and Building Permits for September modestly disappointed. While the -0.5% month-over-month (MoM) was close to the consensus -0.4%, August was revised lower, to a still robust 7.8% from 9.6%. Meanwhile, permits declined -2.9% MoM, appreciably off the expected -0.7%, while the previous month was reduced mildly, to 4.6% from 4.9%. Monthly noise aside, smoother quarterly profiles showed starts falling to a new cycle low (red line) and permits treading water (blue line).

Permits are the home building oracle. Their momentum has us seeing red, and lots of it. At annualized rates over the last three months, six months, twelve months, two years and three years all ended September, the results are as follows: -7.0%, -7.5%, -5.7%, -5.9% and -4.2%, respectively. Home building-related surveys agree with the permits’ impulse. NAHB’s single-family builder sentiment remained entrenched in the contraction zone (green line) and hasn’t expanded since 2022’s second quarter. The American Institute of Architects index for the multifamily residential space has also been sub-50, in persistent pessimism, for eight straight quarters (yellow line). Got rate cuts?

Storming to record highs these last few weeks, the stocks of Home Depot and Lowe’s are seemingly immune to the data. That makes the NAHB’s quarterly Remodeling Index a reality check. Through 2024’s third quarter, components tracking future and current sentiment fell to fresh cycle lows, with the former dipping to a pre-pandemic 55.0 (blue line) and the latter edging down to 71.6 (teal line).

Since the series’ 2001 inception, the patterns drawn by each look a lot like JOLTS’ nonfarm quits (lilac line). We call Quits the ‘Take This Job and Shove It’ gauge. No surprise, peak bravado hit in 2022’s first quarter, right up there with the apex of post-pandemic renovations, which break out by small (under $20,000), moderate (between $20,000 and $50,000), and large projects ($50,000 or more). The inset chart illustrates that small projects are holding their own (green bars), while moderate and large ones have weakened (orange and purple bars). In the third quarter, future remodeling has seen both Inquires and Backlogs sink to cycle lows (not illustrated).

It goes without saying that lower mortgage rates would buttress residential investment. For now, the U.S. 10-year Treasury yield is distracted by the Presidential election. Slippage is the bond’s price is manifest in the spreads between Polymarket (turquoise line) and Predicit (yellow line), which are flagging a Trump win that promises to deliver a relatively higher degree of fiscal recklessness. For the next two weeks, at least, the bellwether 10-year yield tracker – the copper/gold ratio — pointing to lower, not higher, rates will be relegated to the back seat. Also not sitting shotgun are soaring bankruptcies and layoffs, household balance sheet distress, punk loan growth, the deepening industrial recession and inventory correction, waning global trade, geopolitics, and anything else that doesn’t give traction to the narrative spinners.

Preliminary Benchmark Wipes Out More Than a Million Private Sector Jobs

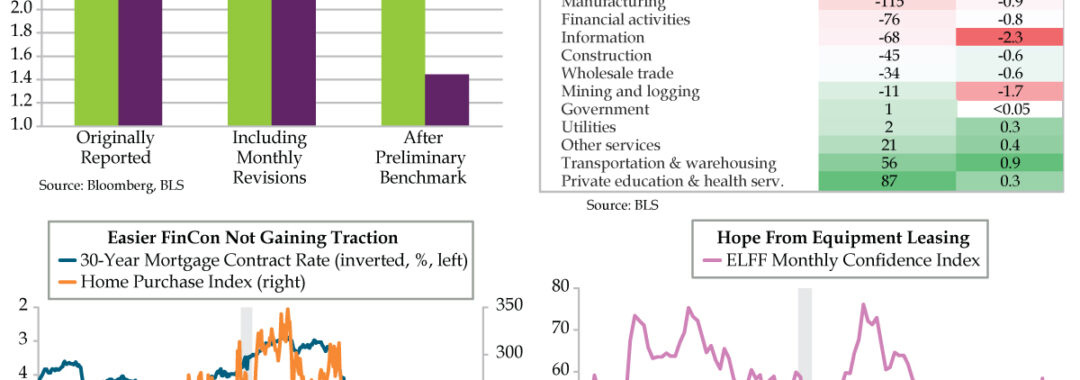

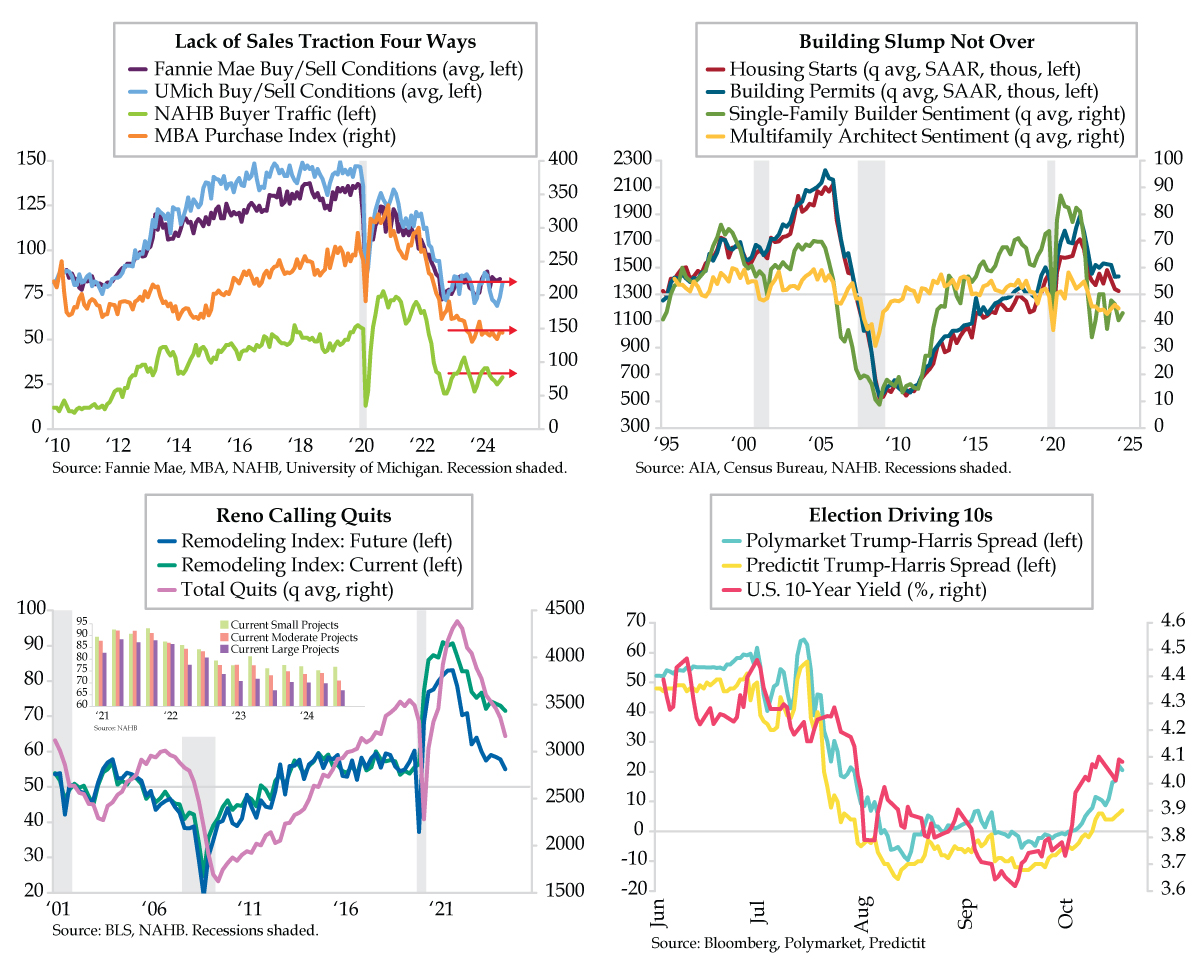

QUICK QUILL — The preliminary benchmark payroll revision was five times larger than normal and six times that for the private sector. More than a million private sector jobs have been wiped off that which was originally reported. Rates markets bull steepened and added additional probability that the Fed could undertake 100 basis points of rates reductions by year-end. Recent declines in mortgage rates, however, haven’t spurred home-buying activity reflecting the anemia in the job market.

TAKEAWAYS

- The preliminary benchmark revision of -818,000 was -0.5% of total nonfarm employment, five times worse than normal; on the private side the decline was six times worse, taking the original 2.461 million jobs added in the 12 months ended March down to just 1.444 million

- Professional and Business Services accounted for 358,000 or 44% of private sector losses, followed by Leisure/Hospitality’s 18%, Retail Trade’s 16%, and Manufacturing’s 14%; Information, a key GDP proxy, had the largest percentage rewrite of any sector at -2.3%

- Though 30-year mortgage rates have fallen in 12 of the last 16 weeks, per the MBA, the Purchase Index has fallen by -7.8% from its late-April high; the continued weakness in housing is indicative of the labor market picture laid bare by yesterday’s payroll revisions

Growth, Labor, and Disinflation Risks Swell

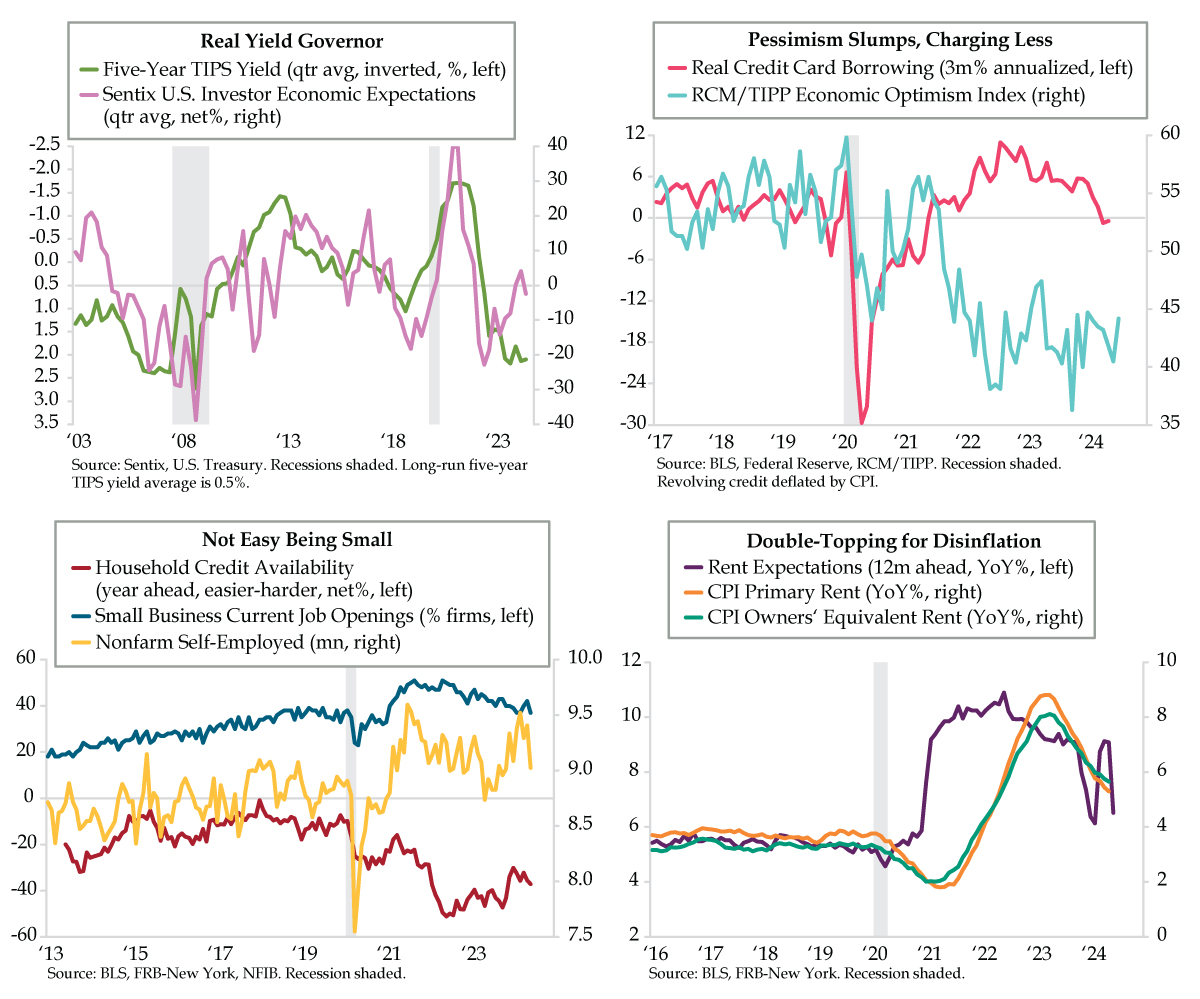

QUICK QUILL — Above-trend real yields take a bite out of investors’ growth optimism. Consumer pessimism has manifested as a short-run contraction in credit card borrowing volume, adding to downside risks. Impaired household credit availability will act as a governor on small business job creation; nonfarm self-employed have already lost a half million in the second quarter. High conviction for rent disinflation is growing as households become aware of concessions required to move new product amidst an onslaught of fresh supply. All told, these growth, labor and inflation risks fundamentally suggest cheap vol presents a tactical opportunity.

TAKEAWAYS

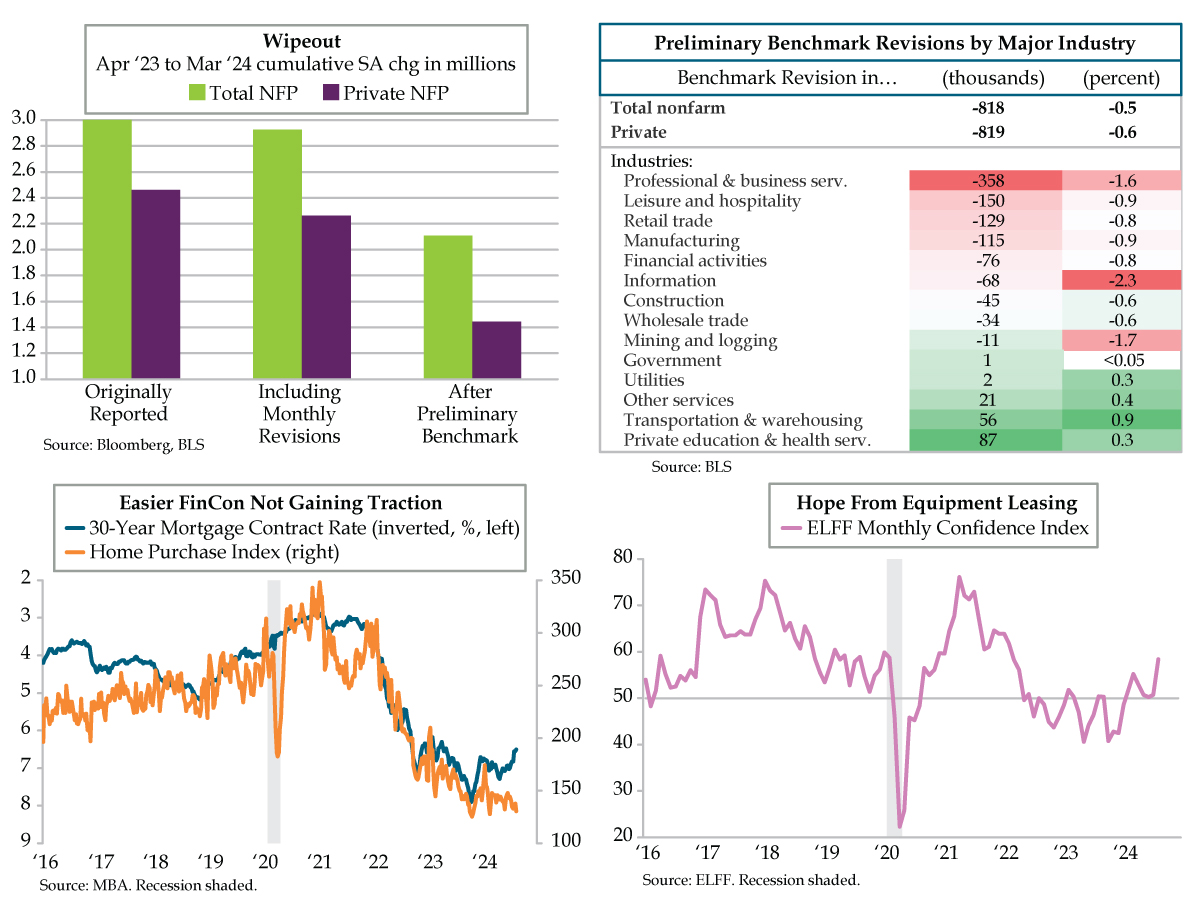

- The Sentix U.S. Investor Economic Expectations Index fell to -2.5 in June, with institutional investor sentiment plummeting to -7.0 vs. retail’s still-positive 2.0; Higher for Longer has left 5-year TIPS yields north of 2% since Q3 2023, well above of their long-run 0.5% average

- Real revolving credit fell -0.4% on a 3MA basis in May, the first negative print, excluding COVID, since Q4 2019, when the economy was sliding into recession; continued weakness in the RCM/TIPP Optimism Index also flags further downside risk for consumer spending

- In the NY Fed’s Survey of Consumer Expectations, Household Credit Availability fell to a net -37.2 in June, down from January’s local high of -30.2; this aligns with NFIB current job openings falling to 37 alongside a loss of half a million nonfarm self-employed workers in Q2

The Daily Feather Sample — Ease Button

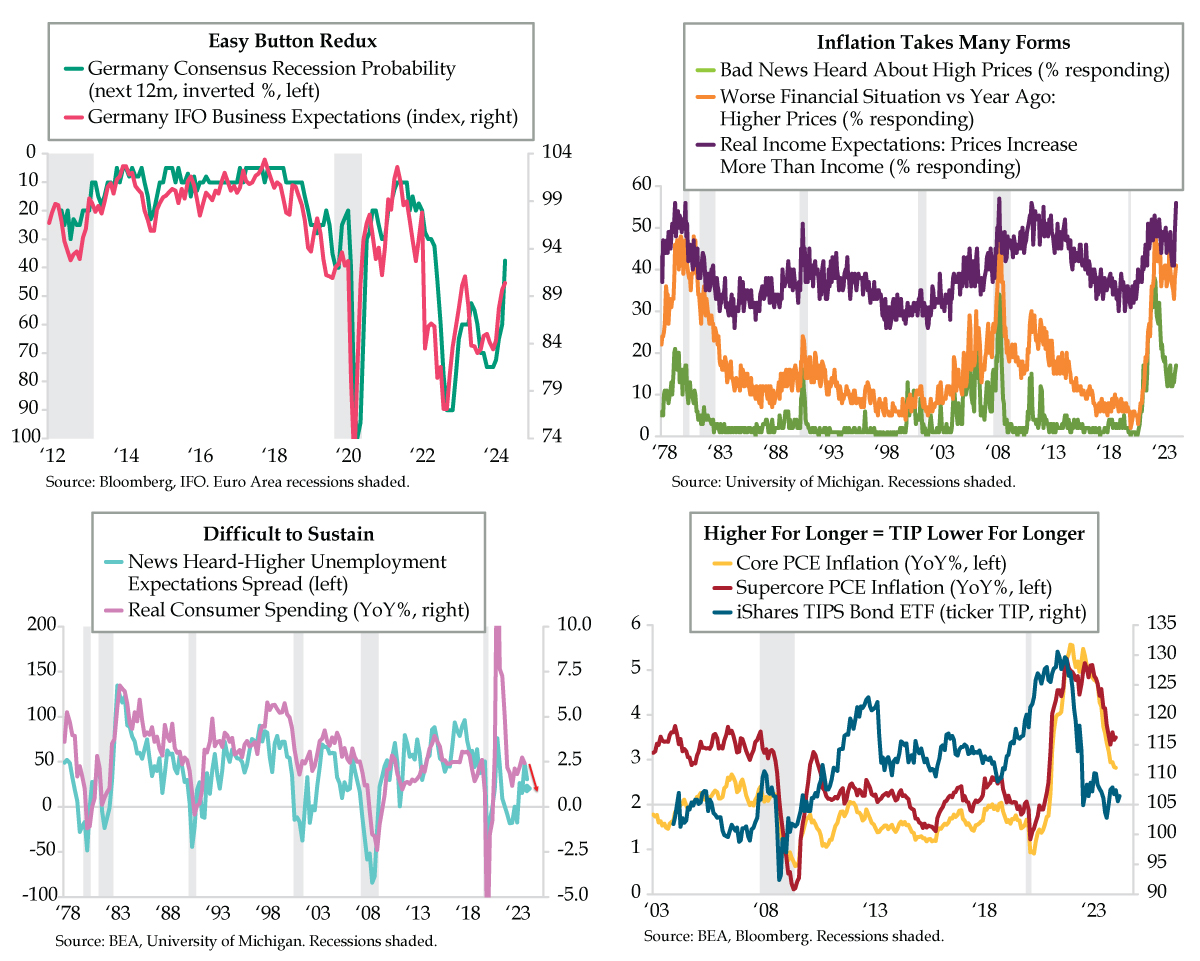

QUICK QUILL — Lower recession probability prompted by brightening expectations in Germany is a green shoot worth monitoring. Back in the States, consumer purchasing power has darkened as income gains wither amidst job cuts even as essentials inflation refuses to abate. The ‘tell’ would be slower consumer spending growth that threatens to fall to such an extent we hear more reports of U.S. households reducing the volume of groceries they can afford to buy. Until Powell sees the whites of the eyes of an unemployment rate with a 4-handle, TIPS investors will have to wait longer to back up the truck and become bullish.

TAKEAWAYS

- The consensus expects headline PCE to hold at 0.3% MoM in April while core PCE falls a tenth to 0.2% MoM; however, UMich’s preliminary May data gave no signs of cooling, with Bad News about Higher Prices climbing to a 6-month high of 17%, tripling the 5% average

- From Q1’s local high of 48.7, the UMich News Heard-Higher Unemployment Expectations spread has since more than halved to 20.0 in May; the downshift suggests real consumer spending has more room to fall after slipping from 2.7% YoY in Q4 2023 to 2.4% in Q1 2024

- TIP, the largest Treasury Inflation-Protected Securities bond ETF, is currently trading well below its post-pandemic highs; so long as Powell is able to point to the lack of forward progress on Supercore as reason to remain Higher for Longer, this looks set to continue

Of the forty hard jobs listed by CareerAddict.com for 2023, two stood out as especially life-threatening – cell tower climber and explosive ordnance disposal specialist. When scaling a tower, you could certainly fall, get your hand crushed, or even get struck by lightning. Detonating or diffusing live bombs would seem to be self-explanatory. Should you cut the red or the blue wire? If it wasn’t your bread & butter, you could romanticize about starring in your own Mission Impossible. In 2005, Staples introduced a fictional fix for real-life dangerous day jobs. It’s advertising agency, McCann Erickson depicted challenging tasks, like a cowboy wrangling a bucking horse and a father changing his twin infants’ diapers. In each case, pushing an “Easy Button” did the trick. The baritone voice-over would then say, “Wouldn’t it be nice if there was an Easy Button for life? Now there’s one for your business. Staples. That was easy.”

In 2008, Staples revived the campaign to “tackle” high prices. In each spot, a shopper is appalled at the price quoted for their purchase — whether gasoline, food, or clothing. The solution: Push the Easy Button and ask if that would make it any less expensive. Needless to say, the answer was always no. The post-pandemic era has been woefully bereft of Easy Button opportunities, even in jest. In the case of the United States, fiscal stimulus gone wild trained countless consumers to live beyond their means for “free,” and continue to do so using debt. In Europe, while there was less in the way of fiscal assistance, relatively stronger strictures on job cutting have helped.

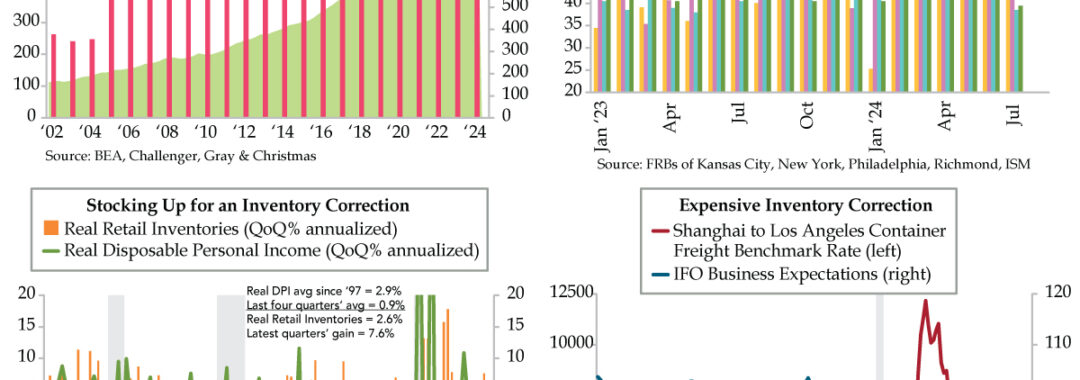

As for inflation, households on both sides of the pond have been largely helpless to fend off inflation over which their respective central banks hold little sway, particularly that of food and energy. Any good news is greeted with open arms as was the case with yesterday’s release of IFO Business Expectations (fuchsia line). Not only does it have an uncannily accurate relationship with recession probabilities in Deutschland (inverted teal line), expectations brightened to such an extent, they sent recession odds under 50% for the first time in two years.

Closer to home heading into a holiday-shortened trading week, the Federal Reserve’s preferred inflation gauge holds the most potential to move markets when it’s released Friday. Consensus is calling for April’s headline personal consumption expenditures (PCE) price index to stay steady with that of March – holding at 0.3% month-over-month (MoM) and 2.7% year-over-year (YoY). The core PCE, however, is expected to cool a tenth to 0.2% MoM, which would maintain its annual pace at 2.8% YoY (yellow line).

Last Friday’s University of Michigan (UMich) preliminary May consumer survey refuted any notion of cooling. Unfavorable News Heard About Higher Prices rose two points to a 6-month high of 17%, more than three times its 5% long-run average (green line). An elevated 41% said their Current Financial Situation had worsened due to higher prices, more than 17% norm (orange line).

Finally, a near record 56% believe price increases will more than offset income growth in the next year (purple line). There is decidedly more afoot than rising prices given May’s downticks for 1-year and 5-10-year UMich Inflation Expectations. The 15-point, two-month vault is unprecedented since the series 1978 inception.

The missing link: PRICING POWER. It’s not that inflation in isolation has resurged, so much as it being a case of inflation not keeping up with diminished incomes as job losses mount. Recall last week’s “Guardians of Gaslighting,” highlighted a Harris poll covered by The Guardian which found 49% of Americans “wrongly” thought the unemployment rate was at a 50-year high instead of it being the opposite case.

Not reporting true labor market data has apparently begun to grate on working Americans. Imagine that. In the meantime, two-thirds of U.S. economic output is comprised of consumption fueled by shrinking paychecks in the aggregate. Given surging credit card charge-offs, absent a continued spike in Buy Now Pay Later, we look to the spread between UMich News Heard-Higher Unemployment Expectations as a guide. It combines all buckets about recent changes in business conditions and contrasts it with households’ fear concerning future job loss. After 2024’s first quarter local high of 48.7, this metric has more than halved to May’s reading of 20.0 (aqua line). Heeding to pressures emanating from the labor market, the trend in real consumer spending already has eased from 2.7% YoY in 2023’s fourth quarter to 2.4% in 2024’s first quarter (lilac line).

Will policymakers at the Fed, who will put us out of our misery by entering FOMC blackout come Friday, be swayed by collapsing household perceptions of the job market? We doubt that seriously. Tourists would agree – that is, passive investors in the asset class designed to protect against inflation. The largest Treasury Inflation-Protected Securities bond exchange-traded fund, ticker TIP, is still trading well below its post-pandemic highs (blue line). The price of TIP is effectively the mirror image of real rates staying Higher for Longer to combat core inflation, which we’ve been told is too sticky and too steep for policymakers’ liking. To be sure, idiosyncrasies attendant to the vagaries of insurance rates and other sources of inflation out of the Fed’s control have stalled disinflation in Supercore PCE (red line). Such realities still won’t prompt Powell et al to whip out the Ease Button.