QI PRO HOLY GRAIL DASHBOARD

LONG MACRO

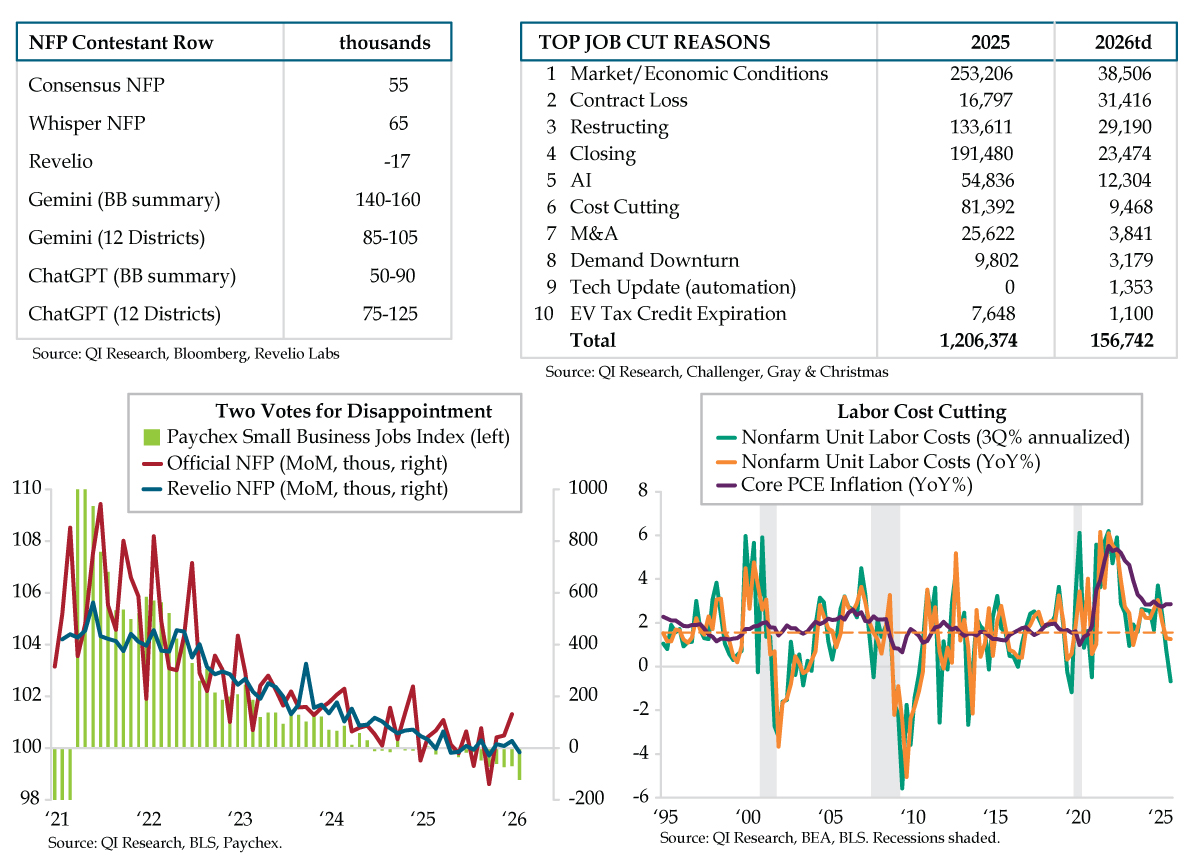

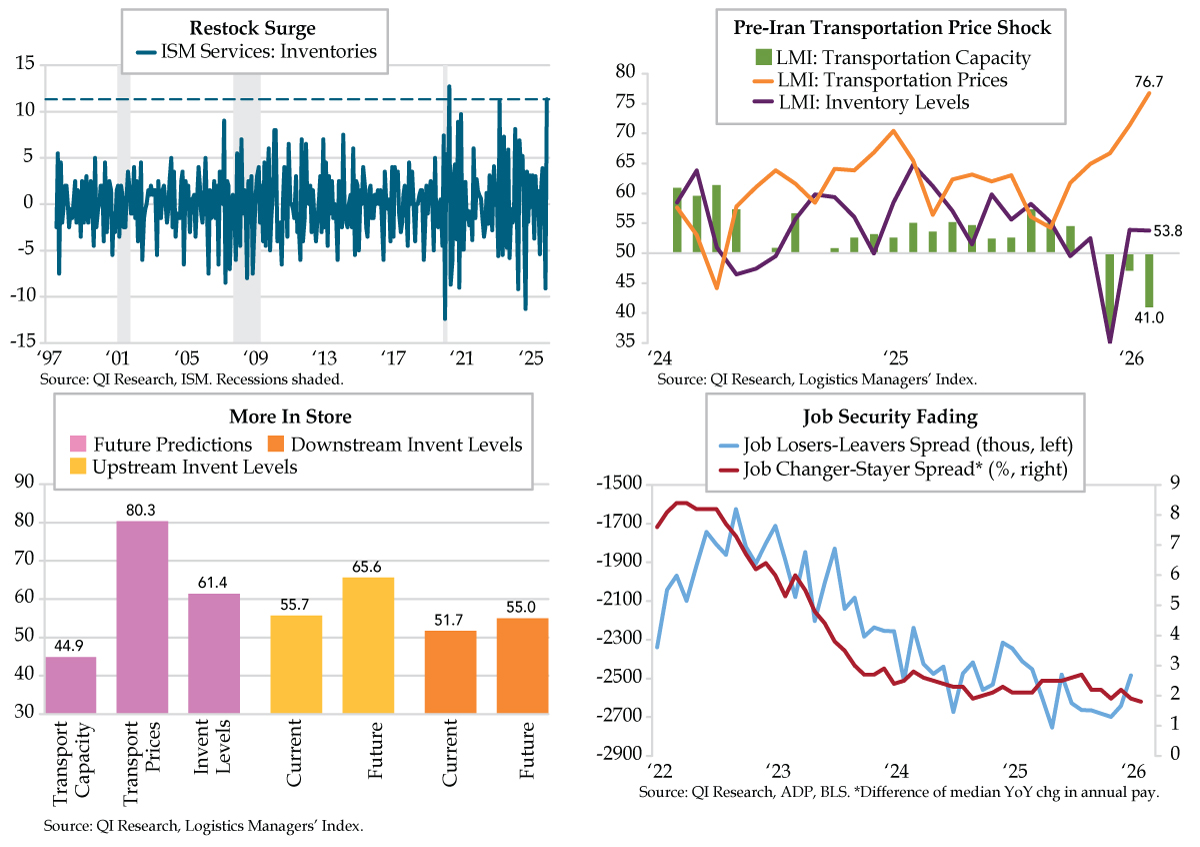

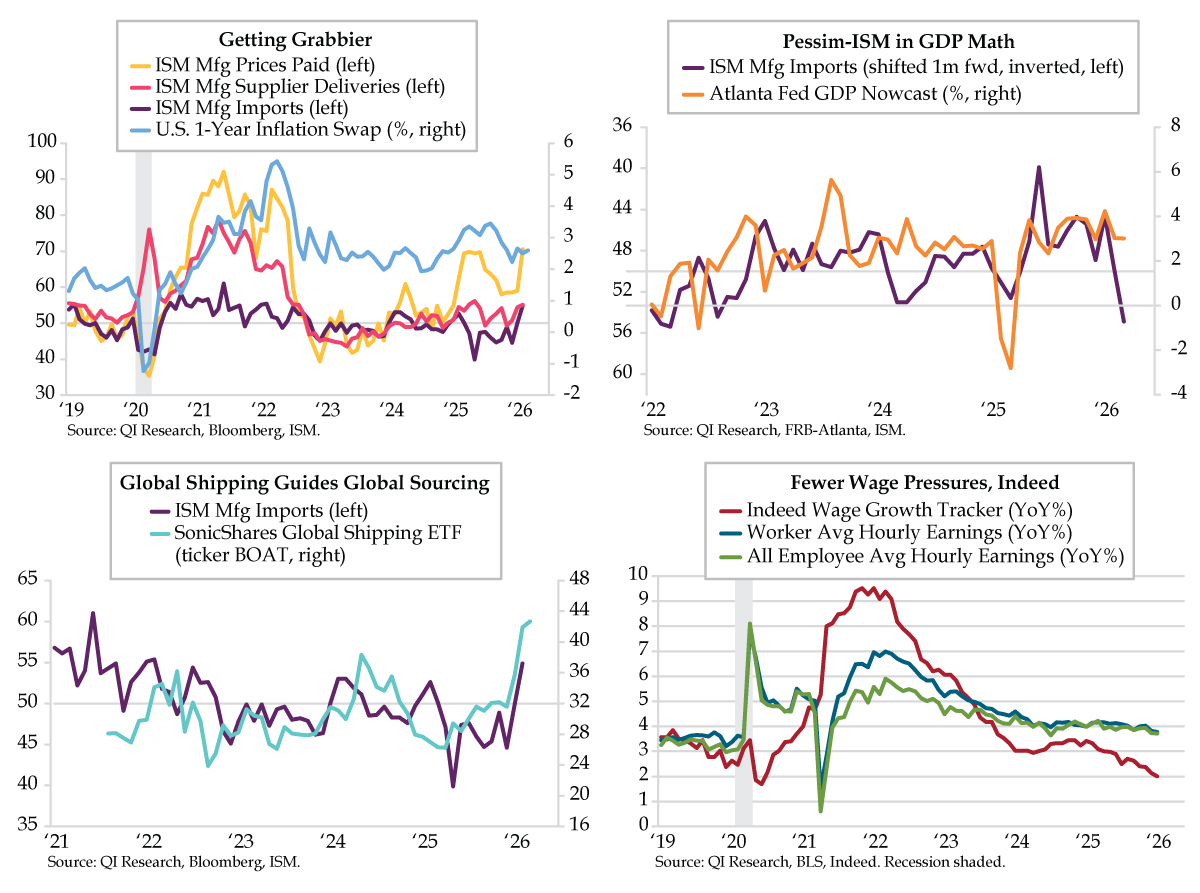

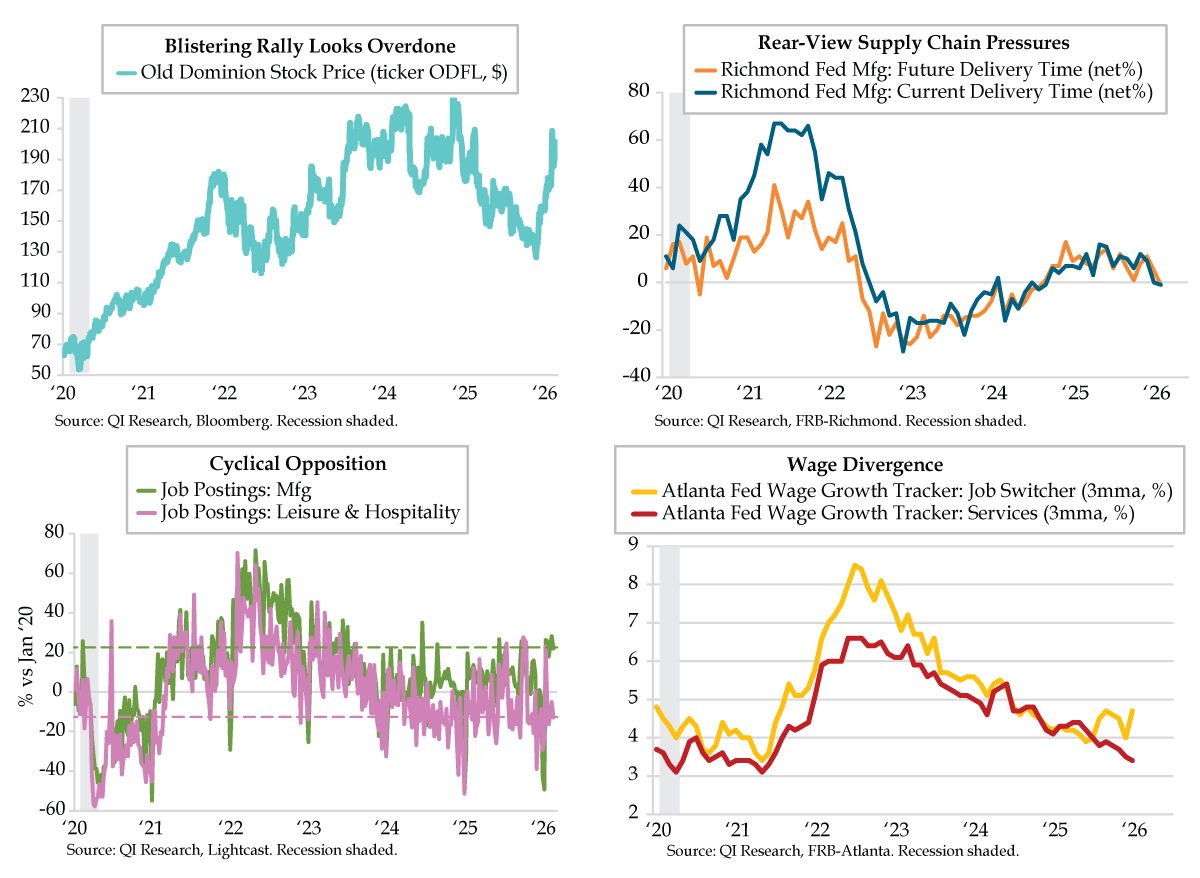

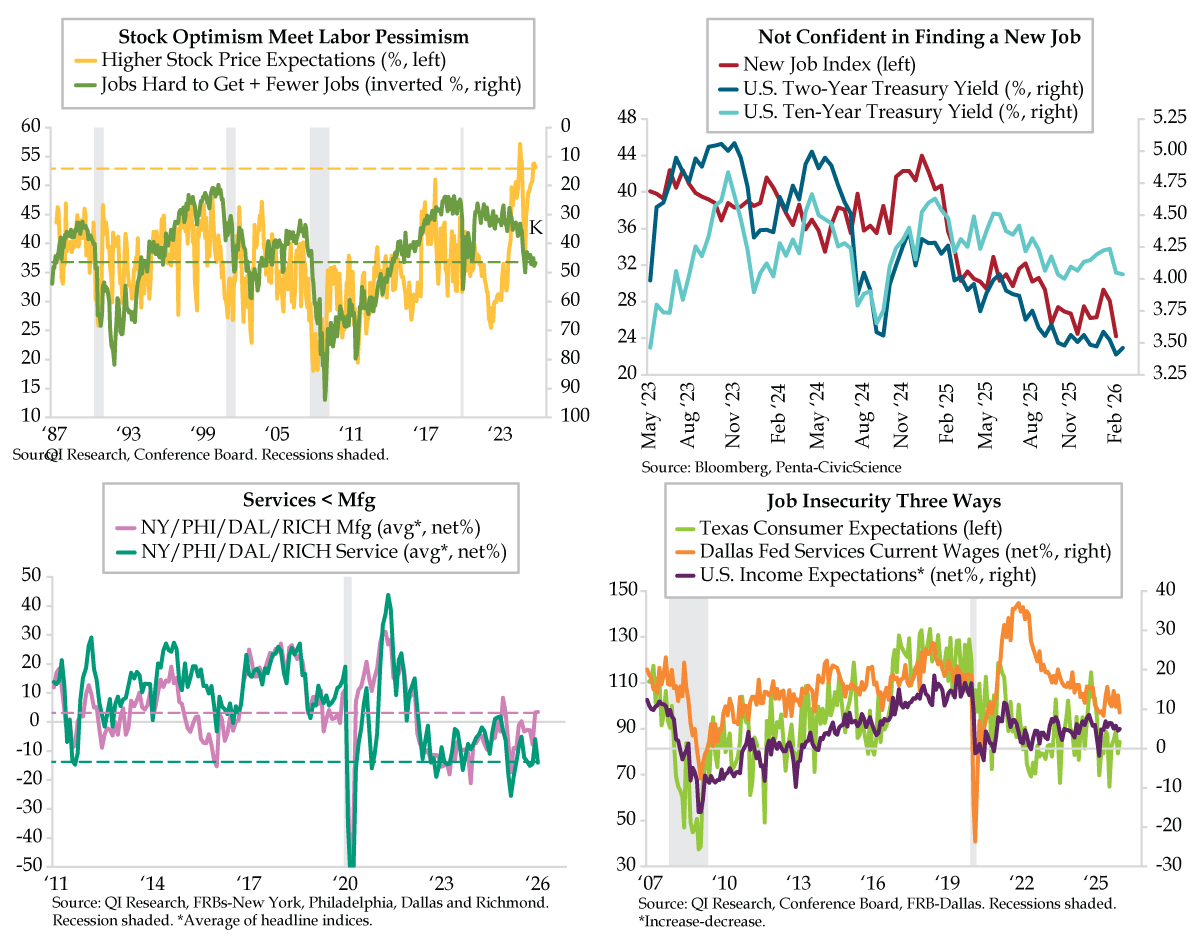

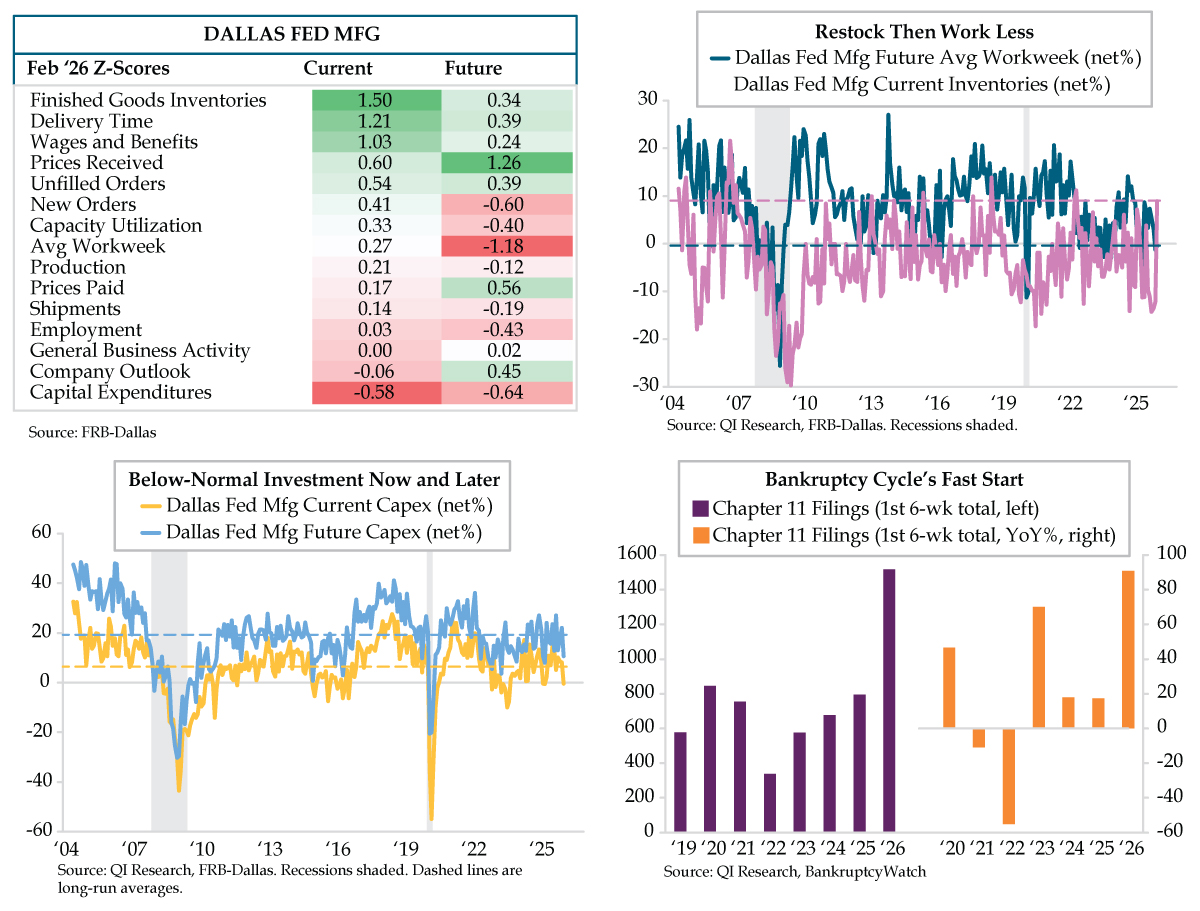

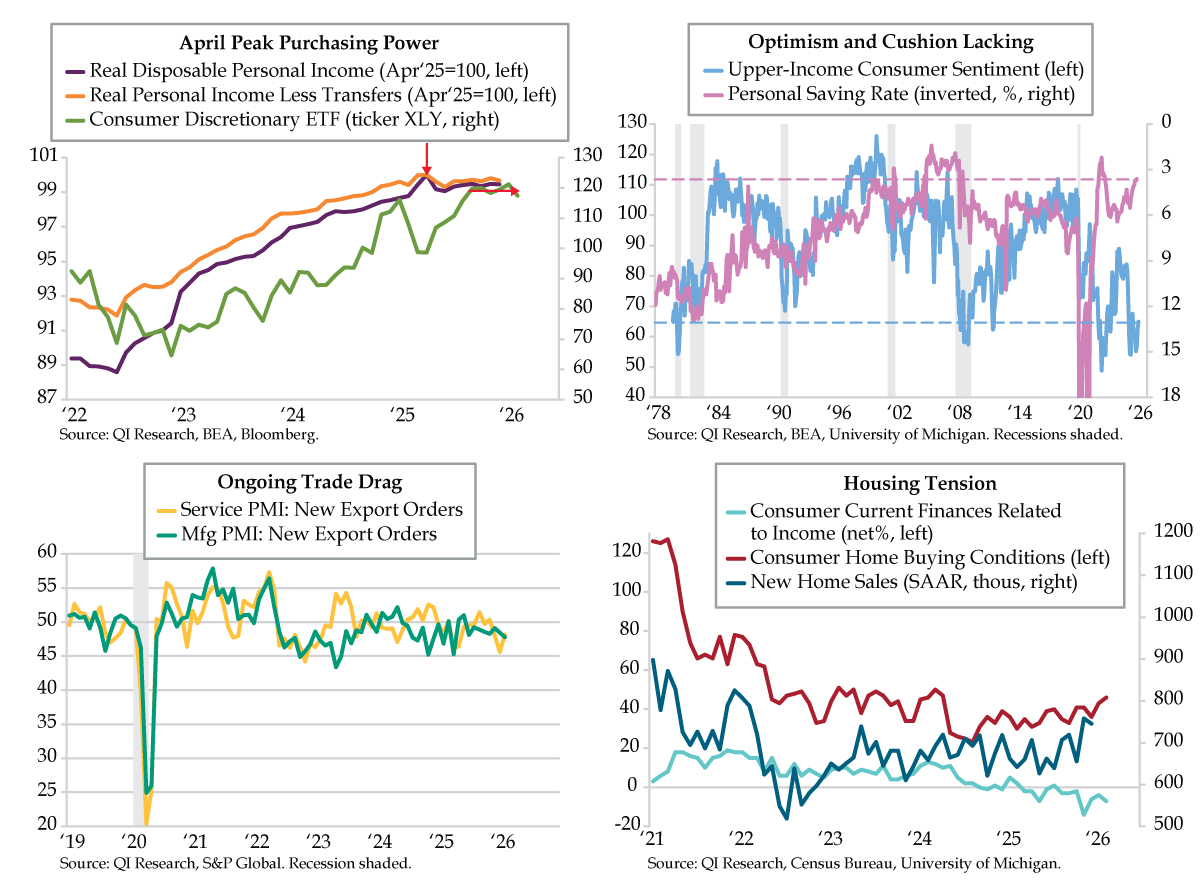

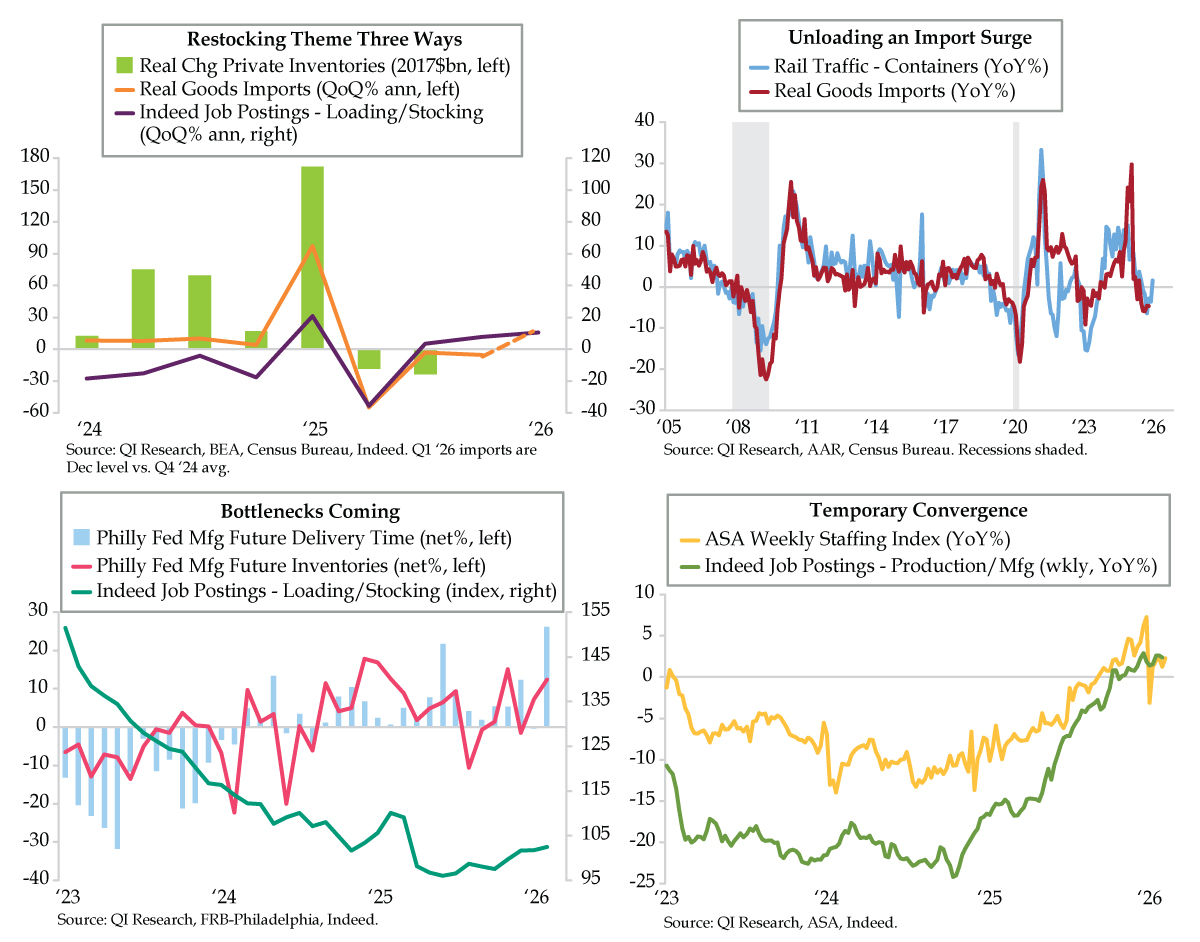

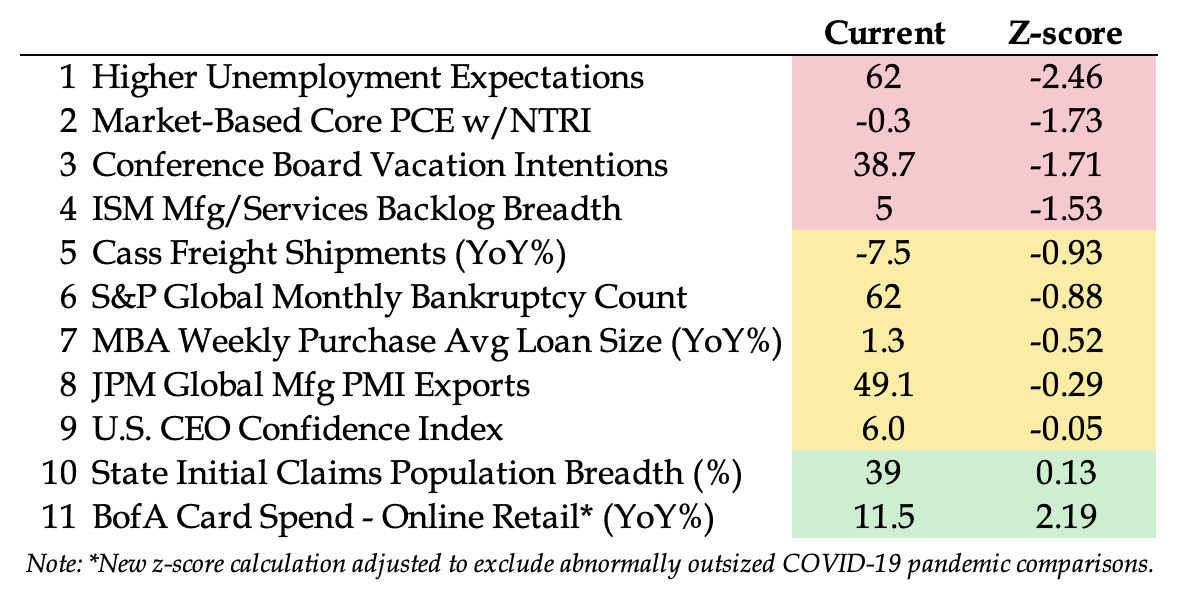

Recession probability to rise into 2025’s second half as private demand underperforms. The tariff shock should generate greater risks for a downshift in business investment and a more challenging environment for consumer cyclicals vis-à-vis consumer non-branded noncyclicals.

Manic shifts in U.S. politics harken first a deflationary gully to cross followed by the threat of impeachment and ultimately, a fourth change in administrations in as many U.S. presidential elections, a first in sequential terms since the precipice of the U.S. Civil War. The subsequent pendulum swing will manifest as Universal Basic Income/Modern Monetary Theory, and with it, the secular rise in inflation being prematurely predicted today by those positioned to profit from being short Treasuries.

Saturday Intelligence Briefing — 3.7.26

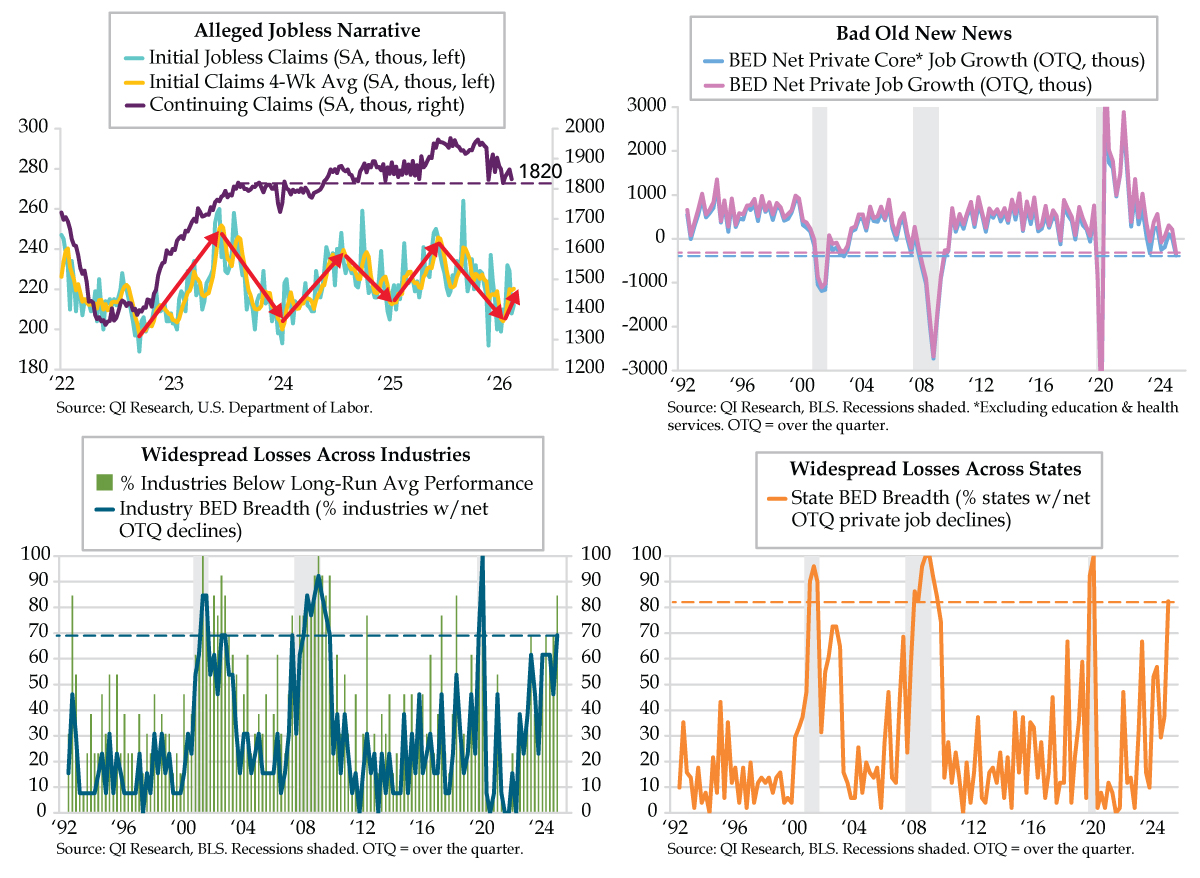

At some point, they must chuckle inside, knowing they’re parodying themselves. “I believe there’s a structural change going on in our workforce versus a cyclical thing. What we’re in is a structural change and most of that is driven by demographics.” To Kansas City Federal Reserve President Jeffrey Schmid, we need do nothing more than chalk it up to retirements, outmigration, and Trump taking a machete to the federal workforce, stated in a more dignified way, “fiscal policy’s” impact.

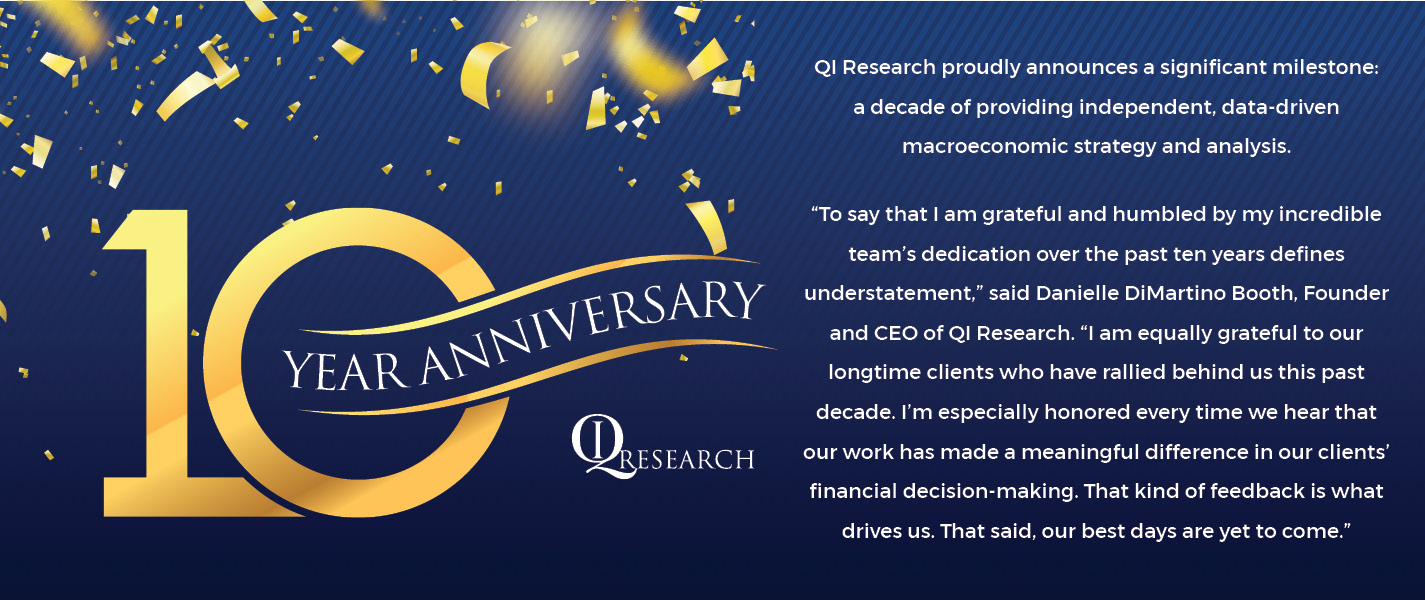

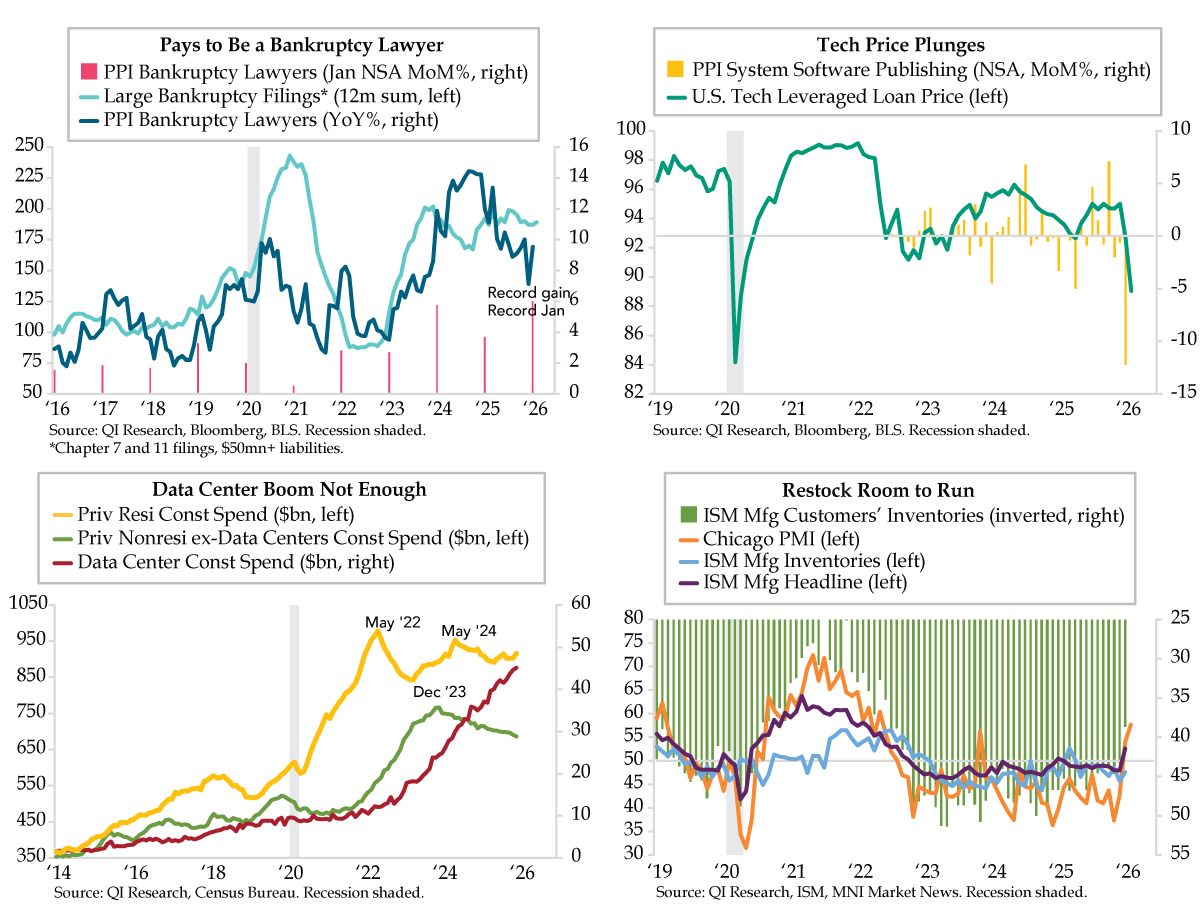

It's as if Schmid has no access to a modicum of internet access. Had he the basic knowledge of job cut announcements being attributable to AI at 8% year-to-date, it might have checked his confidence. Instead, he insisted that cyclical forces have yet to exert an influence, ignoring the balance of layoffs Challenger attributed to just that thus far in 2026. We know, we know. Narratives are sexy. We get it. That’s why you trade them and are in business. But it can’t hurt to know the truth in the event you need context in which to couch a sudden liquidity vacuum sucking the lifeblood out of markets.

TACTICAL

RATES:

Short-end and Belly best opportunities for total return. Rally keys off weaker macro. Challenged private demand, higher unemployment and lower core inflation raise Fed rate cut probabilities.

Long-end holds at elevated levels with de facto caps at 4.5% for the 10-year & 5% for the long bond with the term premium supported by fiscal malfeasance exacerbated by falling sovereign revenues and despite diminishing stimulus to the U.S. consumer.

Curve view – Bull steepener in 2025’s second half.

USD:

A sidelined Fed contrasting with most global central banks easing catalyzed a selloff in the greenback. A Fed forced to play catchup could easily thin the massively crowded trade, especially as global trade weakness impairs an open global economy vs. its closed U.S. counterpart.

CREDIT:

• Underweight HY, overweight strong cash-flow IG

• Lower-rated buckets at risk of dispersion with Fed Higher for Longer

• Jobless claims deterioration makes a cautious Street rethink already-wider-spreads 2025 expectations, i.e., up default estimates as bankruptcy cycle speeds up and size

• Fitch’s acknowledgement of cyclical consumer sector “deteriorating” fits this view

EQUITIES:

OW Utilities

OW Fossil Fuel Energy

OW Senior Living

UW Consumer Staples

UW Consumer Discretionary

UW Large & Midsize Banks

OTHER ASSETS:

• USD view supports UW commodities & EM

• Oil is a different story with geopolitical risk ramping (Israel v Iran)

• Long MOVE to capitalize on runaway lending to Nondepository Financial Institutions triggering a credit event

The Feather — Charts of the Week

The Price Is Right

More Than a Feeling

As Heavy as a Train Full of Granite

The Long Arm of Benjamin Franklin

H&M, Not the Clothing Brand

Most Exclusive Reservations

From Husband, Wife and a Truck to National Carrier

The Longevity of the Moment

Everyone in the Shot

Dostoevsky, The Gambler

Welcome to Echo Park

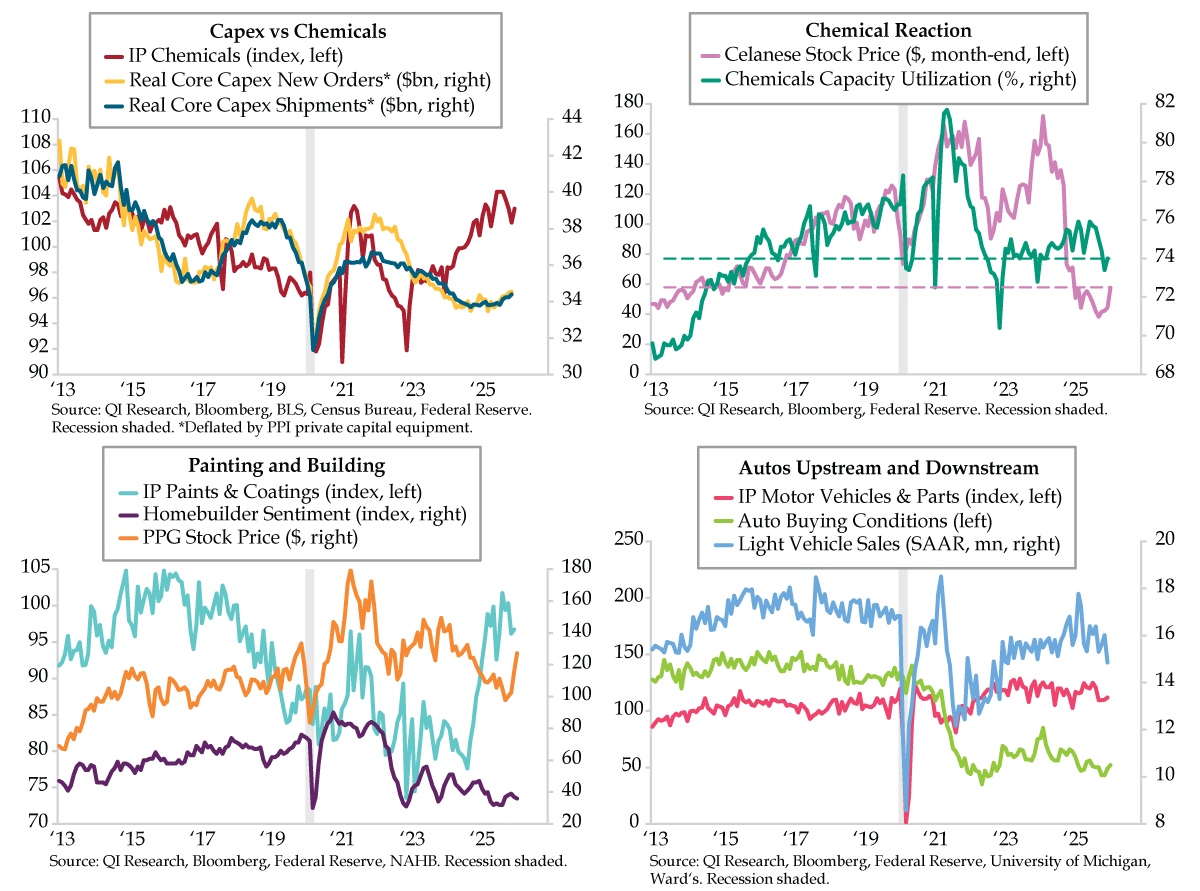

Introducing the Core Capex Straight