QI PORTFOLIO STANCE

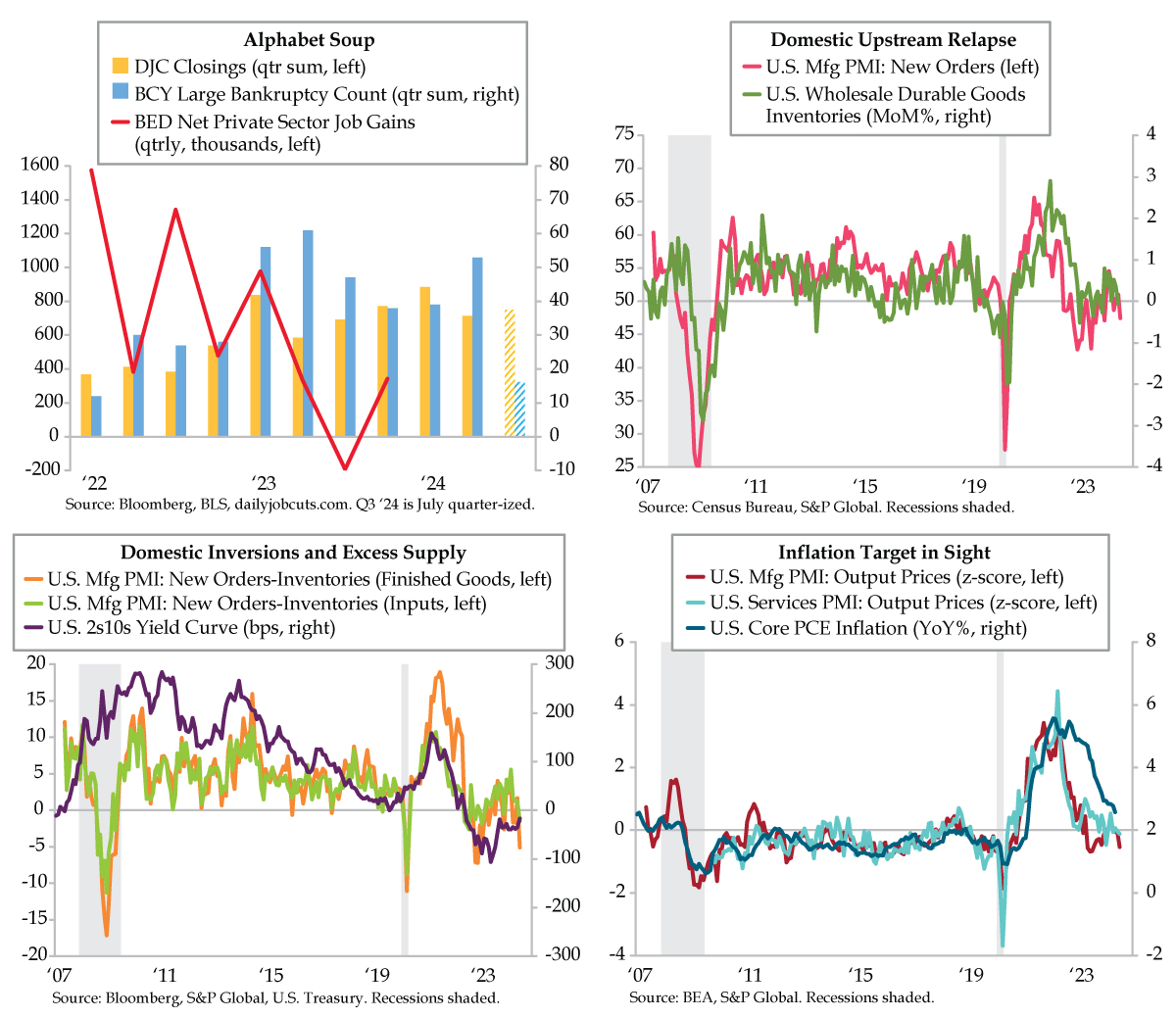

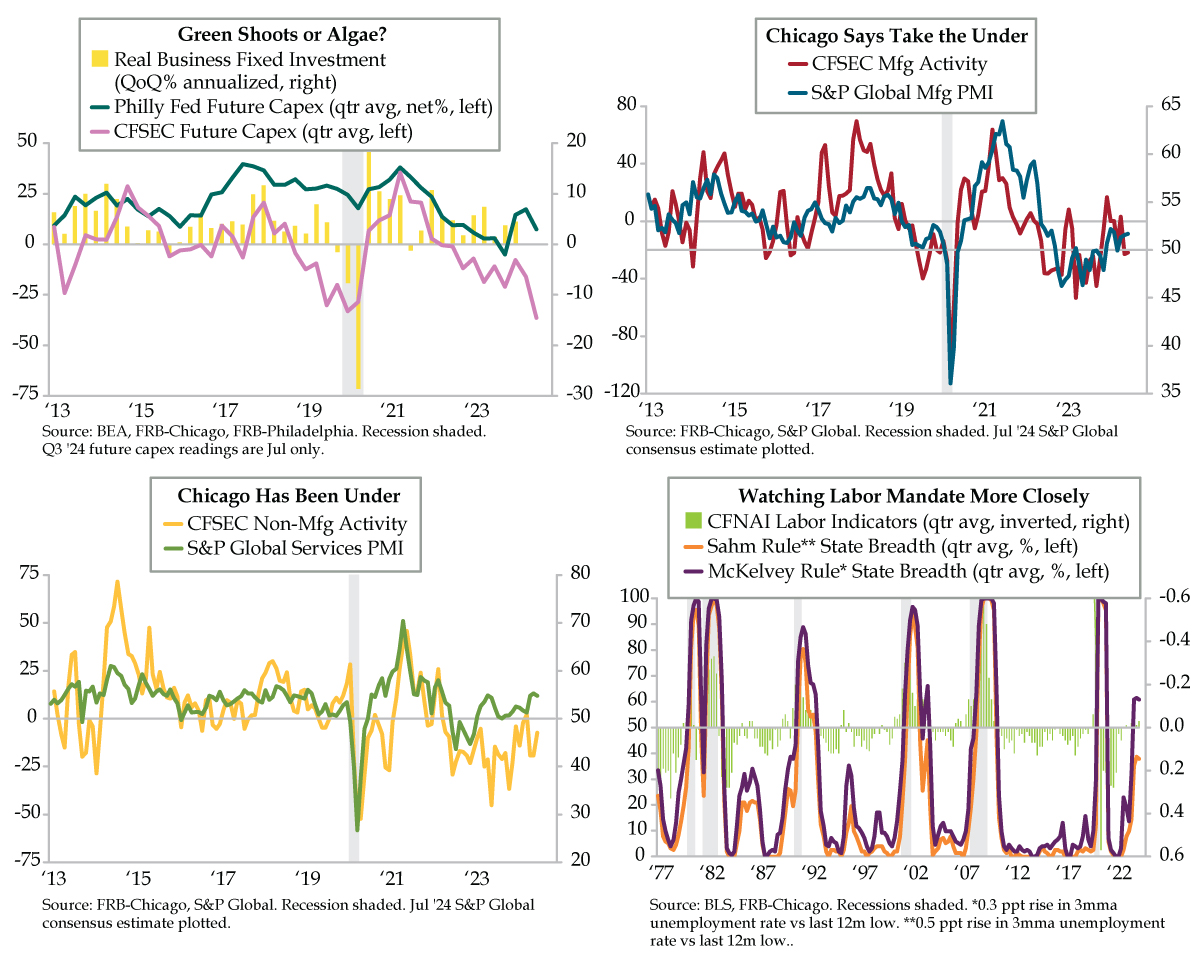

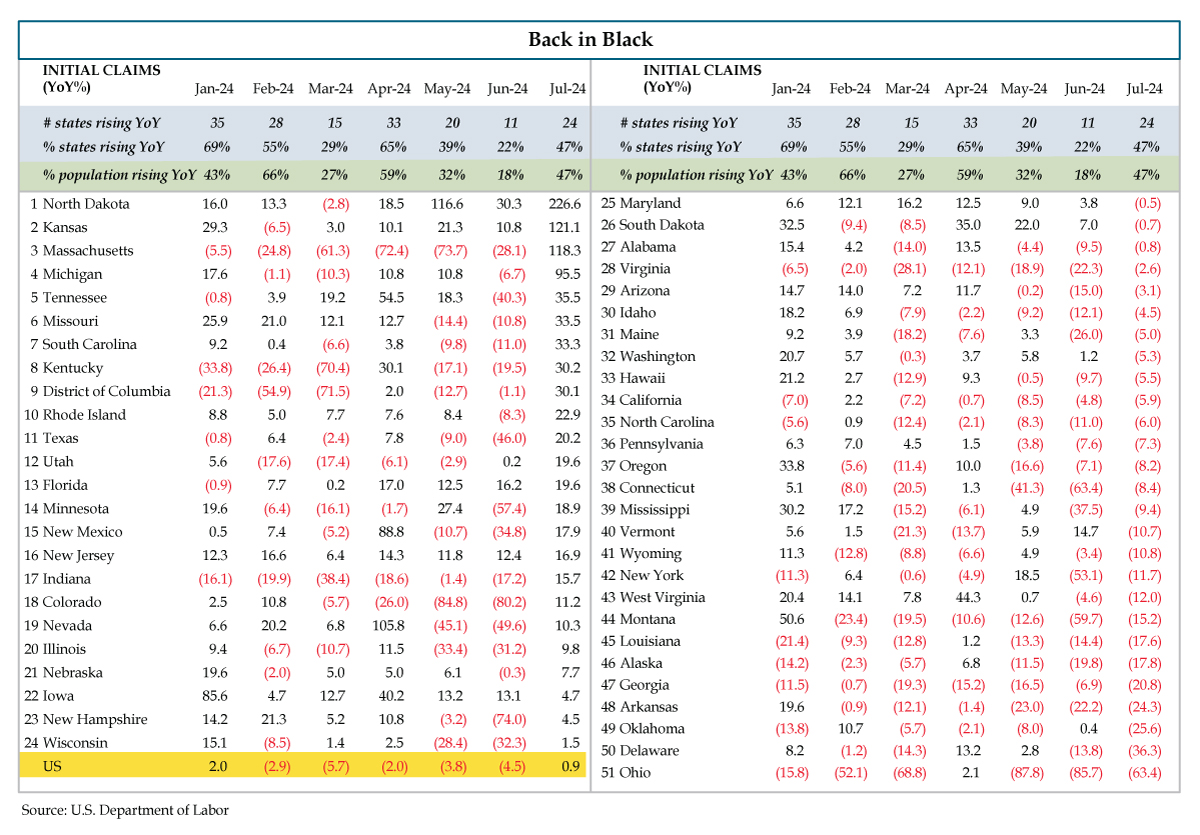

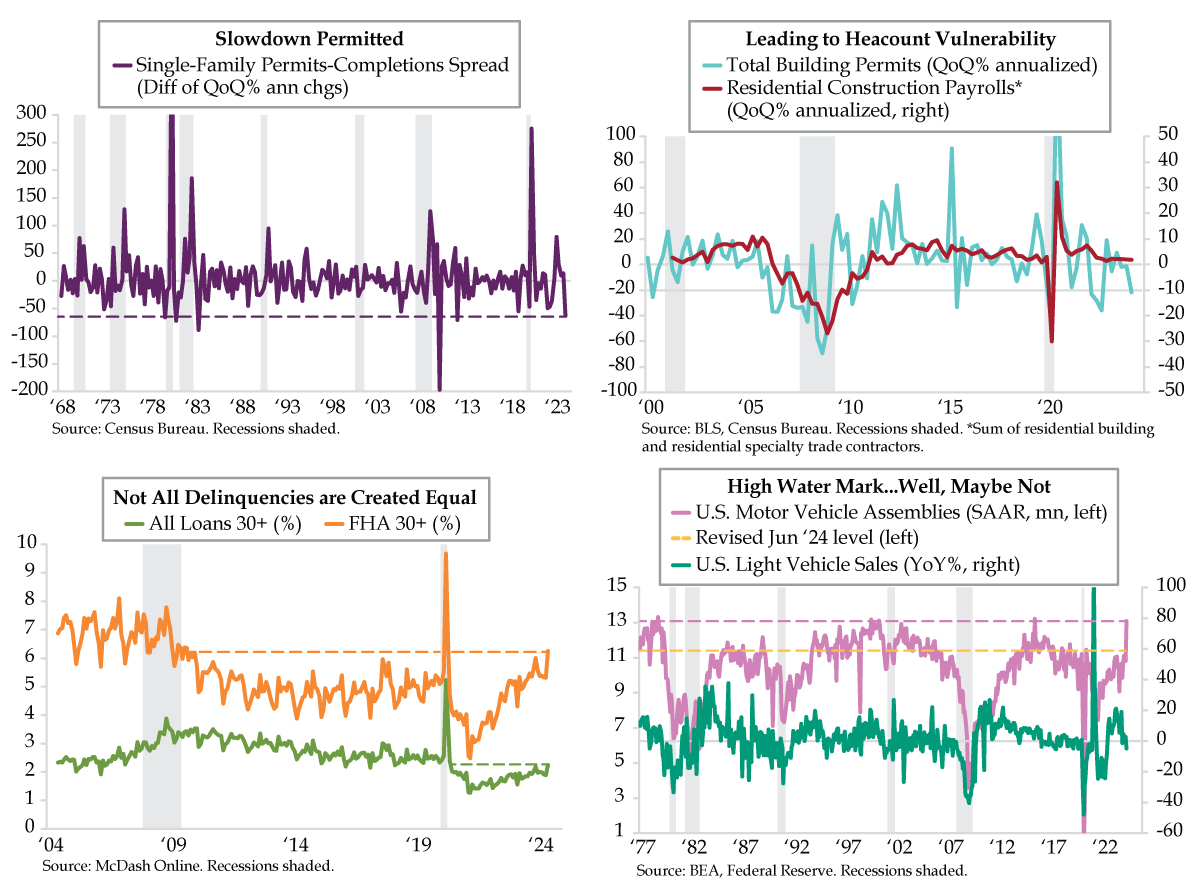

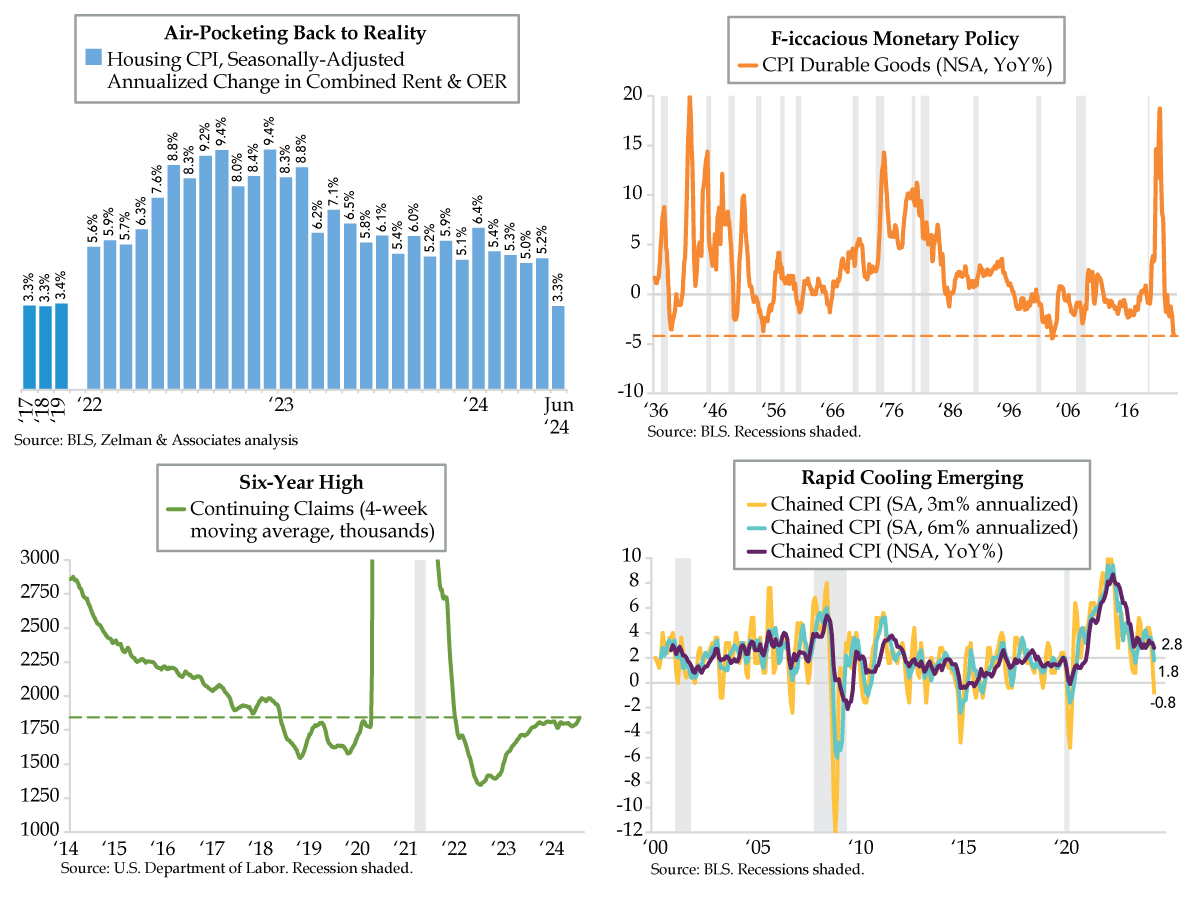

Despite a well-orchestrated, coordinated global central bank shift to an easing stance, a recession is imminent, if not already here, and far from being priced into equities. In 2024, the U.S. economy was propped up by the lagging effects of $7.2 trillion in federal spending despite declining government revenue, a good portion of which went straight into the hands of consumers. This level of stimulus ceased to continue this Fall with COVID spending ending and the arresting of the fraud-ridden ERC. At the margin, fresh stimulus is highly unlikely until after the 2024 election at best. Even then, ‘helicopter money’ will only be legislated back into law if both a Congress with a spending appetite and a cooperating Executive branch are elected. Powell remains committed to maintaining QT to ensure inflation is dead and restore price discovery. This will continue to expose and eliminate dodgy debt within corporations and the real estate sector. The credit and labor cycles have begun their downturn. Portfolios should be defensively positioned and ready to capitalize on idiosyncratic shorting opportunities as they materialize. Apart from Treasuries, longer-term risk exposure should be minimized. [12/15/2023]

Intelligence Briefing Takeaway — 7.20.24

By the time you read this, my feet will be buried in the white sand of the Caymans. With any luck, I can put these charts out of mind and focus on the calming undulations of the quiet waves lapping at the shore. Resting easy doesn’t come easy these days, which makes unplugging more challenging than it is otherwise. To say “tensions are running high” at home fails to capture the magnitude of the disquiet. Glimpses of the Republican National Convention did nothing to calm nerves this past week. Though I was not around in 1968, when chaos erupted at that year’s Democratic National Convention, I can only imagine the quiet nervousness of many in my parents’ generation who were. There was something awkward about the celebratory speeches as if they were the culmination of a competition despite not having been preceded by a race.

QI QUICK QUILL CALLS

• Long SPX Trading Call — Headline employment data continue to run positive & the bulls have technical momentum. Melt up with the S&P 500 to 6000. But don’t make the mistake of identifying as fundamentals what is blatantly speculation. [02/23/2024]

• Use Equity rallies as selling opportunities, minimize your equity holdings to your appropriate risk tolerance and time horizon and maximize your short positioning. Initial bullish reaction to companies’ cost-cutting efforts will eventually give way to recession trumping cost cuts. Until increased deficit spending that injects cash directly into household bank accounts revives demand-driven inflation, don’t fight the Fed. Cuts are being priced in too aggressively. Even then, rallies after the initial cut have historically been short-lived. Markets take an average of 16 months to bottom after the first Fed rate cut. More risk-tolerant investors should use rallies to build prudent short positions. [12/9/2023] Saturday Intelligence Briefing — The Quest for Good Deflation

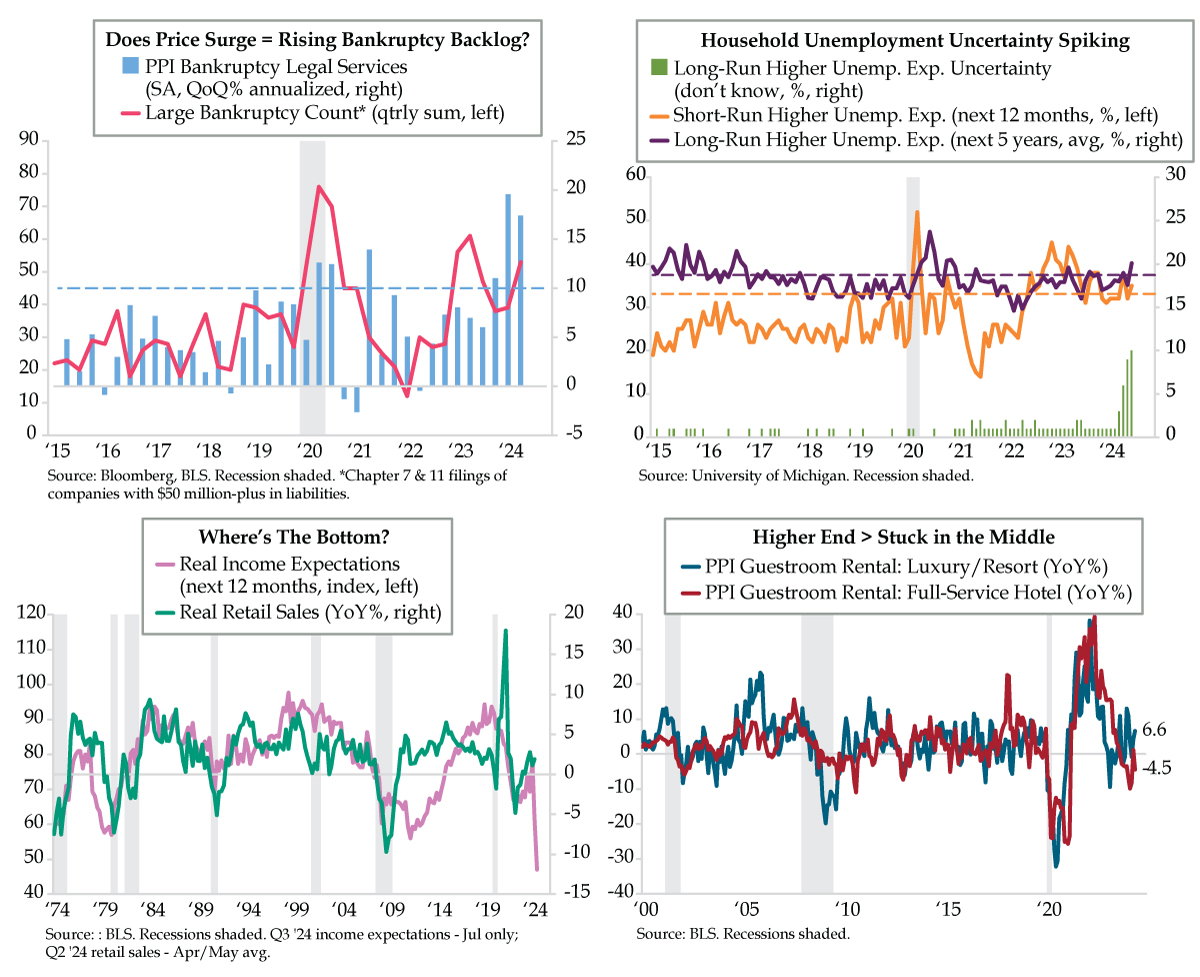

• Short Travel & Leisure within Consumer Discretionary – Government injection of cash into the Platinum-card class through the Employee Retention Credit has hit a brick wall. Beginning with the Q4 Earnings season, we expect this industry will disappoint to the downside. QQ Service Spillover Risks [12/5/2023]

• Short Transports – Stocks in the freight sector have largely priced in the resurgence in homebuilding and the lagged effect of green federal spending. As the economic slowdown manifests in the headline data the sector will be sold further. The Weekly Quill —Craning for Cranes . [Weekly Quill, 5/17/2023] updated view here 8/1/2023]

• Short High-CRE exposed Banks – Shorting a basket of small-to-mid-cap banks with high exposure to Commercial Real Estate makes much sense to QI. Rates are rising, which is good for net interest margins, but CRE defaults are just starting. [7/26/2022]

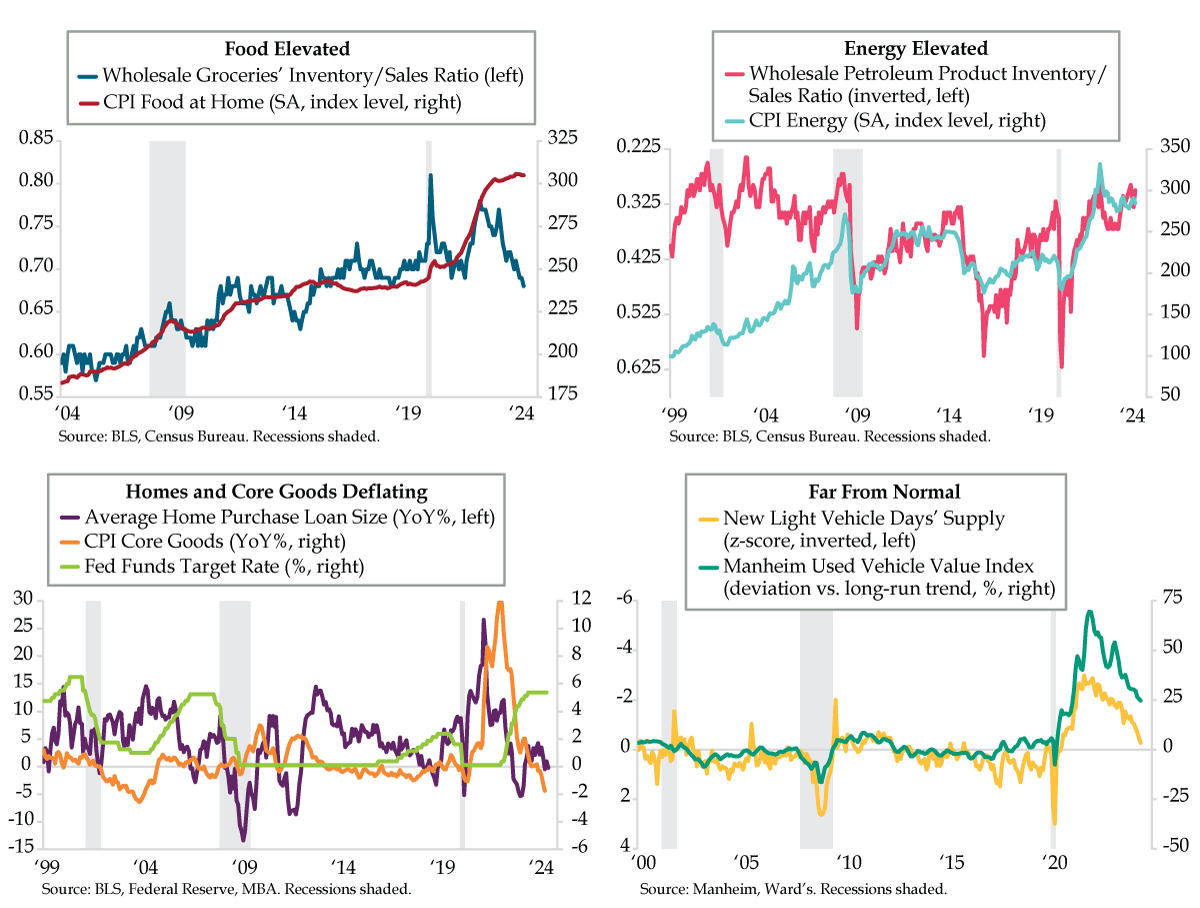

• Short Autos. Macro fundamentals suggest downside for the auto sector. Auto Retailers, in particular, who’ve reaped huge gains are likely to swing to losses as evidenced in collapsing dealer sentiment. [3/24/22]

• Short/Sell Commercial Real Estate. With record low cap rates pushing 2%, half of 2007's prior record, if you own anything in CRE, even Industrial, sell and sell now. A more accessible proxy to this trade is shorting a REIT ETF. Multifamily & Industrial are QI’s preference though Lodging will come under pressure in 2024

• Long Credit Default Swap Indexes - Credit is only beginning to tighten. Sentiment indicators from both credit managers & high-income earners, pockets that have a front-row seat to the lagged effects of Fed policy, challenge the ‘soft landing’ narrative. A more accessible proxy to this trade is shorting a high-yield ETF. [7/31/2023] & [12/7/2023] QQ Clock Ticking on Tight Credit Spreads

The Magnificent Inversion continues to confound the Street. While an initial rate cut is typically accompanied by steepening into positivity, Powell’s intention to continue QT has prolonged an inversion driven by conflicted monetary policy. We look for this grind of continued steepening and re-inversion to continue and expect the biggest moves in yields to be on the shorter end, but the biggest capital gains will be on long-maturity treasuries.

• Bull Steepener in Treasuries. The Great Flattening we first forecasted in June 2021 has run its course. We see the yield curve's slope facing steepening pressure as recession pressures down rates. We expect the biggest moves in yields to be on the shorter end, but the biggest capital gains will be on long-maturity treasuries. Powell has the latitude to maintain his tight stance, including QT continuing to run ‘in the background.’ [3/20/2023]

• Overweight the U.S. Dollar. As the recession spreads globally and Powell maintains relatively high rates, more brittle foreign economies will crack. The U.S. Dollar will likely stay stronger for longer as the world realizes a pivot is not a raised Fed Put strike. [9/19/2022]

• Short Inflation Breakevens. As recession manifests, we reference the duration of the last two occurrences of 2s/10s yield curve inversions — the nine months in 1999-2000 and the seven months in 2006. Because deflation will filter through with a lag, short inflation breakevens. (i.e., long TLT, short TIPS) [5/3/22 updated 7/6/22]