Category Archives: Uncategorized

Shadow Boxing the Consensus

VIPs

- Germany is the most underpriced recession risk in 2019 with the probability of contraction over the next 12 months at 15% compared to 20% in the U.S. and 33% in Japan

- The key leading indicator of the Euro Area labor market – unemployment expectations – has registered noticeable deterioration in France, Italy and Spain; the dissipation in the German skill shortage suggests eurozone-wide job market weakness is a palpable 2019 risk

- As the skill shortage is reported to be dissipating, slower job growth and a bottom in German unemployment are palpable 2019 risks

- Look for stronger U.S. dollar to end 2019; rising U.S. recession risks due to ISM cliff risks hitting markets early on thus the dollar is vulnerable to a sell-off before its safe-haven status drives capital inflows escaping a global slowdown

- A 2% 10-year yield? The U.S. growth outlook will be tested early in the year; housing and autos are likely to underperform expectations as upper-income buyers postpone purchases tied to elevated financial market volatility

- The Fed transitioning away from the rigid language of “gradual increases” to a more flexible, financial market and economic data-dependent policy will see traders price both probabilities of hikes and cuts in 2019

Happy Boxing Day! Feel free to let your servants journey home today such that they too can give their “Christmas Boxes” to family members. Wait…those times have luckily come and gone. We don’t have servants who serve us our pudding on Christmas Day, nor are we British for that matter. Instead, we would encourage you to consider the evolution of the meaning of the tradition, which is rooted in the virtues of charitable giving.

In its second life, Boxing Day fell the day after Christmas Day. Monies placed in special boxes during Christmas services were opened the following day and given to the poor. No doubt, many of you will be prompted to do year end giving in the coming days. QI asks that you to join us in keeping the spirit of giving alive to end the year on the happiest note for the less fortunate people in our communities who are most in need.

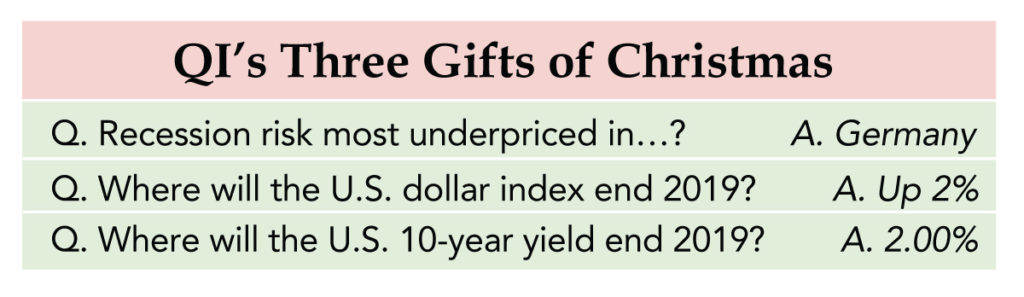

As we look back on the past seven months of writing the Feather since its May 29th launch, our gift to you is a look-ahead to the least expected scenarios to play out in the coming year. To arrive at this juncture, we asked ourselves three questions:

- Where is recession risk the most underpriced?

- Where will the U.S. dollar index end 2019?

- Where, in turn, will the yield on the U.S. 10-year Treasury close on 12/31/19?

Germany: Most underpriced recession risk. The line has been drawn in the sand by the consensus. Germany’s recession probability over the next 12 months stands at 15%, compared to 20% in the U.S. and 33% in Japan. For perspective, relatively lower recession probability breeds business cycle complacency and also can lead to overblown macro outlooks and overvalued financial assets.

Germany’s exposure to the U.S./China trade war makes it decidedly vulnerable to a slowdown. Many blamed the third-quarter decline in German GDP on temporary bottlenecks certifying new vehicles under tougher emissions tests. This interpretation of noise misses the signal from the German export and manufacturing sectors that have faced a persistent loss of traction throughout 2018. As the skill shortage is reported to be dissipating, slower job growth and a bottom in German unemployment are palpable 2019 risks.

Watch contagion risk from Germany’s neighbors. The key leading indicator of the Euro Area labor market – unemployment expectations – has registered noticeable deterioration in three of the Big Four countries — France, Italy and Spain. Germany’s unemployment expectations aren’t raising yellow flags but did trough in July 2018. Further deterioration in Germany’s expectations from here would flag a weakened outlook for growth, inflation, labor and corporate earnings that could lead the DAX to underperform its global peers.

Bullish U.S. dollar. The widely followed U.S. dollar index (ticker DXY) should appreciate by low single-digits (~2%) over the next year versus the 5.5% consensus decline forecasted. Because the euro carries a heavy weight in the DXY, the dollar bull-call is a euro bear-call predicated on surprise economic weakness from Germany.

That said, increased financial volatility from the global central bank shift from QE to QT and rising U.S. recession risks stemming from an ISM cliff threaten to wallop markets early in 2019. The dollar is thus vulnerable to a sell-off first before its safe-haven status drives capital inflows escaping a global slowdown.

Bullish U.S. 10-year yields. The global risk-free rate should fall over the course of the next year (~2.00%) from current levels near 2.75%. This call runs counter to forecasters’ views for rising 10-year yields to 3.30% by the fourth-quarter of 2019.

We disagree with the consensus on the speed of the U.S. slowdown next year.As detailed in our dollar call, the growth outlook will be tested early in the year. The leading housing and auto sectors should continue underperforming expectations as upper-income buyers postpone purchases because of elevated financial market volatility.

We disagree with the consensus outlook for two Fed hikes in 2019.Powell & Co. are likely to be challenged to get off even one more 25 basis-point increase on their desired path to the magic land of neutral.

The return of two-way interest rate risk is another reason investors can price for lower yields.This is a major difference for the rates outlook across the entire term spectrum compared to the QE era when one-way risk prevailed. Investors today are solely pricing rate hike probabilities. The Fed transitioning away from the rigid language of “gradual increases” to a more flexible, financial market and economic data-dependent policy will see traders price both probabilities of hikes and cuts in 2019.

We hope you share QI’s philosophy as you approach investing in 2019. Be contrarian backed not by bravado, but data that lead inflection points. Avoid labels such as “bull” or “bear.” Cycles can turn on a dime.

Conventional Wisdom Meets Reality

VIPs

- When adjusted for inflation, upper-income weekly earnings have already slipped into negative territory. Middle-lower income weekly earnings meanwhile are positive but not by much and their savings are depleted on a relative basis.

- Monthly mortgage payments on the median-priced home are up by $150 a month since the start of 2018.

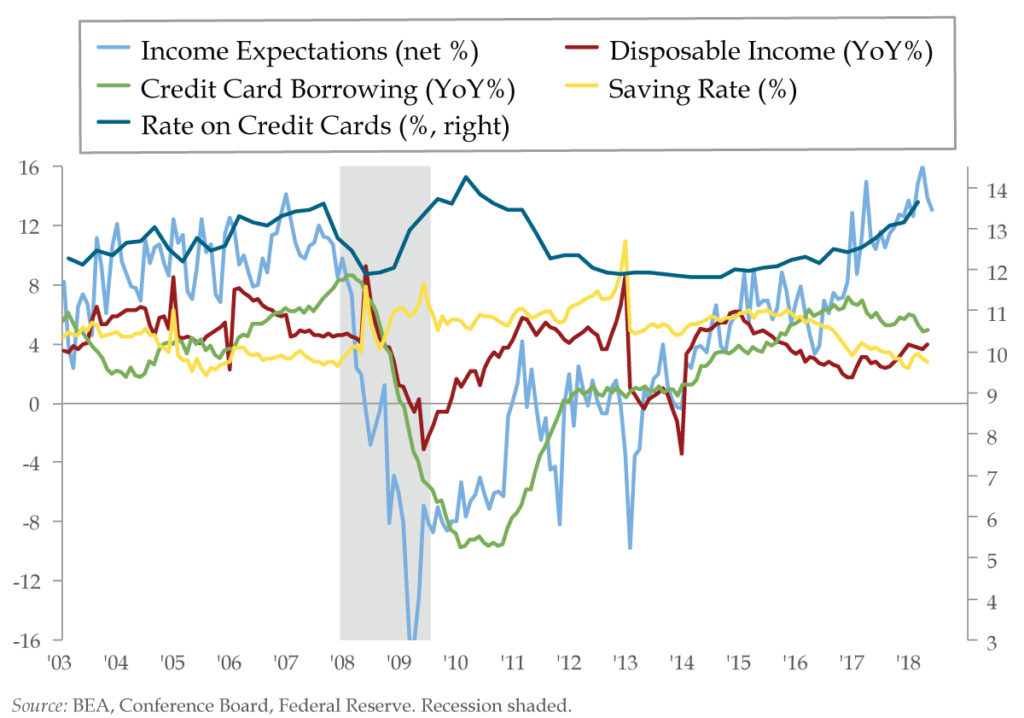

- Bulking up on credit card debt is unsustainable, the near 50 basis-point increase in credit card rates in Q1 was the biggest for any quarter in the last eight years.

For contrarians, conventional wisdom can be a bit tough to swallow. It is generally accepted that U.S. household budgets are in good shape. Mortgage debt has drifted down, via mostly defaults, to more sustainable levels. And while the past decade’s growth has been historic, the aggregate of car, credit card and student loan debt is nevertheless manageable, especially at prevailing interest rates.

If you apply ceteris paribus, yet another overused guidepost – as in all other things being equal – the conventional wisdom holds. The problem is that’s rarely how the real world operates. Interest rates and inflation are both rising rendering both accepted truths false. When adjusted for inflation, upper-income weekly earnings have already slipped into negative territory. Middle-lower income weekly hours meanwhile are positive but not by much and their savings are depleted on a relative basis.

Next week promises to put further downward pressure on the existing trends. The consumer price index is expected to hit 2.7%. And barring an asteroid hitting, Federal Reserve policymakers will raise interest rates another quarter-percentage-point. So we know that wage growth will continue to be countered by offsetting forces.

Ordered to the front lines will be housing, which consumes at least one-third of the average household’s budget and is by far the biggest line item. As for the starting point, the cumulative effect of the combination of rising inflation and borrowing costs is already biting into housing affordability.

Black Knight figures that the combined effects of rising mortgage rates and never-ending home price appreciation have pushed monthly mortgage payments on the median-priced home up by $150 a month since the start of the year.That works out to a 14% increase in five months. The data firm is clear on the outlook: “The current combination of home price appreciation and interest rate increases is unsustainable.”

Sounds like they expect the seller’s market to give way to a buyer’s market. How is that the case when forward income guidance is positive, take-home pay has gotten a fire lit under it from the tax cut, households are levering up with credit cards and the saving rate is falling?

While there is no disputing the unsustainability of housing, Knight offers reassurances that even though affordability is the most stretched since 2010, at 23%, the share of median income needed to afford a home is “still below long-term benchmarks.” OK, so it’s not the 34.6% share-of-income peak that was clocked at the height of the housing bubble. But is that fair?

How valid is it to compare today’s affordability to the biggest housing bubble since that which led to the Great Depression?

Income declined in the last cycle. That’s not how our generation ever thought. Workers that didn’t get cut in the last cycle and kept their jobs and had their pay cut in turn probably felt lucky. Permanent dislocations have been a long road to pave (not the quick job that Lightning McQueen did in Cars). It’s taken 9 years – 9 years! – for job leavers to go above average. And it took a corporate tax cut creating greener pastures to get us there.

Bulking up on credit card debt is unsustainable, too. The speed of increase in credit card rates helps answer the question, “When?” The process is already in motion. Rates have been gradually rising for a few years,but the near 50 basis-point increase in credit card rates in Q1 was the biggest for any quarter in the last eight years. The same goes for the more than 100 basis-point rise over the last four quarters.

With the cost of carrying debt rising more sharply, consumers are finally saying it’s time to slow down the pace of borrowing. In yesterday’s April consumer credit data, consumers added $9.3b of debt, the 2nd lowest amount since July 2012. Non-revolving debt made up of mostly student and auto loans, saw a rise of $7b of this, the smallest since September. For perspective, this component of borrowing is up 73% from the previous PEAK in July 2008. Revolving credit, mostly credit cards, rose by $2.3b m/o/m after a net decline of about $1b in Q1 which came after a spending party in Q4.

Keep in mind that most of this debt is floating rate. This gets back to the whole point that in a credit driven cycle, rather than one driven by savings, the cost of credit drives spending decisions. And it’s getting more expensive.